How to Invoice as a Sole Trader: Guide and Example

To invoice as a sole trader, you need to outline the services you provided, the price you’re charging and how the client should pay you. The invoice notifies the client that payment is due for the products and services that you’ve performed.An invoice is a commercial instrument issued by a seller to a buyer. The invoices that you send as a sole trader must include your business details such as your name or the name of your business, address, invoice number, contact information and payment details along with the details of the clients. If you’ve registered the sole proprietorship, then include the company registration number on your sole trader invoice.

Table of Contents

- What Do I Need to Include on a Sole Trader Invoice?

- How Do I Write a Sole Trader Invoice?

- What Bank Details Are Needed on an Invoice?

What Do I Need to Include on a Sole Trader Invoice?

Once you’ve sold goods and services, you would need to invoice the client. Along with the payment information, an invoice also provides information about the tax.

There are certain pieces of information that have to be included on the document including:

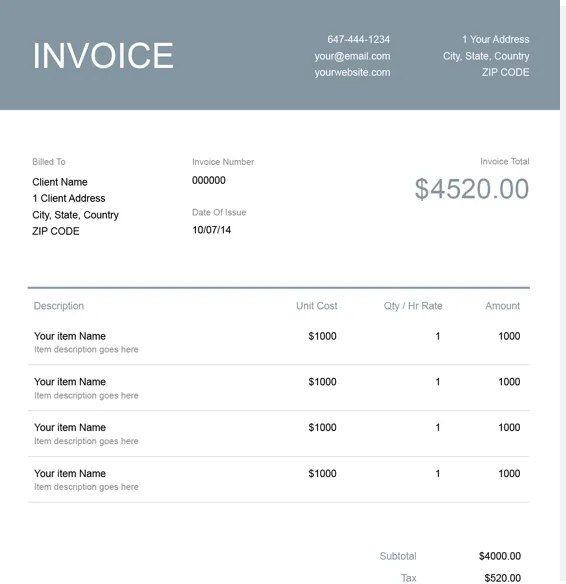

- The word ‘invoice’ on the top of the document

- Date of invoice

- Invoice number

- Your business number (if registered)

- Your name (or business name), address and contact information

- The client’s name and address

- A description of the goods and services you’re charging for

- The date the goods or service were supplied

- The amount for individual products or services and the total amount

- Taxes if applicable

- How you expect to be paid such as bank details

Also Read: How to Fill Out an Invoice Receipt

Tips for Sole Trader Invoicing

- The invoice you send as a sole trader should reflect your brand and should be customized with your business logo, colors and fonts

- Being prompt when sending your invoice ensures that you’re paid as soon as possible

- The payment terms must be defined and make sure your client is aware of them. If you offer different payment options, include them on the invoice

- The item description should be detailed and provide a full account of the product and service you provided

- Use an automated system to send the invoices or send it via email to ensure that both you and the client have a copy of the invoice

- Develop a tactful follow-up plan to get paid when the customer fails to pay the invoices

Also Read: How Should an Invoice Look

How Do I Write a Sole Trader Invoice?

Whether you’re sending your first invoice or have done so many times, it’s important to know how to write an invoice properly. Missing a section may leave you looking unprofessional. You can use the invoice templates provided in your accounting software package, or you can create these documents yourself.

Here’s a simple step-by-step process of creating a sole trader invoice:

- Open a blank word processing document

- Create an invoice heading. Type your name (or business name) and contact information and align it to the right of the page

- Enter the client’s name and address underneath the header and align it to the left.

- Type in the invoice number and date on which the sales transaction took place, also known as the billing date. The invoice number connects the client with the transaction and helps in the bookkeeping process

- Input the product or service description and the price details. Create a simple table of several columns and rows. Each row of the invoice includes a product description followed by a price

- Calculate the total amount that the client owes you. Charge taxes and other fees, if applicable

- Enter the payment details and other notes at the bottom of the invoice

Source: Sole Trader Invoice Template

What Bank Details Are Needed on an Invoice?

One of the most common payment methods is through bank transfers. If you’re opting for bank payments, include the following details on your invoice.

- Full Bank Name

- Account Name

- Account Number

- Invoice reference number

In addition to the bank details, you can also add invoice payment terms. For example, payment at the end of 15 days or 30 days.

At the bottom of the invoice, you may also want to be polite and thank the customer for their business and offer other products or services. Being kind and appreciative not only helps you get paid faster but also allows you to maintain good relations with clients.

RELATED ARTICLES

How to Prepare A Tax Invoice: The Step-By-Step Process

How to Prepare A Tax Invoice: The Step-By-Step Process What Is a Self-Billing Invoice?

What Is a Self-Billing Invoice? Proforma Invoice: Definition, Uses and Template

Proforma Invoice: Definition, Uses and Template What Is a Tax Invoice?

What Is a Tax Invoice? How to Make an Invoice

How to Make an Invoice How to Invoice a Client: 10 Steps to Get Paid on Time

How to Invoice a Client: 10 Steps to Get Paid on Time