What Are Liabilities in Accounting?

Liabilities in accounting are any debts your company owes to someone else, including small business loans, unpaid bills, and mortgage payments. If you made an agreement to pay a third party a sum of money at a later date, that is a liability.

Liabilities are an operational standard in financial accounting, as most businesses operate with some level of debt. Unlike assets, which you own, and expenses, which generate revenue, liabilities are anything your business owes that has not yet been paid in cash.

Many first-time entrepreneurs are wary of debt, but for a business, having manageable debt has benefits as long as you don’t exceed your limits. Read on to learn more about the importance of liabilities, the different types, and their placement on your balance sheet.

Key Takeaways

- Liabilities are any debts a company owes.

- Liabilities can help a business grow if you don’t exceed your limits.

- There are three categories of liabilities: current, long-term, and contingent.

- Liabilities are different from expenses and assets.

Table of Contents

- Importance of Liabilities for Small Businesses

- Types of Liabilities

- Examples of Liabilities

- Where Are Liabilities on a Balance Sheet?

- Liabilities vs. Expenses

- Liabilities vs. Assets

- Manage Your Liabilities Effectively with Freshbooks

- Frequently Asked Questions

Importance of Liabilities for Small Businesses

Liabilities aren’t necessarily bad. Some loans are acquired to purchase new assets, like tools or vehicles that help a small business operate and grow.

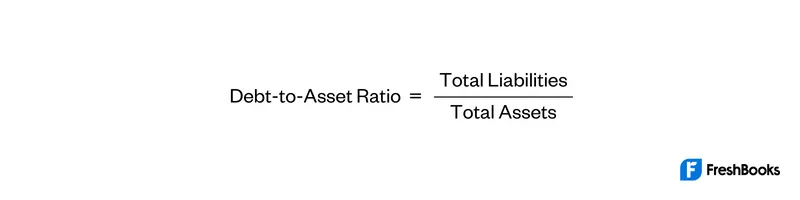

But too much debt can hurt a small business financially. Owners should track their debt-to-equity ratio and debt-to-asset ratio:

Simply put, a business should have enough assets (items of financial value) to pay off its debt.

Types of Liabilities

Liabilities are classified as current, long-term, or contingent. Current liabilities are debts due within a year. Long-term liabilities are debts that take longer than a year to repay, including deferred current liabilities. Contingent liabilities are potential liabilities that depend on the outcome of future events. Liabilities can fall into more than one category. For example contingent liabilities can become current or long-term if realized. Below is a more in-depth look at each type of category.

Current Liabilities

Current liabilities are financial responsibilities that the company expects to pay back within a year. These short-term obligations may include:

- Accounts payable (money owed to suppliers for past transactions)

- Salaries and wages owed

- Interest owed to a lender

- Income tax liability

- Sales taxes payable

- Customer deposits or unearned revenue (pre-payments for goods or services not provided yet)

- Contracts, such as a cell phone contract you can’t cancel without a penalty

- Lease payments owed

- Insurance payable

- Benefits payable

- Accrued expenses (like utilities used that haven’t been billed for by the utility company)

- Dividends payable to shareholders

- Sales tax (usually payable every month or quarter)

- Payroll taxes payable (income and employment taxes withheld from employees and paid to the government)

- The current portion of notes payable—the payments due each month for the next year on long-term debt

Long-Term Liabilities

Long-term liabilities, also known as non-current liabilities, are financial obligations that will be paid back over more than a year, such as mortgages and business loans. Examples of long-term liabilities include:

- Pension obligations (if the company doesn’t expect to fund them within one year)

- Deferred taxes due in one year or longer

- Contingent liabilities (obligations stemming from warranties or lawsuits that the company will likely have to pay and can be reasonably estimated)

- Mortgages payable and other long-term debt

Contingent Liabilities

Until a liability is probable and reasonably estimated, it is contingent. Generally accepted accounting principles (GAAP) recognize three subcategories of contingent liability: remote, possible, and probable. You don’t have to report remote and possible contingent liabilities on your balance sheet, though you should footnote any possible liabilities on the financial statement. You should include your best estimate for any probable contingent liabilities on your balance sheet. Common contingent liabilities include:

- Product warranties

- Pending lawsuits

- Change of government policies

- Change in currency rates/foreign exchange rates

- Bank guarantee and indemnities

- Contingent assets

- Environmental liabilities

Examples Of Liabilities

Here are some examples of liabilities for small businesses:

- A carpenter picks up new kitchen cabinet doors from a cabinet supplier. The supplier has a good relationship with the carpenter and lets him buy on credit. The supplier gives the carpenter an invoice for the doors that he must pay within 30 days. The amount owed on these doors is a current liability for the carpenter.

- The state requires a freelance social media marketer to collect sales tax on each invoice she sends to her clients. The money she collects remains in her business bank account until she pays the taxes to the state. It’s a current liability because she will remit the tax at the end of the month.

- A copywriter buys a new laptop using her business credit card. The cost is $1000. She plans on paying off the laptop in the near future, probably within the next 3 months. The $1000 she owes to her credit card company is a current liability because she will pay it off within the year.

