How to Organize Receipts Electronically: 6 Best Ways

There’s nothing worse than trying to track down a receipt for something you purchased long ago. Where did you put it? Did you throw it out? What if you can’t find it? Keeping track of all your different physical receipts can be tedious and time-consuming.

So, instead of piling a stack of receipts into an old shoebox, how should you organize your receipts? The best and most efficient way is to do so electronically. You can easily organize and store any digital receipts that are then able to easily get found. And you can turn paper receipts into digital receipts to organize everything together.

Key Takeaways:

- Receipts are important documents that help you keep track of where your money is going

- Effective receipt storage can save you time and help you avoid frustration at tax time

- There are a variety of online receipt organization tools you can use to digitally store photos, scans, and electronic receipts for easy access when you need them

- Accounting software like FreshBooks can make receipt tracking even easier

Here’s What We’ll Cover:

The 6 Best Ways to Organize Receipts Electronically

FAQs on How to Organize Receipts Electronically

The 6 Best Ways to Organize Receipts Electronically

It really comes down to personal preference. If you organize all your receipts in a shoebox and it works for you, then that’s great. However, depending on the size of your business or how often you make purchases, you could have thousands of receipts to organize.

Here are the 6 best ways for you to organize your receipts electronically.

1. Save Receipts to Google Drive

Instead of letting physical copies of your receipts pile up around the home or office, you can use Google Drive to save and store receipts electronically, organizing your business expenses. Start by saving all your scanned and electronic receipts onto your computer and then uploading these digital receipts into Google Drive.

You can then go a step further and create separate file folders for specific types of receipts if needed. For example, you can organize your business receipts into a business expense folder, an office supplies folder, or an expense receipts folder.

Everything can also be organized by date, the location the items were purchased, or the type of items purchased. If you keep the folder names short and easy to read, it will make your receipt tracking so much easier later on.

2. Use Evernote

Evernote is a program with a range of functionalities and can be a great place to store and organize files and collect notes. It can also scan receipts or take photographs to convert paper receipts into digital images and then place them into files, making tracking receipts easy.

Setting up Evernote to send receipts from your email directly to the app is even possible. If you tag the receipt properly and use a good subject line, the Evernote app automatically files the email receipt into a dedicated folder. Tags can help you keep all your notebooks organized.

3. Use WellyBox

WellyBox is an intelligently interfaced web-based app that can generate expense reports by locating receipts and invoices throughout linked email inboxes and organizing them together. If you wish, you can even set WellyBox up to forward relevant financial information directly to your accountant or any accounting software you use.

WellyBox can also download receipts or invoices directly from a supplier or wherever you made your purchase. It can be integrated with other platforms like Google Drive and Microsoft Office, taking your receipt organization to the next level.

4. Scan or Download to Your Personal Computer

If you are not comfortable or do not have the time to integrate a new app or filing system into your life, you may wish to simply scan your paper receipts (or take a picture) and save them onto your personal or work computer. You can also save digital receipts in the same way, keeping everything organized in folders that are accessible from your desktop files.

5. Merge Your Receipts into One Document

For many people, the issue with looking back at the year’s receipts is that it can feel chaotic and confusing, but if you take the time to scan each receipt and save them into a single PDF or Microsoft Word document for easier readability. Depending on your small business needs, you may even wish to organize the document by purchase date or vendor.

