How to Accept International Payments: International Payment Methods

Small businesses that sell their products or services to international clients need to develop safe and effective methods for accepting payments internationally. The best international payment option for your business will vary depending on the specific country in which your client is based.

For small businesses, the easiest way to process international payments is to use a secure international invoice payment method that allows them to process international credit cards and also receive funds in multiple currencies.

Key Takeaways

- International payments are any transaction made by one country to another involving at least two different currencies.

- Accepting international payments can occur using online payments, letters of credit, international money orders, or international wire transfers.

- Gateways with the ability to process international payments can be integrated into your current payment software and processes.

- FreshBooks Payments accepts payments in 195+ different countries.

- Creating a streamlined process for international payments allows you to scale your business globally.

These topics will walk you through accepting international payments.

Table of Contents

- What is an International Payment?

- How to Accept International Payments

- Payment Gateways to Accept International Payments

- Conclusion

- Frequently Asked Questions

What is an International Payment?

An international payment is any payment made from one country to another. This transaction requires additional processes and support because of varying conversion rates and regulations in each country. Essentially, an international payment is a business transaction between a buyer and a seller that crosses national borders. These transactions typically involve at least two unique currencies but can involve several depending on the type of goods or services involved.

How to Accept International Payments

There are several methods for accepting international payments from clients based overseas. To accept international payments, you’ll need to choose the payment option that works best for your company.

Factors like conversion fees, processing fees, and processing times are important to consider when choosing your preferred method. Below is a breakdown of popular methods you can use to accept payments:

1. Online Payments

You can accept online payments from international clients through various online service providers, including FreshBooks Payments powered by Stripe, PayPal, Wise, and Amazon Payments.

Advantages of Online Payments:

- Ease of Use: Most online payment services are simple to navigate and require just your basic banking details to begin processing payments.

- Quick Processing Times: Most international online payment services boast quick processing times. Often, the money will land in your account within just a few days.

- Strong Security: With heavy security and encryption for every international transfer, online payments are one of the most secure methods of accepting payments from overseas.

Disadvantages of Online Payments:

- Limited Availability: Online payment services aren’t available in all countries, so do your research and make sure your preferred provider offers its services in the country where your client is based.

- ChargeBack: Accepting a credit card as form of payment always carries the risk of a charge back if the client disputes the charges.

- Transaction Fees: Online payment services charge transaction fees for using their service. The cost per transaction usually ranges from two to five percent. Compared with other options these fees can be rather convenient.

2. Letter of Credit

A letter of credit is an official document issued by one bank and sent to a second bank that’s based in a foreign country. The letter of credit guarantees a person will make a payment for a certain amount by a certain date. The Export-Import Bank of the United States offers more details about how letters of credit are used for international payments.

Advantages of Letters of Credit:

- Low Risk: Your payment is guaranteed by the client’s bank, so if there’s a problem, the bank is responsible for sending you the money owed.

- Secure Payment: A letter of credit involves a payment transferred between two banking institutions, so it’s a secure form of payment.

Disadvantages of Letters of Credit:

- Subject to Fees: Banks tend to charge high transaction fees for letters of credit.

- Payment Expires: A letter of credit will include a specific timeline for the bank’s payment guarantee, so it’s important that the payment requirements are fulfilled before the letter expires.

3. International Money Order

An international money order is a document that looks similar to a check. Money orders are a prepaid payment option, so your customer will need to pay upfront for a money order using cash or a credit card.

Advantages of International Money Orders:

- Low Cost: Money orders are cheap to purchase, and you won’t be charged any processing fees.

- Payment up Front: You’re guaranteed that your client has the money to cover the invoice amount because they pay up front for the money order.

Disadvantages of International Money Orders:

- Long Processing Times: Money orders can take several days to arrive at their destination, and it can take up to ten days for your bank to process the money order.

- Used for Scams: Because money orders are easy to buy and difficult to trace, they’re often used in scams. If you accept money orders, just be sure to watch for red flags that could point to a scam. It’s best to only accept money orders from clients you know and trust.

4. International Wire Transfer

International wire transfers are a common overseas payment method. A type of international money transfer, a wire transfer, is an electronic exchange of money between two bank accounts using a network like SWIFT.

Advantages of Wire Transfers:

- Fast Processing Time: When a client sends you money through a wire transfer, the funds will usually be available in your bank account almost immediately.

- Highly Secure: Because the transactions are made directly between two banking institutions, wire transfers are a secure payment method for international transfers.

Disadvantages of Wire Transfers:

- Expensive: Banks charge high fees, sometimes as much as sixty dollars per transaction, for international wire transfers.

- Not Easily Traceable: Wire transfers aren’t easy to trace, so it can be difficult to settle any payment disputes that might arise between you and a client.