- An online rare bookseller decides to open a brick-and-mortar store. He takes out a $500,000 mortgage on a small commercial space to open the shop. The mortgage is a long-term liability as it’s a debt you’ll repay over several years. Any amount of the principal or interest you pay in the current year counts as a short-term debt.

- A residential plumbing business takes out a 5-year loan for 2 new vans to expand their business. Because the debt is a 5-year loan, this is a current and long-term liability. Record the first year’s payments as a current and the remaining debt as a long-term.

- An online marketing firm uses news clips from around the world to generate clicks and interest. Pending government policy changes that will require firms like theirs to pay royalties to the original owner of the content is a possible contingent liability because they don’t know which way the government will vote and can’t estimate how much they will have to pay.

Where Are Liabilities on a Balance Sheet?

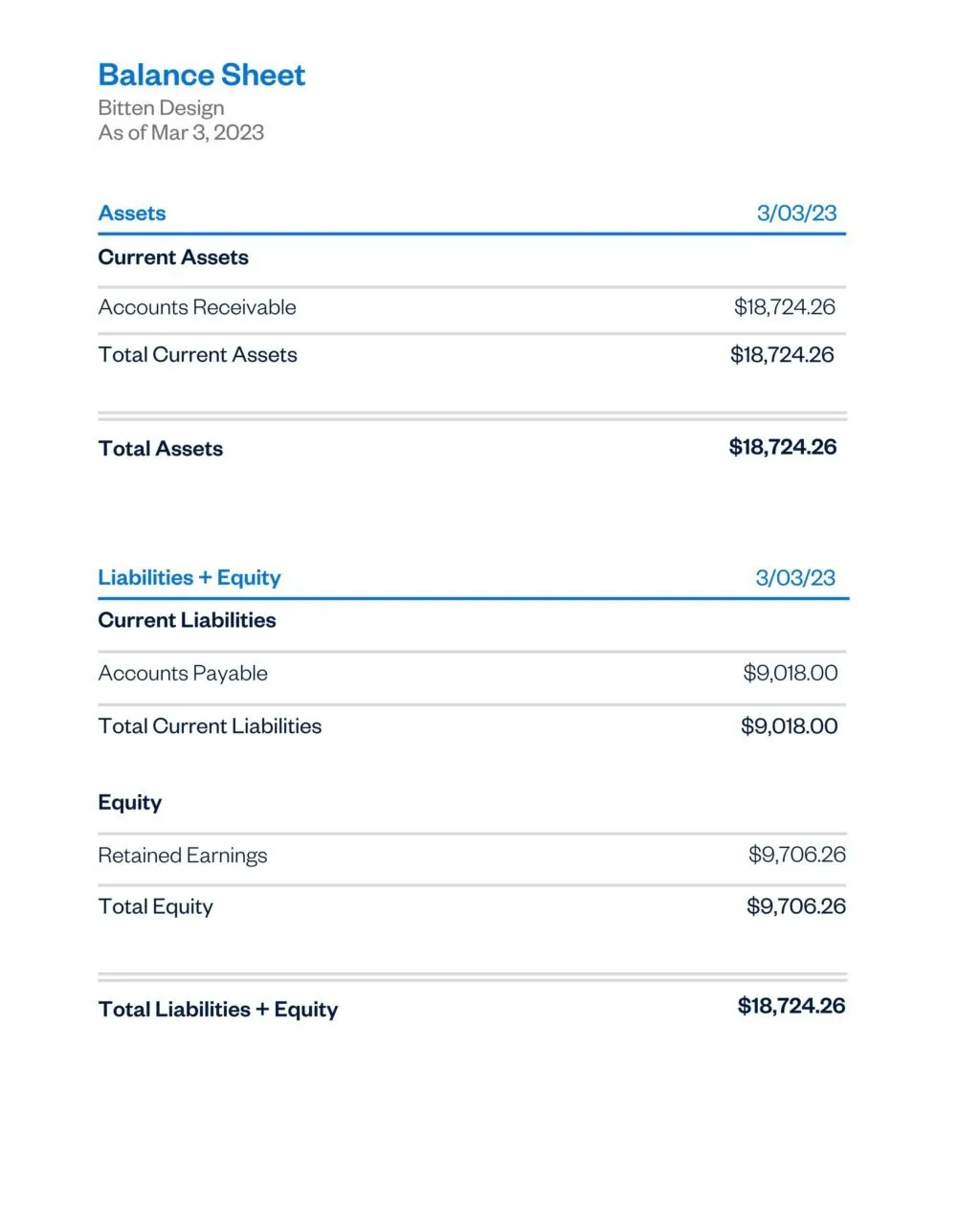

Liabilities are one of 3 accounting categories recorded on a balance sheet, along with assets and equity. The balance sheet is a financial statement that gives a snapshot of a company’s financial health at the end of a reporting period and, when analyzed correctly, these 3 balance sheet categories can provide the necessary data to make informed decisions.

