Bookkeeping Made Easy

FreshBooks is the #1 bookkeeping solution designed for small business owners. The fastest way to invoice clients, track time & run your small business in the cloud. Join over 30 million users who have used FreshBooks to make billing painless.

Featured In

Why FreshBooks Will Revolutionize Your Business

Ridiculously Easy To Use

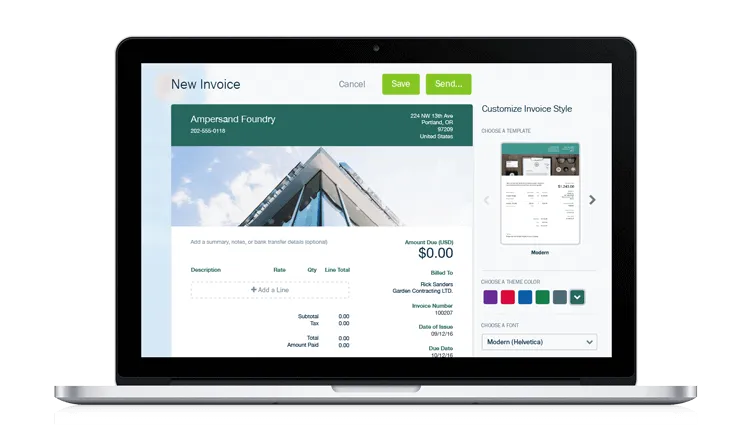

FreshBooks is simple and intuitive, so you’ll spend less time on paperwork and wow your clients with how professional your invoices look.

Powerful Features

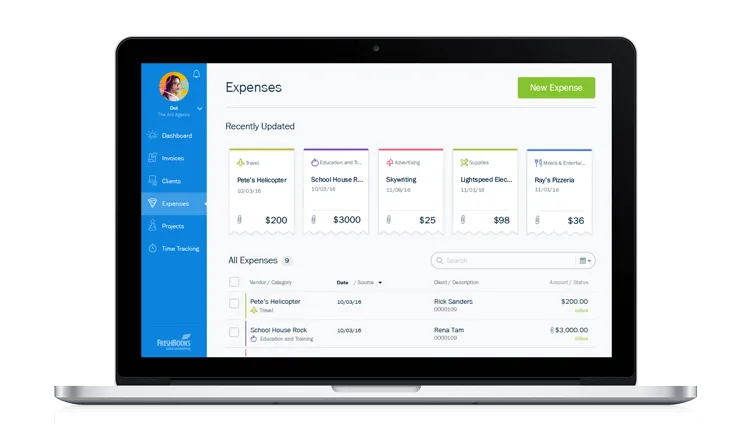

Automate tasks like invoicing, organizing expenses, tracking your time and following up with clients in just a few clicks.

