Invoice Discounting: Definition and Benefits

Invoice discounting allows businesses to secure a more steady cash flow by cashing in on their outstanding invoices. But how exactly does this invoice finance solution work? Keep reading to learn more about invoice discounting, how it works, and why you should consider it for your business. You’ll also learn about another popular form of invoice finance: invoice factoring.

Table of Contents

How Does Invoice Discounting Work?

Benefits of Invoice Discounting

Differences Between Invoice Discounting and Invoice Factoring

What is Confidential Invoice Discounting?

What Is Invoice Discounting?

Invoice discounting is a financial service. It allows businesses to receive cash in advance based on the value of their unpaid invoices. This way, they will gain access to their entire accounts receivable ledger. There’s no need to wait for customers to settle their invoices.

The money comes from a discounting company that acts like a lender. The company accepts unpaid invoices as proof of the money owed. These invoices are called accounts receivable, and the company uses them as collateral. After the supplier gets paid, they return the borrowed amount to the lending company. They also pay an agreed-upon service fee.

Invoice discounting can be instrumental for smaller businesses. These businesses usually can’t afford to wait for payments under delayed invoice payment terms. This solution works great for businesses that can’t get a bank loan due to poor credit history.

How Does Invoice Discounting Work?

Invoice discounting acts like overdraft protection on your accounts receivable. You can also view it as a short-term loan to give your business a necessary cash flow boost. Invoice discounting generally includes the following steps.

- The customer buys goods from the supplier.

- The supplier issues an invoice. The invoice usually has deferred payment terms of up to 120 days.

- The supplier submits the invoice to an invoice-discounting company. The invoice serves as collateral for a short-term loan.

- The invoice-discounting company assesses the invoice’s validity and the supplier’s creditworthiness. Then, it agrees to advance a percentage of the invoice value. This percentage usually goes up to 95% of the invoice’s full value.

- The customer pays the invoice according to the agreed-upon payment terms. Otherwise, the supplier handles chasing late payments.

- After receiving the payment from the customer, the supplier repays the invoice-discounting company. This includes a fee to cover the interest, risk, and costs. Invoice-discounting fees run from 1% to 3% of the invoice total.

Sometimes, the customer makes a direct payment to the discounting company. In this case, they put the money into a trust account in the supplier’s business name. This is how the lender maintains confidentiality. Plus, it minimizes the risk of a non-payment by the supplier.

Benefits of Invoice Discounting

Invoice discounting offers plenty of benefits for businesses struggling due to unpaid invoices. Here are some of the key benefits.

● Invoice discounting offers a business fast access to its accounts receivable ledger.

● This invoice financing service secures a more stable cash flow stream. This is necessary for the business to survive and grow.

● Getting invoice discounting is simpler and quicker than applying for a bank loan.

● Using invoice discounting is cheaper than getting a loan. The service fee rarely surpasses 5% of the invoice amount.

● Invoice discounting is independent of long-term repayment agreements with high interest rates.

● Suppliers are more likely to get approved for invoice discounting than bank loans.

● Invoice discounting allows companies to do business forecasting and planning.

● Invoice discounting is usually confidential.

Businesses can use the money obtained through invoice discounting for various purposes. These include:

● Taking on temporary employees during a busy period

● Buying more raw materials or stock

● Surviving a challenging trading period

● Investing in the business’s growth

Differences Between Invoice Discounting and Invoice Factoring

Both of these invoice financing services offer an advance against outstanding invoices. Still, invoice discounting differs from invoice factoring in several ways.

For starters, invoice discounting is a loan. It keeps the supplier in charge of credit control. In contrast, an invoice-factoring company usually takes over credit control. This means the company deals with customers head on. It also chases late payments on your behalf.

In invoice factoring, a finance company buys the unpaid invoices at a discount. This method can help business owners avoid dealing with credit control. But, it can also damage customers’ perception of the business.

This ties into another critical difference between these invoice financing services: confidentiality. Customers generally never know when a company is using invoice discounting providers. Invoice factoring is next to impossible to hide.

Before buying the unpaid invoices, the invoice-factoring company will credit-check all the customers. This way, they can weed out potential bad players. In invoice discounting, the supplier handles vetting the customers.

Invoice discounting generally carries a greater risk for the lender than invoice factoring. As a result, they often choose to work with large companies with reliable customers. Smaller businesses tend to work with factoring companies. Their terms are often more accessible.

In invoice factoring, suppliers might have to pay back the factoring company. This occurs if a customer fails to pay. To avoid this, businesses can opt for non-recourse factoring. The fees for non-recourse factoring are usually higher. Still, suppliers can have peace of mind knowing they don’t have to pay the money back. This option doesn’t exist in invoice discounting.

What Is Confidential Invoice Discounting?

By default, invoice discounting is confidential. For this reason, it’s often referred to as confidential invoice discounting.

Confidentiality is one of the main reasons businesses choose invoice discounting over factoring. With invoice discounting, customers won’t know you’re working with a finance provider. This allows you to maintain your trustworthiness and a positive relationship with customers.

This confidentiality comes with a catch. You’ll have to chase late customer payments. This is the only way to prevent customers from finding out about the service you’re using. This can sometimes be a good thing. It all depends on the creditworthiness of your customers.