Assets

An asset is anything a company owns of financial value, such as revenue (which is recorded under accounts receivable).

Assets are broken out into current assets (those likely to be converted into cash within one year) and non-current assets (those that will provide economic benefits for one year or more).

Assets are listed on the left side or top half of a balance sheet.

Liabilities

Liabilities are divided into two categories on a balance sheet: short-term (current) liabilities and long-term liabilities.

Different types of liabilities are listed under each category, in order from shortest to longest term. Accounts payable would be a line item under current liabilities while a mortgage payable would be listed under long-term liabilities.

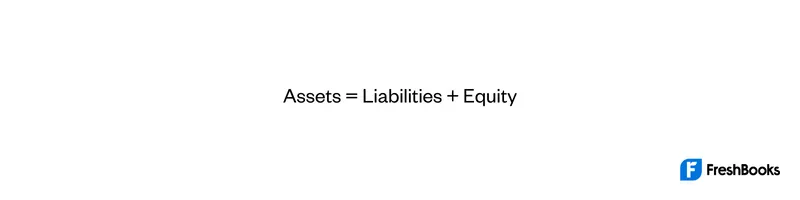

Equity

Owner’s equity (or shareholders’ equity, for a corporation) is the difference between the value of a company’s assets and its liabilities. This relationship is expressed in the accounting equation:

Liabilities and equity are listed on the right side or bottom half of a balance sheet.

Below is a simple example of a balance sheet. Since there’s only one liability, accounts payable, there’s only one category: Current liabilities.

Liabilities vs. Expenses

Liabilities in accounting are money owed to buy an asset, like a loan used to purchase new office equipment or pay expenses, which are ongoing payments for something that has no physical value or for a service.

- An example of an expense would be your monthly business cell phone bill. But if you’re locked into a contract, and you need to pay a cancellation fee to get out of it, this fee would be listed as a liability.

- Utilities for your store are an expense. The mortgage on your store is a liability.

- Liabilities are found on a balance sheet. Operating expenses are listed on an income statement (profit-and-loss statement).

Liabilities vs. Assets

Liabilities are best described as debts that don’t directly generate revenue, though they share a close relationship. To attain assets, you must have money. If you don’t have money, you need a loan. The money borrowed and the interest payable on the loan are liabilities. If the business spends that money to acquire equipment, for example, the purchases are assets, even though you used the loan to purchase the assets. Assets have a market value that can increase and decrease but that value does not impact the loan amount.

Here are a few examples:

- Real estate: the mortgage and interest are the liability but the land is an asset.

- Company vehicles: the car loan and interest are the liability but the vehicles are assets.

- Accounts payable (money going out) are liabilities but accounts receivable (money coming in) are assets.

Manage Your Liabilities Effectively with FreshBooks

Having a better understanding of liabilities in accounting can help you make informed decisions about how to spend money within your company or organization. FreshBooks Software is a valuable tool that can help businesses efficiently manage their financial health. With features like Expense Tracking and Automated Financial Reporting, you can monitor your payable and receivable accounts, view your assets, expenses, and liabilities, and get a snapshot of important financial data with ease.

Try FreshBooks for free by signing up today and getting started on your path to financial health.

FAQs On Liabilities In Accounting

Here are a few quick summaries to answer some of the frequently asked questions about liabilities in accounting.

What is the rule of liabilities in accounting?

The rule of liabilities in accounting asserts that the total debits must be in balance with the credits. The equation Assets = Liabilities + Equity expresses this rule and demonstrates when a business or organization is out of balance.

What is considered an asset?

An asset is anything a business or organization owns. Generally, they help a business generate revenue or add to the value of the company. Assets include cash, machinery, tools, furniture, real estate, and intangible items like copyrights and trademarks.

What qualifies as liabilities?

Any debt a business or organization has qualifies as a liability—these debts are legal obligations the company must pay to third-party creditors. Examples of liabilities include deferred taxes, credit card debt, and accounts payable.

How do I calculate my liability?

You can calculate your total liabilities by adding your short-term and long-term debts. You should also include any probable contingent liabilities. The sum is your total liabilities. Keep in mind your probable contingent liabilities are a best estimate and make note that the actual number may vary.

Reviewed by

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. Michelle earned a Bachelor’s of Science and Accounting from Minnesota State University and has provided accounting support across a variety of industries, including retail, manufacturing, higher education, and professional services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn.

RELATED ARTICLES

Is Depreciation an Operating Expense?

Is Depreciation an Operating Expense? What Is Statement of Account: Definition, And Sample Formats

What Is Statement of Account: Definition, And Sample Formats Debit vs Credit: What’s the Difference?

Debit vs Credit: What’s the Difference? What Are Trade Receivables?

What Are Trade Receivables? What Is a Tax Write Off? Top 10 Deductions for Businesses

What Is a Tax Write Off? Top 10 Deductions for Businesses Types of Errors in Accounting: A Guide for Small Businesses

Types of Errors in Accounting: A Guide for Small Businesses