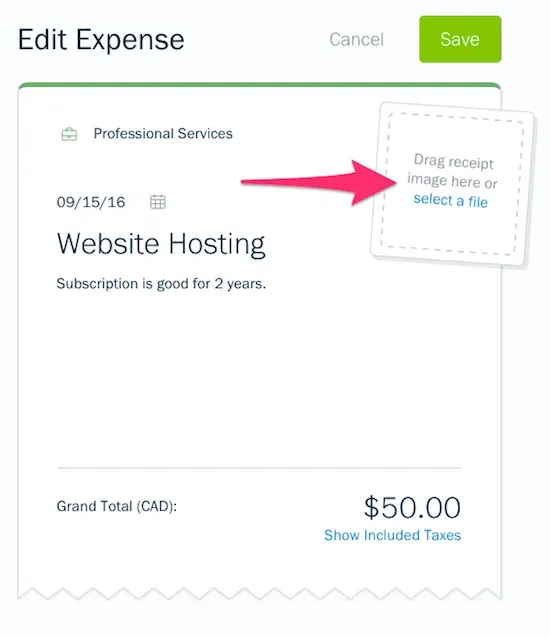

6. FreshBooks Receipt Scanning

There is no longer a need to manually enter your receipts into your accounting software when you have the FreshBooks app on your phone. Learn here more about expense & receipt tracking offered through FreshBooks.

To use FreshBooks for receipt management and storage, just connect your business credit card and bank account to your FreshBooks account, and the software will track expenses electronically. Mobile receipt scanning takes quick digital photos of paper receipts and captures your transactions automatically. Receipts are stored in the cloud, eliminating the need for paper files and time wasted doing data entry.

Conclusion

Organizing all your receipts electrically can keep you proactive and productive. And when you are organized, you can save time, stress, and even money in the long run. You will know exactly how much you spent, where it was spent, and when it was spent.

Plus, switching to digital records for receipt files can reduce paper clutter. Everything can get easily accessed through your mobile phone or computer at the click of a button. So when you need to do your tax return, or you need to quickly find a receipt, you will know exactly where everything is.

Did you enjoy reading this guide? Head over to our expenses category for more great content!

FAQs on How To Organize Receipts Electronically

How do small businesses keep track of receipts?

Most people who run small businesses will use accounting software or receipt scanner app of some kind, uploading digital receipts, as well as photos and scans of paper receipts, so that all of the pertinent financial information they need is at their fingertips. FreshBooks accounting software has receipt reading technology and other organizational tools to keep your small business organized and ready for tax season.

Are scanned receipts valid?

Yes, scanned receipts are valid as proof of purchase as long as they are identical to the original paper receipt and show all the information on the receipt. This means you cannot have a scan of a torn receipt or a cut-off scan that does not show all of the information included in the original.

What is the best app for storing receipts?

FreshBooks accounting software offers convenient receipt capture technology that can take information directly off a photo of your receipt, including the merchant, the total amounts, and taxes. This ‘Digital Bills and Receipt Scanner’ will help you stay organized without wasting time manually filing information.

How long should I keep electronic copies of receipts?

You should keep your electronic receipts for 3 to 7 years, especially if you use them to verify your tax return information. This way, if an audit occurs, you will have proof to back up any claims you have made.

Can I use electronic receipts for tax purposes?

Yes, in most cases, you can use electronic receipts for your taxes. The IRS will accept them as long as they are legible and can be accessed reliably in case of an audit.

Reviewed by

Jason Ding is a seasoned accountant with over 15 years of progressive experience in senior finance and accounting across multiple industries. Jason holds a BBA from Simon Fraser University and is a designated CPA. Jason’s firm, Notion CPA, is an accounting firm with a business-first focus. The firm specializes in preparing personal and corporate taxation while providing fractional CFO work and leading the accounting and finance function for several small-to-medium-sized businesses. In his free time, you’ll find Jason on the basketball court, travelling, and spending quality time with family.

RELATED ARTICLES

Expense Reimbursement Policy: Best Practices

Expense Reimbursement Policy: Best Practices 3 Best Travel and Expense Management Software

3 Best Travel and Expense Management Software 5 Best Expense Management Software & Tools

5 Best Expense Management Software & Tools What is Medical Mileage Rate Deduction?

What is Medical Mileage Rate Deduction? What are Payroll Expenses? A Complete Payroll Expense Guide

What are Payroll Expenses? A Complete Payroll Expense Guide How to Calculate Mileage Reimbursement for Taxes

How to Calculate Mileage Reimbursement for Taxes