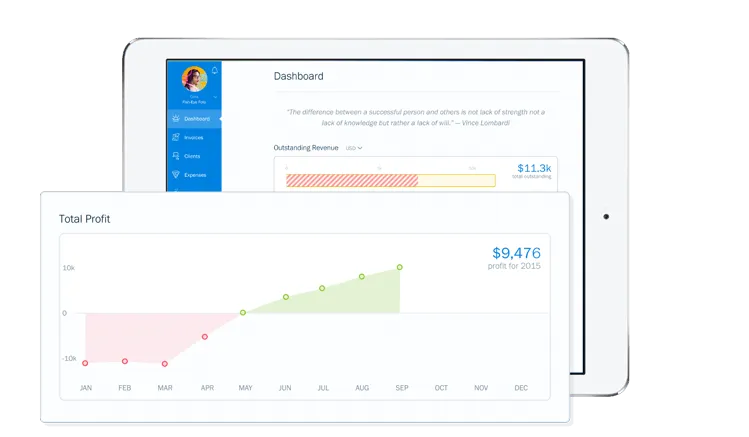

Organized in the Cloud

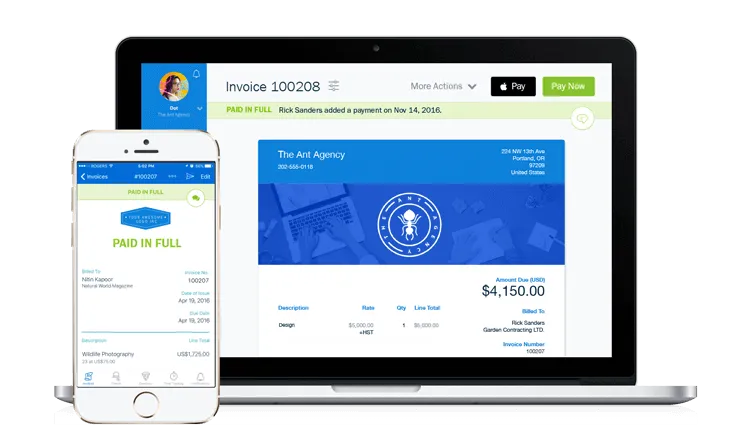

FreshBooks lives in the cloud so you can securely access it from your desktop, phone and tablet wherever you are.

Easy Invoicing

Organize Expenses Effortlessly

Insightful Time Tracking

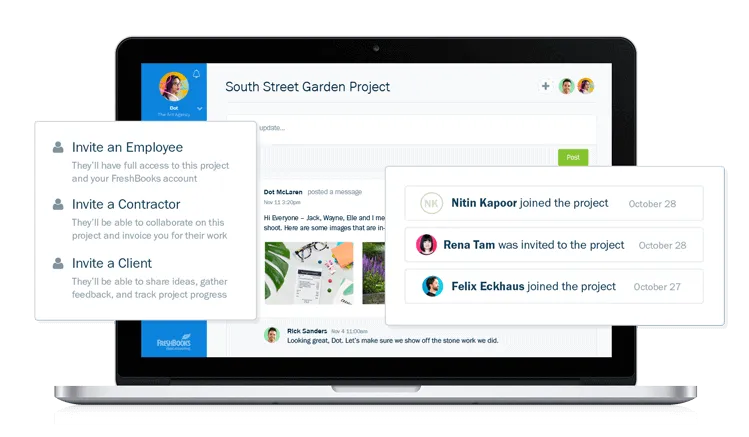

Seamlessly Collaborate on Projects

Get Paid Faster

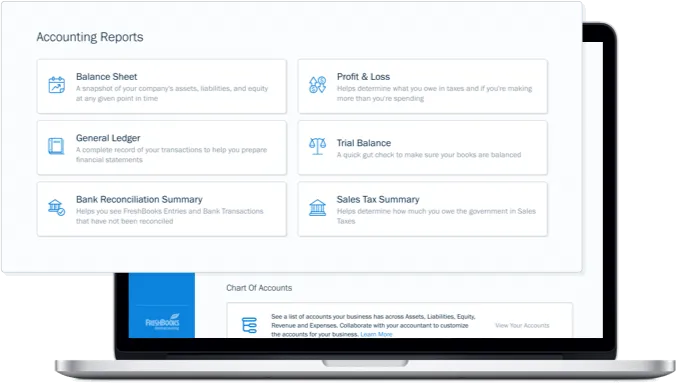

Easy To Understand Reports

Easy-To-Use Double-Entry Accounting

Work Anywhere with the FreshBooks Mobile App

Why Small Business Owners Love FreshBooks

It makes my life so much easier. I wish I had this when I first started my business!

It’s beautiful and really well designed. The invoicing, accepting online payments and keeping track of expenses couldn’t be simpler.

I’ve been using FreshBooks for 6 years and love how the design, functionality, and platform has grown with me – from freelance designer to the owner of a branding agency!

Frequently Asked Questions

FreshBooks automates lots of your accounting so you can spend more time focusing on your work and your clients. You can have invoices automatically generate and send, expenses automatically tracked and even have your payments automatically recorded, all without you lifting a finger.

You sure can. FreshBooks’ iOS and Android apps let you painlessly invoice your clients and track expenses wherever and whenever you need to.

Absolutely. With FreshBooks Payments you can start accepting credit card payments online right away, with zero set up required.

The safety of your private data is our top priority, that’s why it’s protected by 256-bit SSL encryption — the gold standard in Internet security. FreshBooks is cloud based and uses industry – leading secure servers.

Yup. With FreshBooks both you and your team can collaborate on and track time towards the same projects and clients. Your team members can also help you with your accounting by creating invoices and tracking their expenses.

Great news: FreshBooks is available on any device — desktop, mobile or tablet and plays nicely with both Mac and PC.