Why Would a Vendor Request a W9 Form?

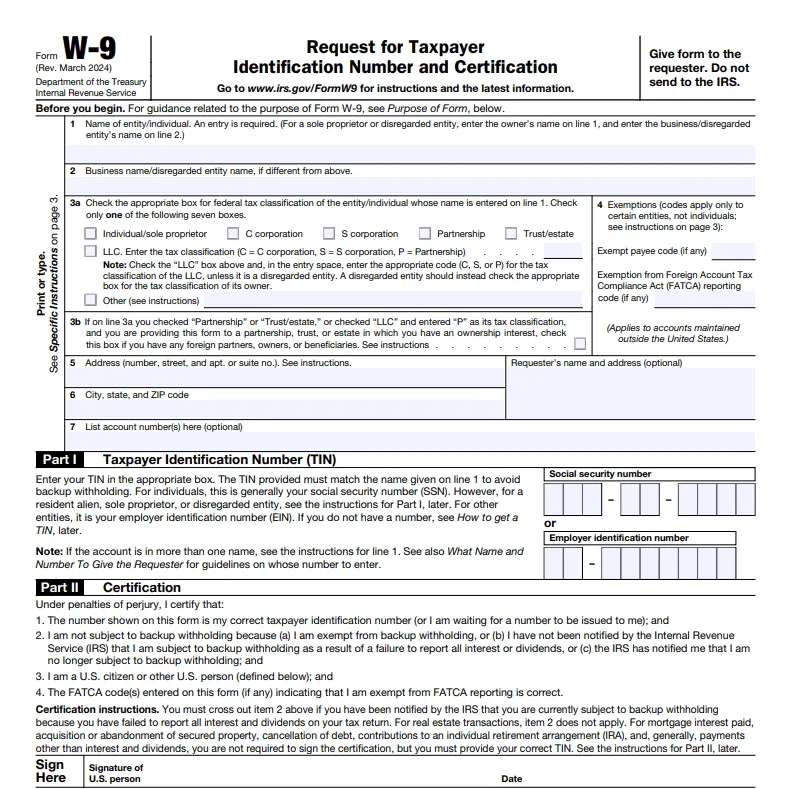

An IRS Form W-9 is an important document used for taxpayer identification and certification a business needs to request from any vendor in order to understand how to report their payments to the internal revenue service (IRS). Every person in a single-member LLC classified business, independent contractor, freelancer, c-corporation, and vendor needs to complete this simple, one-page document when they are first brought on board to a company or project, providing their name, address, self-employment tax classification, individual taxpayer identification number or social security number, and withhold taxes requirements. The individual then signs the form to certify the provided information. The business contact information must also be supplied if they are operating under a business name or trade name.

Key Takeaways

- A W-9 form is used for taxpayer identification and certification when freelancers and independent contractors work for a business. The business owner needs this form to properly report certain payments to the IRS.

- This form requires your name, address, federal tax classification, SSN, and withholding requirements.

- The purpose of a W-9 IRS form is to ensure all parties are compliant with tax laws.

- A W-9 form is needed whenever the vendor is paid 600 USD or more in one year.

Here’s What We’ll Cover:

What Is the Purpose of a W-9 Form?

Do I Need to Get a W9 From My Vendors?

Do I Ever Need to Get a New W9?

What Is a W9 Form?

A W-9 form is a form your client or the business you work for as a contractor should request from you as you start working together. The form provides the necessary information to the hiring party so they know if they need to later report your payments to the IRS via the 1099 form. The W-9 is only one page long and is pretty simple to fill out. Follow our guide on how to fill out a W-9 as an individual for a step-by-step walkthrough on properly completing the form.

In addition to the vendor name and address, it also requires either a Social Security or an employer identification number.

What Is the Purpose of a W-9 Form?

The purpose of this form is to create a record of the business relationship. When you make reportable payments, you’ll then have the correct taxpayer information.

Once the time comes to file forms 1099, the hiring company will know which vendor they will need to send the form to.

Why do Companies Need a W-9

It’s easy to understand why a W-9 form is important for your business. You need one from every vendor. But why would a vendor ever need to get that information from you?

There’s really only one reason this might be the case: if you’re buying goods and reselling them for a commission. For example, if you’re selling for a company like Tupperware or Avon, they might need a W9 from you. But in that case, it’s because they’re a business paying you a commission.

In other words, they’re asking for your W-9 information in the capacity of a payor, not a vendor. Even so, this requirement only kicks in if you buy more than $5,000 of goods for resale. If you’re selling the odd makeup palette on the weekends, you may not even hit that level of spending.

Keep Your Books in Order with Accounting Software

Accounting Software can help you stay on top of your income, outgoing sales, and tax return documents. FreshBooks is an accounting software service provider offering powerful accounting and bookkeeping tools, offering benefits like receipt tracking, payroll services, and online payment processing, streamlining your business operations and keeping you on track during tax return time. Click here to learn more.

