How To Pay Independent Contractors In 2025

Freelancers and independent contractors are important in today’s workforce, bringing an array of useful skills while allowing small businesses to contract their work without paying a full-time employee salary with benefits. A 1099 contractor is defined by the IRS as a self-employed individual “if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done.”

Although they are not part of your everyday team, paying contractors correctly and efficiently in 2025 is imperative, not only to maintain a good business relationship with them but also to stay compliant with tax laws.

In this article, we’ll explore multiple payment methods like checks, wire transfers, and PayPal. We’ll also look at factors like processing times, transaction fees, and tax compliance to help you decide which is the best way to pay 1099 contractors.

Key Takeaways

- There are many ways small business owners can pay independent contractors, including checks, wire transfers, credit cards, direct deposit, ACH bank payments, online payment methods, accounting software, and cash.

- When choosing a payment method, business owners should consider payment processing times, transaction fees, accessibility, ease of use, documentation processes, and whether it can help with tax compliance.

- Accounting software makes life easier for small business owners and can help with record keeping, tax compliance, and more, making it one of the best ways to pay contractors.

Table of Contents

- Checks

- Wire Transfers

- Credit Cards

- Direct Deposit

- ACH Payment

- PayPal

- Accounting Software

- Cash

- Factors to Consider When Paying Contractors

- Independent Contractor vs. Employee

- Streamline Contractor Payments with FreshBooks Payroll

- FAQs on How To Pay Contractors

1. Checks

Personal checks are a simple and familiar way to pay your contractors. Just grab your checkbook, fill out the relevant information, and send it to the independent contractor—simple as that.

While their simplicity makes checks a great option, it takes time for a physical check to get delivered and processed before the funds are transferred. The check takes time to arrive in the mail, and there will often be a hold on the funds for 2 to 5 business days before the check clears, potentially leading to delays in payment for the independent contractor.

eChecks are an alternative option—although they still take a few days for banks to process, you can email them to your independent contractor, meaning they won’t have to wait for their payment to arrive in the mail.

2. Wire Transfers

Wire transfers are a fast, reliable way to pay independent contractors almost anywhere in the world. While an international transfer may take a few days, domestic wire transfers usually clear in 24 hours, making them one of the quickest ways to pay a 1099 contractor.

There are some downsides, however. A wire transfer’s sender and recipient will both usually incur a fee. For domestic transfers, the sender will have to pay a fee of $20 to $30, and the recipient will pay a fee of $15 to $20. These costs are even higher for international transfers. Also, it’s very difficult to reverse a wire transfer in case of a dispute or mistake—especially for international payments.

Between the fees and risks of wire transfers, using them only when time is of the essence is suggested.

3. Credit Cards

Credit cards can be another quick, reliable way to pay a contractor. Many business owners opt for credit card payments because they offer additional layers of security for the sender, keeping your banking information private and separate from your independent contractor payments.

Credit cards also offer extra assurance in the form of dispute resolution. Because credit card payments are made with a line of credit versus your actual money, it’s much easier to initiate a dispute or reverse a mistaken payment. Many credit card companies offer comprehensive protection for their clients (some even offer zero fraud liability), making them an attractive option for paying freelancers and contractors.

On the other hand, you’ll likely need a merchant account with your bank (and will have to pay transaction fees) to pay an independent contractor via credit card, meaning this isn’t always the best option.

4. Direct Deposit

Direct deposit is one of the most common ways to pay employees, contractors, and freelancers alike. It’s simple to set up for freelancers—all you need is the banking information from each independent contractor, and then you can set up the deposit arrangement with your bank. After that, payments are sent directly to your contractor’s account.

Direct deposits are great for freelancers you send recurring payments to since you just have to set up the direct deposit payments a single time to pay them in the future.

It’s also a very secure way to make payments, and the funds are usually available to the recipient within 1 to 2 business days. Overall, this is a great option for paying freelancers with little to no downside other than the administrative function of obtaining their banking information ahead of time in a secure manner.

5. ACH Payment

Automated Clearing House (ACH) payments are a form of bank deposit payments commonly used for employers, staff, and independent 1099 contractors for transferring money between banks. These can be used for a wide range of deposit and debit transactions, including online sales and bill payments, business-to-business transactions, mortgage payments, and more.

ACH transfers may be confused with direct deposits, but, in fact, direct deposits are a type of ACH, with payroll, tax refunds, and certain benefits being deposited directly into a person’s bank account.

