Keep tax time stress-free

Tax-ready reports

Stay on top of every number with detailed, tax-ready financial reports like your Profit & Loss, Expense, and Accounts Aging reports. By tracking every dollar spent and keeping an eye on your finances, you’ll always be ready for tax time.

Painlessly switch to FreshBooks

Coming from another accounting platform? Currently using spreadsheets to track sales and expenses? Joining FreshBooks is simple with our easy-to-use platform and data migration services.

Accountant collaboration made easy

FreshBooks lets you give your accountant free access to the platform (available on the Plus plan and higher) so you can effortlessly collaborate in one central location during tax time and beyond.

The features you need.

All in one place.

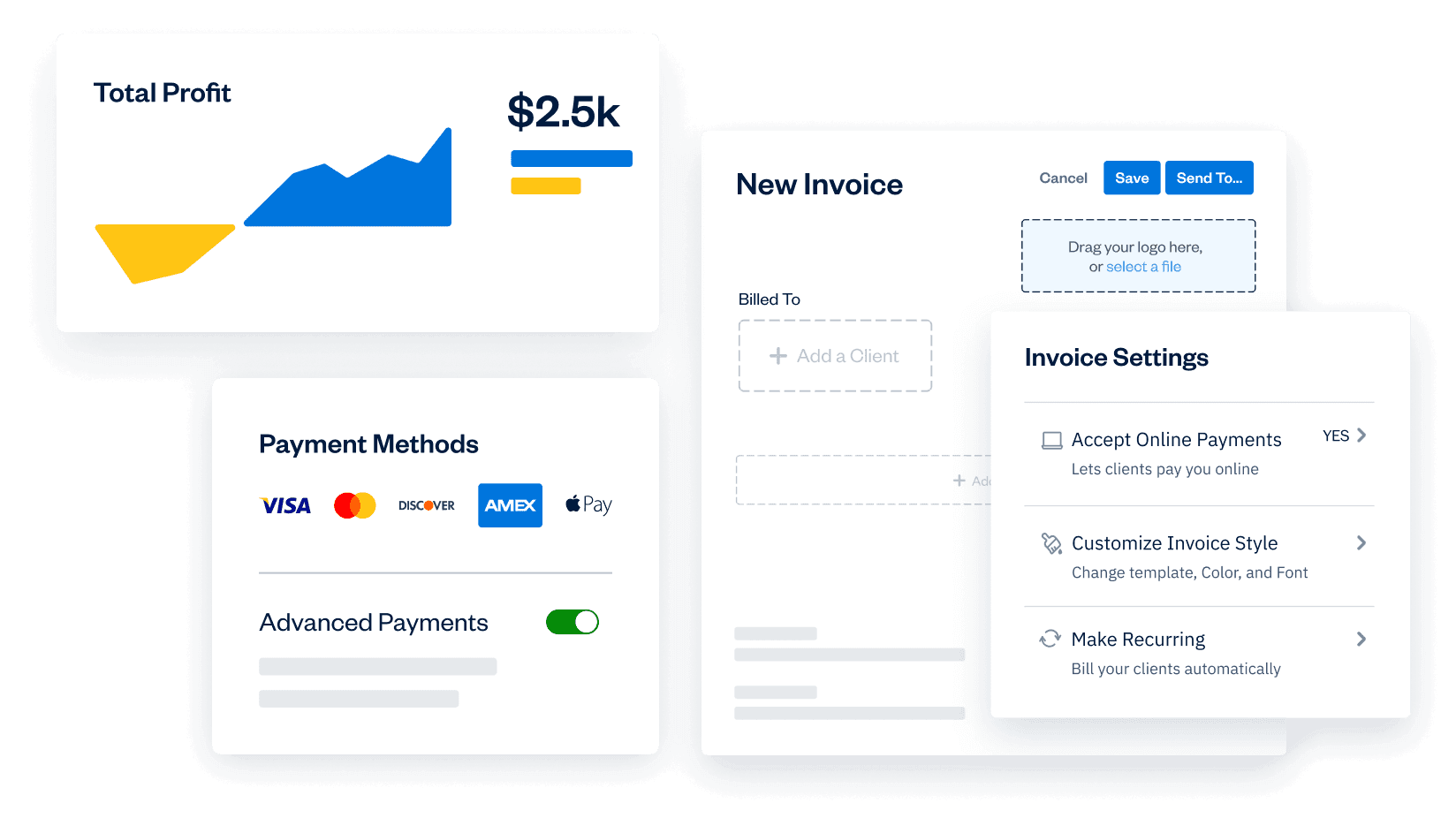

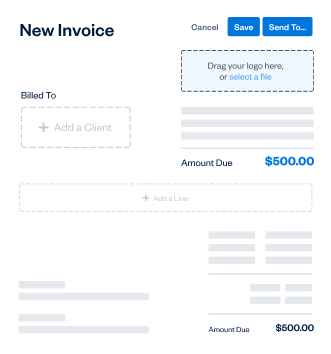

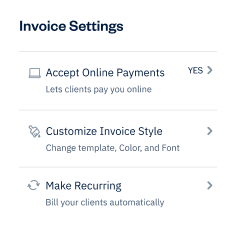

Invoicing

Create professional invoices in minutes. Automatically add tracked time and expenses, calculate taxes, and customize your payment options.

Billing and Payments

Bill fast, get paid even faster, and automate the rest with recurring invoices, online payments, and late payment reminders.

Expenses

Keep track of your expenses with mobile receipt scanning, bank account imports, and automated expense categorization.

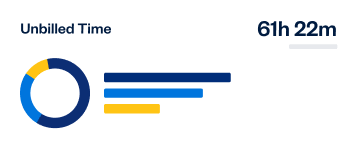

Accounting

Know where you stand in real-time with double-entry accounting tools, powerful financial reports, and easy access for your accountant.

Make taxes less taxing with robust reporting

Profit and Loss report

With the Profit and Loss report, you can instantly see your revenue, costs, expenses, and profits/losses. This shows how well your company will be able to generate revenues, manage costs, and make a profit.

Expense report

The Expense report details all of your expenses, including any applicable taxes. Connect your bank account to import expenses automatically.

Accounts Aging report

The Accounts Aging report will show you which clients have outstanding and overdue invoices – all in one place for you to review.

Support that actually supports you

95.3% satisfaction rating

Our friendly and helpful support team is filled with product experts who care about you and your business.

4.8/5.0 Star Reviews

Yup, that’s our rating across 120,000+ reviews (and a big reason owners prefer us versus other software).

100% in-house

No outsourcing here—we care about quality, friendly, and helpful support that goes above and beyond.

95.3% satisfaction rating

Our friendly and helpful support team is filled with product experts who care about you and your business.

Frequently Asked Questions

Ready to get started?