Payment Gateways to Accept International Payments

Using a gateway is another way to process international payments. There are many options available, all with varying perks and advantages. Gateways can be integrated with e-commerce software, making accepting international payments an effortless transaction for you and the customer. This allows users to process credit card payments, manage transfer fees, and keep track of any foreign currency.

Keep in mind the third-party gateway you choose has to be fully PCI-compliant to keep your transactions secure. Here are some of the best gateways available:

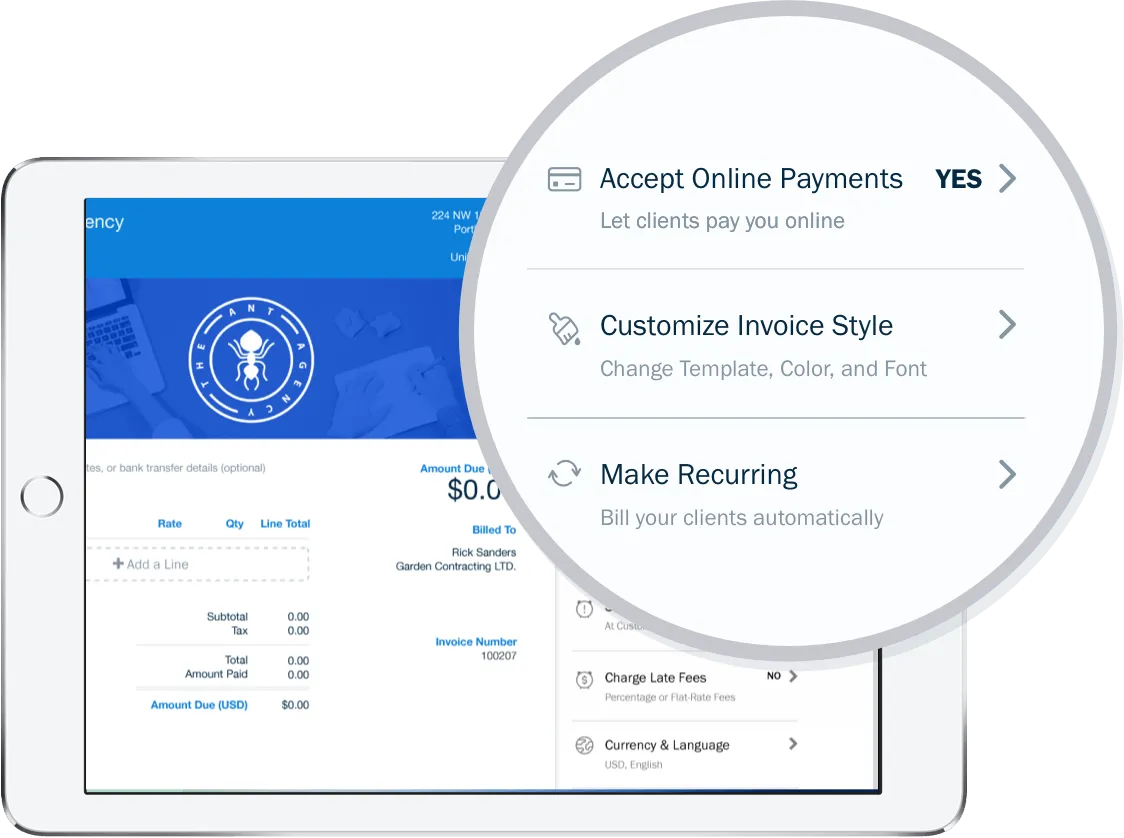

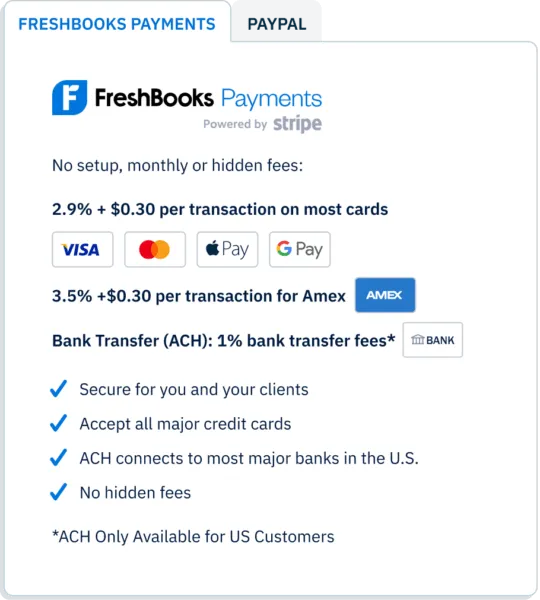

1. FreshBooks Payments

FreshBooks Payments is the best gateway to accept international payments. Powered by Stripe, FreshBooks Payments allows you to accept online payments nationally and internationally. Get paid easily, quickly, and securely through one centralized account. There are no hidden or monthly fees for a FreshBooks Payments account, plus you can easily turn online payments on and off with each invoice for a customized payment system. FreshBooks accepts payments in foreign currencies from over 200 countries directly on invoices. Click here to start your free trial.