ACH transfers are simple to set up, and once you’ve done so, you can continually pay the same independent contractor without having to collect more information. This makes ACH transfers ideal if you’re working with the same contractors ongoingly. ACH bank payments are also paperless, making them relatively secure for both the sender and the recipient.

Banks will sometimes charge a fee to the sender for processing ACH payments (sometimes as high as $10 per transaction), but this varies greatly depending on your financial institution and any arrangement you’ve already negotiated with them.

6. PayPal

As the world’s leading online payment platform, PayPal is a very common method for business owners to pay freelancers and independent contractors.

As the sender, you simply need to link your bank account to your PayPal business account. This lets you transfer funds directly to your independent contractor’s PayPal account, which they can use directly from PayPal or transfer into their regular bank account. Of course, this has a downside—all your contractors must have a (free) PayPal account of their own for this method to work.

Bear in mind that PayPal charges fees for merchant and business accounts in some regions, but not all. Double-check the relevant fees in your region before using PayPal as your main payment method for freelancers—these costs can add up over time.

7. Accounting Software

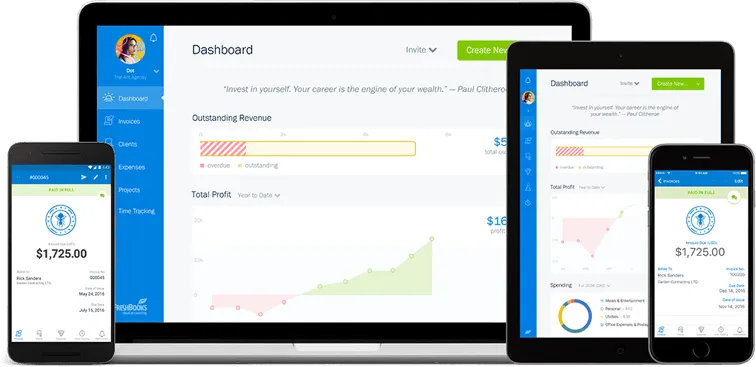

Accounting software can streamline payments to independent contractors by automating payment processes, managing records, and ensuring compliance with tax laws. Using accounting software like FreshBooks, QuickBooks, Xero, or Sage for payroll means you can utilize features like direct deposit, automatic tax form generation, and integration with other financial tools.

FreshBooks Payroll software, powered by Gusto, is a convenient option for contractor management. With its comprehensive accounting solution that allows businesses to easily manage contractor payments through automated processes, our clients have access to direct deposits and ACH bank payments with simpler record-keeping processes and easier compliance with state and federal tax regulations. Many business owners believe that accounting software with integrated add-ons like FreshBooks Payroll is the best way to pay freelancers and independent contractors.

8. Cash

Despite all the more high-tech options on the list, you can also use cash to pay independent contractors that you interact with personally. Cash has its benefits: It’s tangible and physical, it can’t bounce like a check, and it doesn’t need to be processed by a bank before it can be spent.

Some contractors might prefer to be paid in cash, but it’s considered a risky move for businesses. Paying in cash often means no paper trail, leaving you open to the risk of a tax discrepancy or even an audit. This also makes it possible for freelancers to evade some taxes or make mistakes when reporting their business income, which can lead to more questions and challenges at tax time. Though not technically illegal, it’s often advised not to pay any contractors in cash.

If paying in cash, consider, at the minimum, obtaining a cash payment receipt signed by the contractor.

Factors To Consider When Paying Contractors

There are plenty of options when it comes to choosing the best method to pay an independent contractor. Here are a few key factors to consider before making your decision.

1. Payment Processing Time

Certain payment methods, like checks, ACH transfers, and PayPal payments can be subject to payment processing delays. In some ongoing arrangements where trust is established between the business owner and the independent contractor, this may not be an issue, but it can be a concern for new contractors or one-off projects.

2. Transaction Fees

If you use a lot of contract workers in your business, you’ll need to consider the fees associated with each payment. Fees for credit card payments, PayPal transfers, or transfers may seem reasonable at first, but they can add up to a significant sum over time. Opt for lower-cost options if you’ll be making consistent, ongoing payments to freelancers.

3. Ease of Use and Accessibility

Choosing an easy-to-use payment method (such as bank deposit or ACH transfer) helps make life easier when you pay contractors. Certain payment methods also make the funds more readily accessible for the contractors, which may be important in maintaining good working relationships with your freelance team.

4. Record Keeping and Documentation

It’s essential for businesses to keep good records of all payments made to freelancers for both tax purposes and to maintain good financial accounts.

