Operating Expenses (OpEx): Definition, Formula, and Example

Operating expenses are necessary costs for conducting daily business activities. Understanding operating costs helps you manage your business finances and make the most of your tax-deductible expenditures. We’ll explore the definition of operating costs, how to calculate operating costs, and how to distinguish them from other common business expenses.

Key Takeaways

- Operating expenses are ordinary and necessary costs incurred for running a business.

- Examples of operating costs include rent, utilities, insurance, and administrative wages.

- Fixed operating costs are costs that stay the same regardless of productivity.

- Variable operating costs change in relation to a business’s output.

- Most operating costs are tax-deductible in the year they are incurred.

Table of Contents

- What Are Operating Expenses?

- What Is Included in Operating Expenses?

- Fixed Costs and Variable Costs

- How To Calculate Operating Expenses

- Operating Expenses Formula

- Operating Expenses Example

- Managing Operating Expenses

- Operating vs. Non-Operating Expenses

- CapEx vs. OpEx

- Importance of Operating Expenses

- Optimizing Your Operating Expenses with FreshBooks

- Frequently Asked Questions

What Are Operating Expenses?

Operating expenses, or OpEx, are the costs incurred for normal business operations. This includes rent, utilities, marketing, administrative salaries, and other costs required for running the core operations of your business. Operating expenses are indirect costs, meaning they’re not directly associated with the production of your primary good or service.

What Is Included in Operating Expenses?

Operating expenses include all the normal indirect costs of doing business. Common examples of operating costs are property-related costs like rent, utilities, maintenance, and building repairs, as well as administrative costs like salaries, insurance, licensing fees, marketing, and costs for research and development.

Operating expenses vary depending upon the size and type of your business, but some common operating costs include:

- Payroll for staff (excluding labor for manufacturing)

- Insurance

- License fees

- Rent

- Research

- Marketing (including for social channels like Facebook)

- Accounting fees

- Building maintenance and repairs

- Office supplies

- Utilities

- Attorney fees

- Property taxes on real estate

- Vehicle expenses

- Travel expenses

Fixed Costs and Variable Costs

Operating expenses can be classified into two categories: fixed costs and variable costs. Fixed costs are recurring costs that stay the same regardless of business productivity. Rent, insurance payments, and administrative salaries are all examples of fixed operating costs.

Variable costs will change depending on your productivity and output. For example, if your company manufactures and sells an unusually large volume of product in one month, you’ll pay a greater amount to ship that product to your client. Things like transportation and fuel costs, seasonal labor, and raw materials are variable costs.

How To Calculate Operating Expenses

The first step in calculating operating expenses is to track and categorize all of your business expenses. Organize your expenses into operating and non-operating costs; you can also organize further by separating fixed and variable costs so you can easily track changes in your expenditures.

At the end of your accounting period, separate your operating expenses from other types of expenses. You’ll then use the formula described in the following section to calculate your operating expenses.

Operating Expenses Formula

There are 2 common methods for calculating operating expenses:

- Add up all operating expenses using the formula:

Operating Expenses = Rent + Utilities + Insurance + Administrative Costs + Etc.

- Subtract operating income and Cost of Goods Sold from total revenue using the formula:

Operating Expenses = Revenue – Operating Income – Cost of Goods Sold

Cost of Goods Sold refers to costs directly related to the production of your goods or service, including raw materials and labor costs.

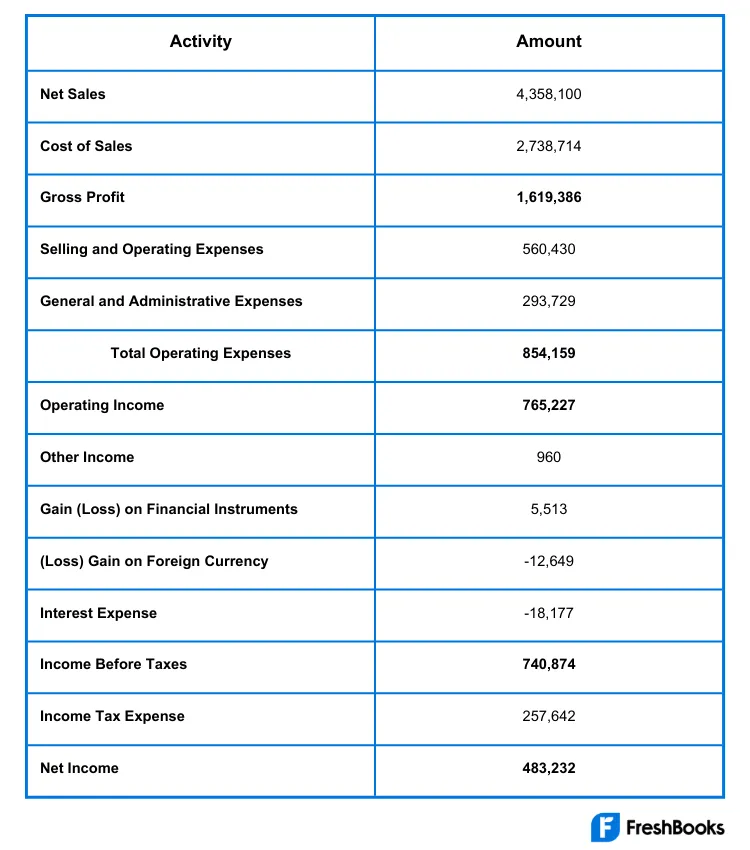

Operating Expenses Example

The above image from Harvard Business School Online shows an example of a company’s income statement for their financial year. 1 It breaks operating expenses into two categories: Selling and Operating Expenses and General and Administrative Expenses. Added together, these result in Total Operating Expenses of $854,159.