Be Wary of Handing Sensitive Information

Every vendor should provide a W-9 to their hiring company. In turn, the hiring company must ensure that they keep sensitive information secure. Cloud-based accounting software can assist with this. It is secure and password-protected, ensuring that your sensitive information is kept safe and secure at all times. If you want to learn more, follow our guide on what is cloud accounting, where we have explained it in detail and listed the top cloud-based accounting software.

Do I Need to Get a W9 From My Vendors?

Yes. You should get a form W-9 from vendors and independent contractors in any business relationship where you are the payor.

Even vendors exempt from backup withholding will still need to fill one out. They simply enter an exempt payee code to provide a record of the vendor relationship. They may even leave every other field blank. That way, the business has all the information it needs when it’s time to file the 1099 forms with the IRS, and you, as a contractor, are provided with the correct forms to file your individual taxes.

What About Foreign Vendors?

Foreign vendors are the only vendors who don’t need to fill out a W-9. These entities will need to fill out W-8 forms instead.

Under most circumstances, you will need to fill out Form 1099-MISC or 1099-NEC at the end of each year. This serves as a record of how much you paid out. That said, if you did not make enough reportable payments, you wouldn’t need to fill out a 1099. You can enter your vendors’ information into your accounting software. You will then be able to print a report that will list all the vendors you need to send the form.

Running a business involves many moving parts, and it can be easy to misplace or forget important forms like the W-9 until they are needed during tax return season. Implementing accounting software into your business processes can reduce your workload and your stress level.

Make managing and organizing income taxes easier, including W-9 forms using FreshBooks accounting software for startups. With its user-friendly interface, FreshBooks makes it easier to keep track of vendor information, generate reports, and stay on top of income taxes and compliance.

FreshBooks accounting software can simplify the process of preparing and filing 1099 forms, and processing payments, saving you time and reducing the risk of errors or omissions during the filing process. Click here to get started.

Make sure to get your form W-9 from each vendor as soon as possible. Keeping your tax documents in order is easier than scrambling to get them together at the end of the year.

Do I Ever Need to Get a New W9?

In most cases, you will be able to use the same W9 from year to year. That said, there are certain times when a change is necessary. In the case of independent contractors or a corporate vendor, there could be several other reasons. For example, a sole proprietor could form an LLC, or a company could change its business address. A vendor may even spin-off from another company and receive a new TIN.

Conclusion

A W-9 is needed when the business pays a freelancer, independent contractor, or self-employed worker $600 or more in one year.

The purpose of a W-9 form is to create an official record of a business relationship between a company and an individual who is not a regular employee. It is a record of the vendor that has their taxpayer identification information, making it easier to create a 1099-MISC and file taxes during tax time.

If you found this article helpful, check out our taxes category for advice, guides, and informational blog posts full of related topics. Everything inside is designed to help business leaders succeed.

FAQs on Why Would a Vendor Request a W9

What type of vendor needs a W9?

Businesses should provide W-9 forms to anybody they are paying over $600 in one year for business purposes. This includes self-employed individuals, freelancers, people in a single-member LLC, and anybody who is paid to work for the company and is not an employee.

How much taxes will I pay on a W9?

Income tax for an individual paid through a W-9 arrangement will be taxed at a flat 28% unless you have backup withholding which may change this amount.

When is a W9 not required?

An IRS form W-9 is not needed if the vendor or freelancer is paid less than $600 in one year or if payments exceeding that amount were not business related.

What happens if a vendor does not provide a W9?

A business is required to document all attempts to obtain W-9 information from the vendor (a minimum of three attempts). If your business fails to collect an IRS form W-9 form from a vendor, and you have paid them over $600 in one year, then you must correctly complete a 1099-MISC form for each vendor, with penalties ranging from $60 to $310 for missing forms. The vendor may face IRS penalties.

How do I know if I need a W9 from a vendor?

If your payments to the vendor are under $600 in a calendar year, or your transactions are unrelated to your business or conducting a trade, then you do not need a form W-9. Any transactions over $600 that are business-related require a W-9. That said, collecting this IRS form from all vendors is a good idea.

Reviewed by

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

RELATED ARTICLES

List of Common Tax Deductions for Owner Operator Truck Drivers

List of Common Tax Deductions for Owner Operator Truck Drivers What Are IRS Meal Allowances Per Diem Rates for Tax Payers

What Are IRS Meal Allowances Per Diem Rates for Tax Payers What’s a Dependent? Definition & Tax Tips

What’s a Dependent? Definition & Tax Tips What Is SUI (State Unemployment Insurance) Tax Rate?

What Is SUI (State Unemployment Insurance) Tax Rate? Small Business Tax Forms: The Complete List

Small Business Tax Forms: The Complete List What is Form 940?

What is Form 940?