Adjusted Gross Income: What It Is and How to Calculate

The term adjusted gross income (AGI) refers to your gross income minus certain key adjustments, such as contributions to a retirement plan. Your AGI is a critical factor in determining your taxable income and, ultimately, calculating how much you owe in income taxes.

In this guide, we’ll cover everything you need to know about your adjusted gross income, including its exact definition, how to calculate it, and how to lower it to reduce your taxable income and increase your tax return.

Key Takeaways

- Adjusted gross income, or AGI, is the amount you earn minus certain adjustments, such as for traditional IRA contributions, HSA contributions, educator expenses, and student loan interest paid.

- You calculate your AGI by totaling your gross income (includes wages, capital gains, dividends, pensions, etc.) for the year and subtracting all eligible deductions, such as health savings account contributions, retirement savings with an IRA, alimony paid, and 50% of your self-employment taxes paid.

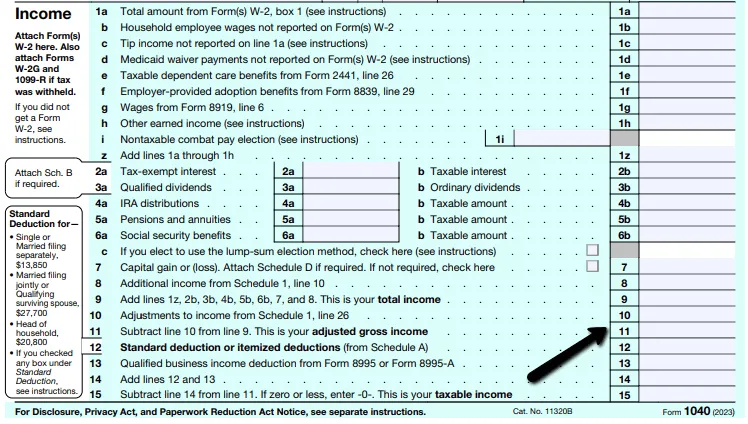

- Your AGI is listed on line 11 of Form 1040, 1040-NR, and 1040 SR for the 2020–2023 tax years.

- Your AGI is essential for determining your tax obligations and your eligibility for certain tax credits and tax-saving strategies.

- You can lower your AGI (and therefore decrease your total tax liability) by maximizing HSA and IRA contributions and claiming deductions for student loan interest and educator expenses paid.

- Your modified adjusted gross income, or MAGI, is another number that adds some deductions back into your AGI to determine eligibility for certain tax breaks, Roth IRA contributions, and IRA deductions.

Table of Contents

- What Is Adjusted Gross Income?

- How to Calculate Adjusted Gross Income?

- Where to Find Your AGI on Your Tax Return?

- Importance of Adjusted Gross Income

- How Can You Lower Your Adjusted Gross Income?

- What Is Modified Adjusted Gross Income?

- Use FreshBooks to Maximize Your Tax Deductions and Reporting

- FAQs About Adjusted Gross Income

What Is Adjusted Gross Income?

Adjusted gross income (AGI) refers to the total amount of income you earn from sources such as wages, dividends, capital gains, business income, retirement income, and other forms of income (e.g., tips, rents, interest, stock dividends, etc.), minus certain deductions, also called adjustments.

Adjustments can include 50% of the self-employment taxes you pay, self-employed health insurance premiums, interest on student loans, alimony, health savings accounts, teacher expenses, and contributions to certain retirement accounts, such as a traditional IRA. In other words, AGI is gross income minus certain eligible adjustments.

How to Calculate Adjusted Gross Income?

Calculating your AGI is a fairly straightforward process but one you’ll need to master to ensure accurate tax calculations. First, you’ll need to start with your gross income sources. These sources make up the total income you’ll earn in a year, including money from:

- wages or salaries from jobs

- investments

- businesses you own

- pensions

- government benefits, such as Social Security

- unemployment benefits

- rental income

- farms

- real estate

Add all the money you earned from the above sources to get your unadjusted total gross income, then add all your deductions (or adjustments) together. Subtract the total deductions from your gross income to calculate your adjusted gross income. These adjustments might include:

- expenses for educators (e.g., books, supplies, etc.)