It’s recommended that you choose an online payment method that makes it easy to keep organized documentation of all payments. Accounting software makes it much easier to keep thorough records of each time you pay contractors.

5. Tax Implications and Compliance

Good financial records go hand in hand with organized tax information and compliance with all tax laws. It’s recommended to choose a payment method that makes it simple to keep track of the tax obligations of paying freelancers.

Accounting software can automatically generate tax forms and other important data to ensure full compliance for your business.

Independent Contractor vs. Employee

Hiring an independent contractor is much different from hiring an employee. Some of the biggest differences between W-2 employees and 1099 contractors are the length of time they’re employed and how they’re classified during tax time. Independent contractors are hired to complete a project. They provide their own tools, they have different tax responsibilities, and they don’t receive any benefits that a regular W-2 employee would, like health insurance or vacation pay. You’ll have less control over the work they do, as they’re independent from the company.

On the other hand, an employee is bound by the terms of employment at your company. They are considered a permanent part of the team, and you can control when, where, and how the work is done.

It’s important to classify your workers correctly to ensure you’re complying with labor and tax laws and paying independent contractors correctly, as the rules for each classification vary. Misclassifying your workers can come with serious fines and consequences, even if it’s not done on purpose.

Streamline Contractor Payments with FreshBooks Payroll

There’s no one-size-fits-all answer on how to pay your contractors. Whether you choose to pay by check, wire transfer, credit card, direct deposit, ACH payment, online payment, or cash, every business will have to look at their specific needs to find the best option for them. Certain situations require different payment methods, and you’ll want to consider important factors like fees, processing times, and tax implications.

If you’re looking for a flexible starting point, FreshBooks Payroll software is a streamlined solution for managing payments. With automated payments, direct deposits, and compliance management, it’s an excellent choice for businesses looking for a more efficient way to pay independent contractors.

You can try FreshBooks for free today and find out how this powerful financial management software can save you time and money.

FAQs on How To Pay Contractors

More questions about how to pay contracted workers in a secure, reliable, and efficient way? Here are the most commonly asked questions about payment methods for independent contractors and freelancers.

What are normal payment terms for contractors?

Normal contractor payment terms include how they’re charging for work (e.g., hourly, price per deliverable, etc.), the currency they’ll be paid in, the payment methods they accept, the payment schedule (e.g., whether payment is due in advance, upon delivery, etc.), and the payment due date.

Should contractors be paid upfront?

You may need to pay an independent contractor before they begin work. This might be a deposit (such as 50% of their total fee) to ensure the company remains communicative while the contractor is working. Some contractors may demand the entire payment upfront, but this varies by industry.

How long do you have to pay a contractor’s invoice?

You have until the agreed-upon payment due date to pay your contractor’s invoice. This date will be indicated on the invoice itself or in the statement of work and depends on the specific contractor’s payment policies. Paying after this date could result in late fees.

Can you 1099 someone you paid cash?

Yes—in fact, you’re required to provide a 1099 to an individual or corporation if you paid them more than $600 in a tax year, whether that payment was made in cash or with another method. Failing to do this can result in penalties from the IRS.

Should you ever pay a contractor in cash?

It’s not recommended to pay a contractor with cash because there’s no record of payment. This can lead to tax discrepancies and other issues. It’s better to pay self-employed freelancers and independent contractors online, through your bank, with a credit card, or using accounting software to ensure you remain compliant with records of how much you’ve paid your contractors in case of an audit.

What is the safest way to pay a contractor?

Direct deposit is the most secure way to pay a contractor. This avoids payment being routed through email or physical mail. Instead, it goes directly into the contractor’s bank account, with fewer security vulnerabilities. You can usually set up a bank deposit with your financial institution or use it through accounting and payroll software like FreshBooks.

Reviewed by

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. Michelle earned a Bachelor’s of Science and Accounting from Minnesota State University and has provided accounting support across a variety of industries, including retail, manufacturing, higher education, and professional services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

RELATED ARTICLES

What Is a Warehouse? Definition & Important Elements

What Is a Warehouse? Definition & Important Elements The Importance of Business Plan: 5 Key Reasons

The Importance of Business Plan: 5 Key Reasons Comp Time Vs Overtime: What’s the Difference?

Comp Time Vs Overtime: What’s the Difference? 3 Better Alternatives to SWOT Analysis for Business Planning

3 Better Alternatives to SWOT Analysis for Business Planning What Is a PayPal Invoice? And How Does It Work?

What Is a PayPal Invoice? And How Does It Work? 5 Best Remodeling Estimating Software

5 Best Remodeling Estimating Software