How to Write a Rent Receipt?

Have you decided to invest in real estate? Have you just gotten your first tenant? If so, you’ll need to know how to write a rent receipt. Rent receipts are crucial for both you and the tenant. They help you track your income from rent, and they help your tenant track their expenses. Every rental agreement should come with rent receipts. Learn how to write them here!

Key Takeaways

- As a landlord or real estate investor, it is important to know how to write a rent receipt

- A rent receipt acts as proof of payment to you from your tenant

- Rent receipts track your income from your rental property while helping your tenant keep track of their expenses

- A rent receipt can often solve a dispute about payment

- Issue the receipt to your client complete with your signature, and keep a copy for yourself as well

- If your client does not pay in person with cash payments, you can still issue a rent receipt through your electronic payment portal of choice

- Receipts should be issued for rent payments, security deposit payments, late payments, and partial payments so all incoming money is documented

- Rent receipts are often required by state and/or local law

Here’s What We’ll Cover:

- What is a Rent Receipt?

- Issuing a Rent Receipt

- How to Write a Receipt for Rent Payment

- How to Send a Rent Receipt

- Benefits of Keeping Rent Receipts

- Why Should Rent Receipts Be Used?

- Conclusion

- Frequently Asked Questions

What is a Rent Receipt?

A rent receipt is a document that is provided by a landlord or property manager to a tenant. It acts as proof of payment for money received for rent. Rent payments can be received in a number of ways.

- Cash payment

- Check payment

- Electronic fund transfer

- Credit card payment

- Money order

No matter the type of payment, a receipt should be issued.

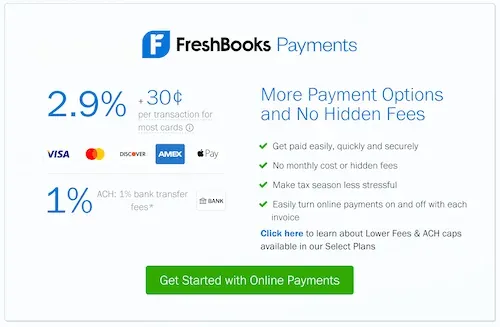

If you want to make receiving rent payments easier on yourself and make sending the money more convenient for your tenants, consider enabling online payments through software like FreshBooks payments. Connect to your accounting software and make things even easier for yourself at tax time. Click here to get started.

Issuing a Rent Receipt

When you give a rent receipt is crucial. If you’re receiving rental payments, review the steps below on issuing a receipt for the payment:

- Collect the payment from your tenant.

- Write, or generate, the rent receipt and sign it.

- Provide a copy to your tenant and keep one for yourself.

If you’ve never written a rent receipt before, keep reading to learn how to.

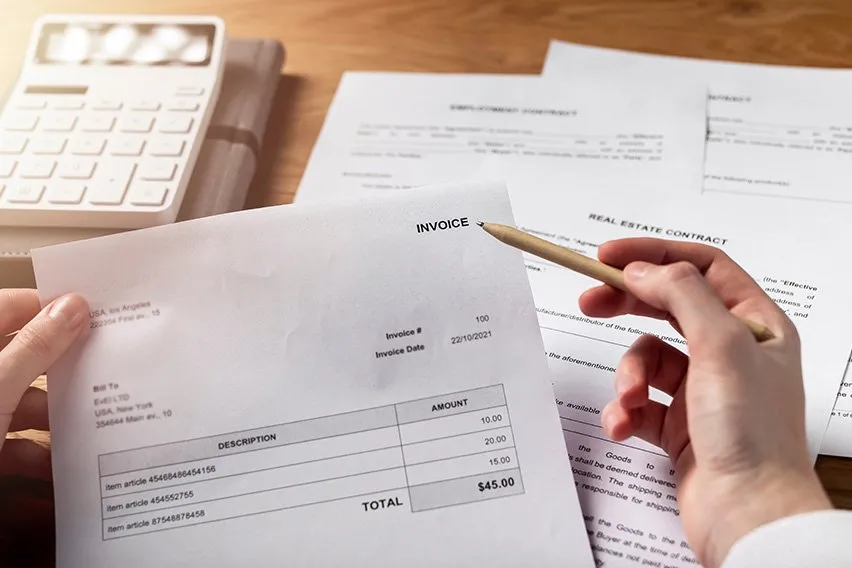

How to Write a Receipt for Rent Payment

Include the date and rental period of the payment, the property address, the tenant’s full name, and the person receiving the payment. Include the payment amount, the method of payment, the remaining lease balance (if applicable), and any other information that may be important, like late fees.