Managing Operating Expenses

Operating expenses typically represent a significant portion of a company’s total expenses, so it’s important to manage them effectively. At the same time, reducing necessary operating expenses can impact your firm’s competitiveness. The following strategies can be helpful to reduce operating expenses while staying competitive in your industry:

- Expense Tracking: Being aware of all expenditures can help you eliminate excess spending before it becomes an issue.

- Research Your Options: Look for opportunities to save on your existing expenses. Consider whether other insurance providers offer coverage at a better price or whether you could save on office materials with a new supplier.

- Regularly Review Your Strategies: Are your current marketing tactics effective? Is your business paying for utilities that you don’t really use? Reviewing your expenses and strategies can help you ensure that you’re only paying for things that help you generate a profit.

- Engage Your Employees: Happy and motivated employees usually perform better, so consider engaging your team to provide ideas on how to make the most of everyday office expenses.

FreshBooks expense tracking software can help businesses efficiently track and categorize their operating expenses, such as rent, utilities, insurance, and travel expenses. This feature helps businesses stay on top of their operating expenses, monitor their cash flow, and identify areas where they can reduce costs. It can also automatically organize categories such as office expenses, travel expenses, and equipment expenses. Our expense tracking feature helps you save time and reduces the risk of errors.

Operating vs. Non-Operating Expenses

A company’s operating expenses are costs required for everyday business operations, while non-operating expenses are other costs a business incurs that are not directly related to primary business operations. The most common examples of non-operating expenses are financial costs such as loan fees and interest charges. Losses from business investments, currency exchange, legal fees, and bank fees are also non-operating expenses.

It’s important to distinguish between operating and non-operating expenses when filing your business taxes. The Internal Revenue Service allows businesses to deduct most operating expenses that are necessary for business operations. Non-operating expenses are not usually tax deductible.

CapEx vs. OpEx

Operating expenditures are the day-to-day costs of doing business, while capital expenditures are long-term investments that increase a business’s productivity and performance. Capital expenses, or CapEx, can include things like patents, machinery, and business real estate.

Distinguishing between operating expenses and capital expenses is important for maintaining accurate accounting practices. The IRS treats OpEx and CapEx differently. It defines operating expenses as being ‘ordinary and necessary’, meaning they are commonly accepted in that industry and required for a company to conduct business. Most operating expenses are tax-deductible.

Capital expenses are recorded on a company’s balance sheet, but full recognition of the asset is usually spread across several years. This enables the business to recognize asset depreciation and spread out the cost. While capital expenses are usually dispersed across several years, operating expenses must be claimed in the year in which they are incurred. 2

Importance of Operating Expenses

Operating expenses are important because they help assess a company’s costs, reduce operating costs, and stock management efficiency. Essentially, they highlight the level of cost a company needs to make to generate revenue, which is ultimately the main goal of any business. When a business doesn’t successfully track its operating expenses, it can end up losing money on spending oversights. Diligent accounting of operating expenses keeps profits on growth for continued success.

Optimizing Your Operating Expenses with FreshBooks

Operating expenses are all the normal costs of running a business and are divided into both fixed costs and variable costs. Most operating expenses are tax-deductible, so it’s important to track and categorize your operating expenses so you can make the most of your tax return.

FreshBooks expense tracking software makes it a breeze to track and organize all your operating expenses. Scan and categorize your receipts, integrate your invoices, and stay on track with your budget to make tax time a breeze. Try FreshBooks free to discover how the right accounting software can streamline your operating expenses tracking.

FAQs on Operating Expenses

Learn more about what’s included in operating costs and how operating costs affect gross profit along with frequently asked questions about operating costs.

Is income tax expense an operating expense?

No, income tax expense is considered a non-operating expense and should not be included when calculating operating expenses for a business.

Is operating expense a liability or asset?

Operating expenses are represented on a balance sheet as a liability. Because they are a financial expense that does not directly contribute to selling services or products, they aren’t considered assets.

How do operating costs affect profit?

Operating expenses differ by industry and how a company decides to operate based on its business model. As a general rule, an increase in any type of operating costs lowers profit.

Are operating expenses included in COGS?

No, operating expenses and cost of goods sold are shown separately on a company’s income statement. This is because the cost of goods sold is directly related to the production of a product, as opposed to daily operations.

Are wages operating expenses?

Wages and salaries for administrative staff are categorized as operating expenses. Labor costs that are directly related to the production of a business’s primary goods or service are included in Cost of Goods Sold, which are not part of operating expenses.

What does an increase in operating expenses mean?

Higher operating expenses typically mean less profits for a business, since operating costs are deducted from revenue. However, more operating expenses are not always bad—if these costs are increasing in relation to your business’s core operations and productivity, they may simply be necessary to support your growing business.

Article Sources

- Harvard Business School Online. How to Read and Understand an Income Statement. Accessed July 10, 2024.

- IRS. Section 263 – Capital Expenditures. Accessed July 10, 2024.

Reviewed by

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. Michelle earned a Bachelor’s of Science and Accounting from Minnesota State University and has provided accounting support across a variety of industries, including retail, manufacturing, higher education, and professional services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

RELATED ARTICLES

What is the Difference Between Financial and Managerial Accounting?

What is the Difference Between Financial and Managerial Accounting? What is the Direct Write Off Method?

What is the Direct Write Off Method? How to Calculate Depreciation

How to Calculate Depreciation What is a Good Profit Margin?

What is a Good Profit Margin? How to Calculate Bad Debt Expense

How to Calculate Bad Debt Expense What is Managerial Accounting?

What is Managerial Accounting?