2. PayPal

PayPal is a popular payment gateway worldwide. They operate in around 200 countries and have support for over 100 individual currencies to process payments. With express checkout, mobile card reader, credit card reader, barcode scanning, bill me later, and many other features, PayPal remains a convenient choice. Your existing PayPal account can have international capabilities added. It’s also PCI-compliant, making your international transactions safe and reliable.

3. Stripe

Stripe is a cloud-based payment method that provides a range of APIs. This gives merchants full control to integrate new payment options. The Stripe payment gateway is ideal for startups and SMBs who want to scale at a later stage of growth. It offers robust security and fraud prevention measures that help prevent disruption to global sales. Stripe supports over 135 currencies and features a custom UI toolkit, consolidated checkout, mobile interface, recurring payments, and 24/7 technical support.

4. Authorize.net

Authorize.net is a great option for small businesses, with longevity and success that makes you feel comfortable and secure in all your transactions. They have a robust infrastructure and advanced fraud protection measures. Its international payment gateway can accept payments from major card providers around the world. It also has a fully integrated Account Updater and electronic check processing to make payment processing more flexible.

5. Worldpay

If you deal with foreign currency frequently, WorldPay’s international payment gateway provides innovative solutions for large enterprises, B2B, and B2C, while still having the right infrastructure for small and medium businesses as well. It has access to 126 foreign currencies and can process payments in 146 countries. It offers flexible integration options like hosted pay pages and integrated payment pages.

Conclusion

If your business sells products or services to international clients and you often receive international payments, it’s vital to learn how to accept international payments. Finding the right combination of international money transfer practices, processing methods, gateways, and support is the best way to set yourself up for success and continue scaling your business here and abroad. The right payment gateway securely validates your customer’s payment details, ensuring funds are available so you can get paid faster and more reliably every time.

FAQs on How to Internationally Accept Payments

How do I enable international payments on FreshBooks Payments?

With FreshBooks Payments, international payments acceptance is enabled by default, so you can start accepting international cards right away.

How do I enable international payments on PayPal?

To enable international payments on your PayPal account, log in and click the ‘Summary’ link. Navigate to the ‘Currencies’ link in the Money section. Click the ‘Add Currency’ button. Follow the prompts to add the currencies of your choice.

Can I receive money from abroad directly to my bank account?

Yes. Money sent from another country can be deposited directly into your bank account via an international wire transfer. You must supply the sender with your bank data, including your complete name, bank account number, sort code, and IBAN and SWIFT codes.

How to receive money internationally without a bank account?

You can use a payment gateway instead of a local bank account, such as PayPal or Venmo, for international transfers. Without a digital wallet account, the only other way to send money internationally without using a bank account is a money order. The money orders act as cash transfers and can be exchanged for cash value once received.

Which payment method is best for an international transaction?

For international sales, wire transfers are still very popular. Gaining in popularity is accepting international credit cards using a payment gateway like FreshBooks Payment.

How much is the FreshBooks Payments fee for international cards?

Besides the standard transaction fees, there is a surcharge to accept international credit cards. For customers based in the U.S. the surcharge is 1.5% of the transaction value.

For customers based in Canada the surcharge of 0.8% of the transaction value when accepting international credit cards. If your customer pays in their local currency, and is different than your bank account currency, an additional currency conversion fee of 2% of the converted amount will be applied.

How much is the PayPal fee for $100?

The most common PayPal fee of 3.49% + $0.49, the fee for a $100 transaction would be $2.98, making the total money received after processing $96.02.

Reviewed by

Kristen Slavin is a CPA with 16 years of experience, specializing in accounting, bookkeeping, and tax services for small businesses. A member of the CPA Association of BC, she also holds a Master’s Degree in Business Administration from Simon Fraser University. In her spare time, Kristen enjoys camping, hiking, and road tripping with her husband and two children. In 2022 Kristen founded K10 Accounting. The firm offers bookkeeping and accounting services for business and personal needs, as well as ERP consulting and audit assistance.

RELATED ARTICLES

Suing for Non-Payment of Services: How to Take Legal Action and Get Paid

Suing for Non-Payment of Services: How to Take Legal Action and Get Paid How Does Invoice Payment Work?

How Does Invoice Payment Work? Do You Send an Invoice Before or After Payment? Invoice Timing Explained

Do You Send an Invoice Before or After Payment? Invoice Timing Explained Invoice Payment Methods For Small Business: How to Get Paid Faster

Invoice Payment Methods For Small Business: How to Get Paid Faster How Partial Payment Invoice Helps to Get Paid Upfront Payments

How Partial Payment Invoice Helps to Get Paid Upfront Payments How to Collect Money from Clients Who Won’t Pay

How to Collect Money from Clients Who Won’t Pay