If you’ve never written a rent receipt, you can look online for a rent receipt template or printable rent receipt, for example. It is important to fill out a rent receipt properly, with all the following information:

- The date of the payment

- The rental period the payment is for

- Which rental property is the payment for

- The tenant’s full name

- Who received the payment

- The property address

- The payment amount

- The method of payment

- The remaining balance for the lease

- Late fees, if there have been late payments

Add any other important information that may be considered valuable or that the tenant finds valuable. Often, you’ll find that a rent receipt template will allow you to modify the fields on it.

Managing property and keeping track of rent and expenses is much easier when you utilize software like FreshBooks that eliminates the need for manual entries. When your client pays monthly rent due, FreshBooks receipt-tracking software will automatically incorporate the amount into your monthly income, keeping you up to date. Click here to try it for free.

How to Send a Rent Receipt

There are many ways to send a rent payment receipt. If the tenant pays in cash, writing a receipt is easy to do. For handwritten purposes, there are many books that have templates in them. These can contain a blank template, a cash receipt template, or a simple receipt template with just the necessary details.

If you accept electronic payments, the service you use will keep an electronic record. Many times, an online payment portal will give you easy receipts. They’ll track everything for you, including the payment method and the amount. They will provide copies to the landlord and the client automatically, as well. Additional receipts can be printed at any time, too.

Benefits of Keeping Rent Receipts

As a landlord, reserving rent receipts will keep you above board legally, as some states require rent receipts in various cases. Even if your state doesn’t require them, check with your local city housing board, as city rules vary. It also helps you to maintain a professional appearance.

If you are finding it difficult to keep track of rent payments and other important business proceedings like accounting and payroll, you may want to try property management accounting software like FreshBooks, as automating these services can free you up to focus on the parts of property management you enjoy. Click here to start a free trial today.

Why Should Rent Receipts Be Used?

There are a number of reasons that rent receipts should be used. The biggest reason is that they are good for record keeping. No matter what kind of you’re utilizing, they will help you keep an accurate record between you and your tenant.

They are also a good way to keep disputes to a minimum. If your tenant states that they’ve paid rent and you have no record, coming to an agreement becomes much more difficult.

A rental receipt may also be required by the city or state that you’re in. Many states require that landlords provide tenants with receipts when requested. Others require that a receipt is generated any time a payment is made, even if the tenant doesn’t want one. Be sure to check state and local laws.

Conclusion

Renting out real estate means being responsible for receiving sums of money, and writing out a rent receipt for funds received will give your tenant peace of mind while documenting income for yourself or your rental business.

Keeping detailed records of all finances, payments, and cash flow is one of the most important aspects of being a landlord or running a property management company. It is sometimes easier to stay organized if you utilize financial software to keep track of rental properties, especially if you have multiple tenants and homes to manage.

Did you find this article helpful? If so, there are plenty more available in our invoicing category. Be sure to stop by and check them out!

FAQs on How to Fill Out a Rent Receipt

Do rent receipts need to be signed?

Yes, a signature is part of the legal agreement between you, the landlord, and the renter or tenant. It provides proof to your tenant that you have received their payment and that they have fulfilled their legal obligation to pay their rent.

Is it necessary to submit rent receipts for taxes?

Yes. If you are renting a property out, you must report your rental income on your tax return every year, and rental receipts are a good way to document each transaction between the tenant and the landlord.

Is a handwritten receipt legal?

Yes, there is no difference between a handwritten receipt and a typed receipt when it comes to enforcing the contract in a legal context. The receipt must be legible and contain all pertinent information to the transaction or sale.

What makes a receipt invalid?

A receipt will not be valid in the United States if it does not list the transaction date, the amount of money received, the vendor name (or the name of the place the transaction took place or the person paid), and the purpose for payment. It is also not valid if it is illegible.

Should Receipts Be Given for All Payments?

Generally speaking, yes, receipts for all tenant payments should be provided if they are paying you for your property for any reason. This includes a tenant’s rent payment, security deposits, late payments, and partial payments. When you enter a lease agreement with a tenant, receipts should be a standard part of the process.

Reviewed by

Michelle Alexander is a CPA and implementation consultant for Artificial Intelligence-powered financial risk discovery technology. She has a Master's of Professional Accounting from the University of Saskatchewan, and has worked in external audit compliance and various finance roles for Government and Big 4. In her spare time you’ll find her traveling the world, shopping for antique jewelry, and painting watercolour floral arrangements.

RELATED ARTICLES

Online Invoicing Portal: A Small Business Guide

Online Invoicing Portal: A Small Business Guide What is a Disputed Invoice? – How to Resolve Them

What is a Disputed Invoice? – How to Resolve Them 7 Best Invoice Management Software for 2025

7 Best Invoice Management Software for 2025 What Is a Credit Invoice?

What Is a Credit Invoice? What Is an Invoice: Purpose, Types, Elements & Example

What Is an Invoice: Purpose, Types, Elements & Example 6 Steps on How to Write a Simple Invoice

6 Steps on How to Write a Simple Invoice