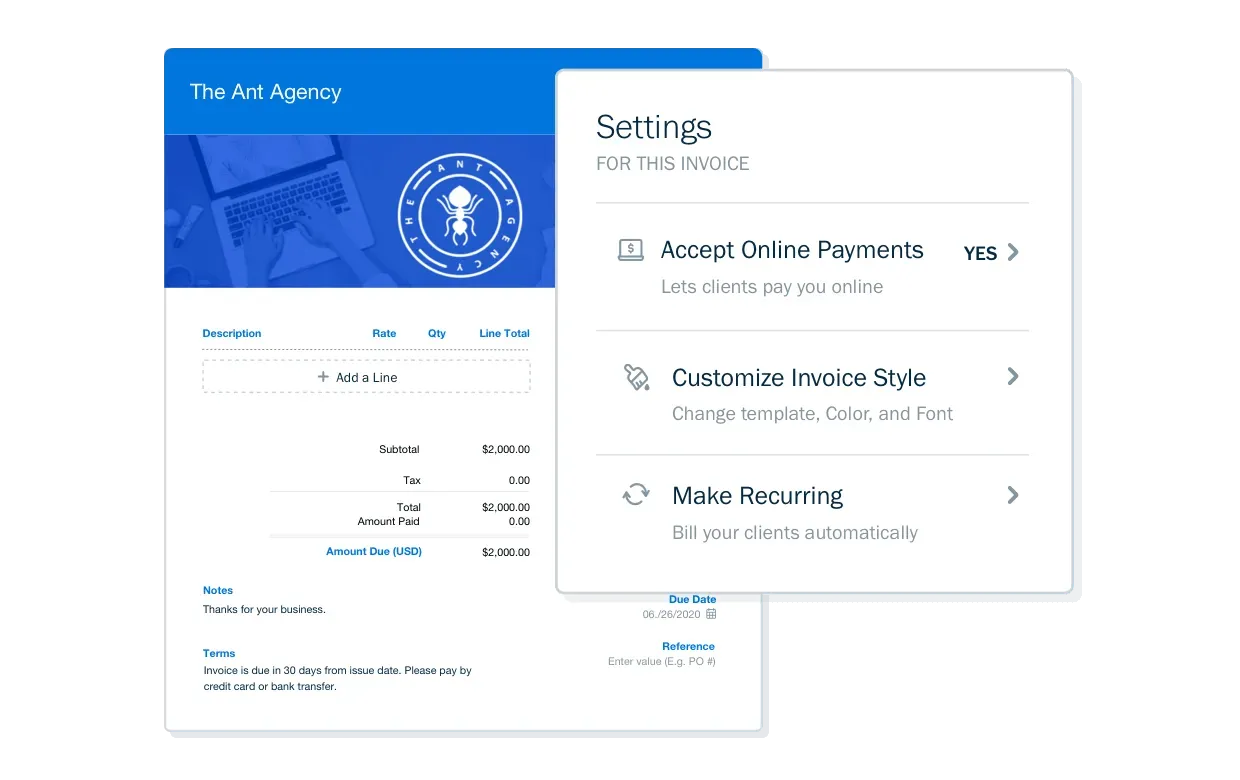

To avoid dealing with late payments, suppliers can use an invoice software program. These programs will help them track their invoices, ensuring they get paid on time. FreshBooks invoice software offers an excellent invoice-tracking tool that can follow up with a customer.

FreshBooks will send automatic reminders to the customer. It will also apply an automatic late fee. This gives clients an incentive to pay their invoices on time. The due date will always be crystal clear on the invoice. FreshBooks will also notify you as soon as the customer pays for an invoice.

Key Takeaways

Invoice discounting allows a business to maintain a more stable cash flow. This is necessary to run and grow a business. When businesses use invoice discounting, a lender pays them money for specific invoices. The business repays the lender after receiving the payment from the customer. Invoice financing offers another valuable option: invoice factoring. Invoice factoring differs from discounting in privacy, risk, and supplier and lender roles.

FAQs on Invoice Discounting

What is the risk in invoice discounting?

Companies that use invoice discounting finance methods risk damaging their customer relationship. They also risk becoming dependent on this service for sustainable cash flow.

Is invoice discounting taxable?

The Internal Revenue Service regards invoice discounting as a taxable service. Invoice discounting will likely get taxed if you work with an offshore company. The IRS will look into your discounting agreement and reporting in detail. This way, the agency ensures compliance in taxation.

Is invoice discounting more expensive than factoring?

Invoice discounting is more affordable than factoring. After all, the business still collects and manages the unpaid invoice debt independently.

RELATED ARTICLES

Fake Invoice: How To Protect Your Business

Fake Invoice: How To Protect Your Business 8 Best Invoicing Software for Small Business (2025)

8 Best Invoicing Software for Small Business (2025) Automated Invoicing Processing: How Does It Work?

Automated Invoicing Processing: How Does It Work? Invoice vs Statement: What’s The Difference?

Invoice vs Statement: What’s The Difference? EDI Invoice: Definition and How It Works Explained

EDI Invoice: Definition and How It Works Explained What is a Commercial Invoice? Definition & Format

What is a Commercial Invoice? Definition & Format