- deductible health savings account contributions

- moving expenses (military members only)

- deductible self-employment taxes

- deductible contributions to an IRA or other retirement plan, such as SEP or SIMPLE

- interest paid on student loans

- alimony payments

- penalties paid for early savings withdrawal

- certain business expenses

For a complete list of eligible adjustments, take a look at the instructions for Form 1040 and Form 1040-SR.

Once you’ve totaled your gross income and all eligible adjustments, subtract the adjustments from your income to get your AGI. You’ll report this number on line 11 of Form 1040.

Where to Find Your AGI on Your Tax Return?

Since your AGI determines your tax obligations, you’ll need to know where to find it on your tax return. You’ll find your AGI for the previous tax year on line 11 of your Form 1040, Form 1040-SR, and Form 1040-NR, but different versions of Form 1040 might have your AGI listed on a different line. Here’s where to find your AGI depending on the form you’re looking at and what year it’s from:

- Form 1040, Form 1040-SR, and Form 1040-NR (2020–2023 tax years): Line 11

- Form 1040 and Form 1040-SR (2019 tax year): Line 8b

- Form 1040 (2018 tax year): Line 7

- Form 1040A (prior to 2018 tax year): Line 21

- Form 1040EZ (prior to 2018 tax year): Line 4

If you do your taxes manually on paper, you’ll need to find last year’s tax return. The AGI will be on IRS Form 1040 (the form number is in the top left corner). If you filed your tax return electronically, you should be able to access forms from previous tax years by logging into your tax software and downloading a copy of the form you need.

Importance of Adjusted Gross Income

Your AGI is an important number to have on hand. Not only is it used to verify your identity with the IRS when filing your taxes, but it’s also used to determine your income tax liability. AGI is essentially the starting point in determining your total taxable income—it’s the number from which you’ll make all other deductions to determine how much you owe in tax for the year.

Your AGI also greatly impacts the deductions and tax credits you’re allowed to claim, potentially making a big difference in your total tax bill. Deductions can help significantly reduce the taxes you owe (or increase your tax refund), but some deductions are limited based on your AGI for higher-income earners, depending on your filing status.

How Can You Lower Your Adjusted Gross Income?

Reducing AGI is sometimes known as an above-the-line tax deduction since you’re reducing the amount of income before making further deductions when doing tax calculations. There are a few key ways to reduce your adjusted gross income and, by extension, your income tax obligations for the year. These include:

1. HSA Contributions

One of the best ways to lower your AGI is by contributing to an eligible health savings account, or HSA. As an individual, you may have the option to contribute up to $4,150 for 2024. Families can contribute up to $8,300 for the year. If you’re 55 or older, you can contribute an additional catch-up contribution of $1,000 to your HSA.

The more you can contribute to your HSA, the lower your AGI will be for the year. The money you put into the account remains, meaning it’s there to cover future out-of-pocket medical expenses while reducing your current taxable income now. There’s also no need to itemize these deductions, making it even easier to take advantage of this above-the-line deduction.

2. Retirement Contributions

Another great way to reduce AGI (and your tax bill) is by contributing to a retirement savings account, provided it’s eligible for AGI deductions. If you have a traditional individual retirement savings account or IRA, you could see a dollar-for-dollar reduction of your AGI, all while saving money for the future. For 2024, the limit for this deduction is $7,000, though the limit increases to $8,000 for those 50 years of age or older in 2024.

3. Student Loan Interest Deduction

If you pay interest throughout the year when repaying a qualified student loan, you can deduct the interest paid as another deduction to your AGI. The maximum amount you can deduct for student loan interest is $2,500 in 2024, but it may not be available depending on your income and filing status.

If your filing status is single, head of household, or qualified widower, and your modified AGI is more than $95,000 for 2024, you won’t qualify for a student loan interest deduction. The same goes for married couples filing jointly and making more than $195,000 in 2024. If your income is less than these amounts based on your filing status, you should be able to deduct up to $2,500 in interest from your AGI.

4. Educator Expenses

This adjustment is available solely for teachers and other eligible educators to help offset the out-of-pocket expenses that education professionals pay. If you spend your own money on class or classroom costs as a qualified educator for kindergarten to grade 12 classes, you can deduct up to $300 when filing as an individual from your AGI to cover expenses like books, instructional supplies, classroom tech, and other classroom items. If you’re married and filing jointly, and both you and your spouse are eligible educators, you can claim a $600 adjustment.

What Is Modified Adjusted Gross Income?

Modified AGI (or MAGI) is a term that comes into play if you’re itemizing certain deductions on Form 1040. For most taxpayers, MAGI refers to your adjusted gross income before subtracting deductions for student loan interest, but it may be more complex in certain scenarios. Other deductions that might be added back to your AGI to calculate MAGI include foreign-earned income, housing exclusions, and employer adoption benefits.

Knowing your MAGI can be important when determining your eligibility for certain tax breaks, whether you can contribute to a Roth IRA, and whether you can deduct IRA contributions. You can also use it to determine eligibility for other tax credits, such as the American Opportunity Credit or Lifetime Learning Credit.

Use FreshBooks to Maximize Your Tax Deductions and Reporting

Adjusted gross income is just one example of the many tax figures you’ll need to accurately track and calculate to ensure an accurate tax filing and the lowest possible income tax liability. We know it can be challenging for small business owners to find the time to maximize their tax deductions. FreshBooks accounting software simplifies this process with tax-ready financial reports and other features that save business owners time.

Our invoicing software simplifies getting paid by your customers. It automatically tracks your gross income throughout the year, while our expense tracking software makes it easy to keep spending on track. Thanks to automated features and accurate tax reporting, it works smoothly and efficiently, simplifying the deduction process when it’s time to file your taxes. Don’t let tax season get the best of you this year—try FreshBooks for free.

FAQs About Adjusted Gross Income

Still curious about calculating your AGI? Here are a few frequently asked questions about AGI to expand your knowledge.

What if I Can’t Find My AGI From Last Year?

If you can’t find your previous year’s AGI, you can use the IRS’s Get Transcript online tool to access it quickly. You’ll have to pass the IRS’s secure identity verification process, then click “tax return transcript” and scroll down to the adjusted gross income line entry.

What Qualifies for Adjusted Gross Income?

Qualifying deductions for your AGI include half of the self-employment taxes you pay in a year, self-employed health insurance premiums, HSA contributions, traditional IRA contributions, interest paid on a student loan, alimony paid, educator expenses, and certain business expenses.

How Do I Find the AGI on My W2?

Your AGI isn’t listed on IRS Form W2. You’ll need to use income information from Form W2 to calculate your AGI, but the adjusted gross income itself isn’t listed on the form. To calculate AGI, you must total your gross income for the year and subtract all eligible deductions.

What Is the Difference Between Adjusted Gross Income and Net Income?

Your adjusted gross income is your total income minus deductions or the amount you receive that is subject to taxes. Net income, on the other hand, refers to your total income after you’ve paid taxes.

Reviewed by

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. Michelle earned a Bachelor’s of Science and Accounting from Minnesota State University and has provided accounting support across a variety of industries, including retail, manufacturing, higher education, and professional services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

RELATED ARTICLES

Indirect Tax: Definition, Types, and Example

Indirect Tax: Definition, Types, and Example Freelancer Taxes: Ultimate Guide for Tax Filling & Smart Savings

Freelancer Taxes: Ultimate Guide for Tax Filling & Smart Savings Self-Employed Health Insurance Deduction

Self-Employed Health Insurance Deduction How Far Back Can IRS Audit? Everything You Need to Know

How Far Back Can IRS Audit? Everything You Need to Know Itemized Deductions: What They Mean and How To Claim

Itemized Deductions: What They Mean and How To Claim SALT Deduction: How to Write Off State And Local Tax

SALT Deduction: How to Write Off State And Local Tax