How To Calculate Liabilities: A Step-by-Step Guide with Formulas

Total liabilities are all the short-term and long-term debts and obligations that your business owes to another person or company. Understanding your company’s total liabilities will give you a better idea of your financial obligations owed and what it will take for your business to use others’ debt wisely and to have enough cash flow to pay off its debts

You can use a simple accounting formula to calculate your total liabilities by hand or incorporate helpful accounting software to simplify the process. In this guide, we will take you through each step required to calculate liabilities.

Key Takeaways

- Total liabilities are all short-term and long-term business liabilities added together.

- Short-term liabilities are debts or obligations that must be paid within one year.

- Long-term liabilities are debts owed at a later date, usually more than a year in the future, often paid down in monthly or quarterly payments.

- Understanding liabilities lets you know how much debt the company has incurred, and can help you determine how much money needs to come in to pay them off.

Table of Contents

- What are Liabilities?

- How To Calculate Liabilities

- How To Calculate Total Liabilities

- How To Calculate Current Liabilities

- What is the Purpose of Calculating Liabilities?

- Conclusion

What are Liabilities?

In business, liabilities are any debts, outstanding payments, loans, mortgages, accounts payable, or anything else your business owes to a bank, suppliers, or another company. In short, liabilities are the opposite of total assets a company owns. It is the money that is owed to somebody else.

How To Calculate Liabilities

Calculating liabilities can be done by completing the following steps:

1. List Your Liabilities

To calculate liabilities, first, you need to know what liabilities you have. Some common examples are accounts payable (money you owe to suppliers), salaries and wages payable, and customer retainers and deposits. Other business liabilities you may have include:

- Income tax payable

- Sales tax liability

- Debt on business loans

- Contracts you can’t cancel without penalty

- Lease agreements

- Insurance payable

- Benefits payable

- Taxes on investments

- Accrued liabilities (like interest payments that you haven’t been invoiced for yet)

Liabilities can further be classified into several distinct types.

- Short-Term Liabilities

All short-term liabilities are financial obligations due within a year or less. Some examples of short-term liability include credit card debt, insurance premiums payable, payroll taxes, or staff wages.

- Long-Term Liabilities

Long-term liabilities are debts and financial obligations due more than one year in the future. These may include mortgage loans, machinery leases, pension liabilities, or bonds payable. They may also include long-term leases.

- Other Liability Types

“Other” liabilities are any unusual debt obligations a company may have. These are typically minor, like sales taxes or intercompany borrowings.

- Expenses Are Not Liabilities

Expenses are continuing payments for services or things of no financial value. Buying a business cell phone is an expense, while liabilities are loans used to purchase tangible assets (items of financial value), like equipment.

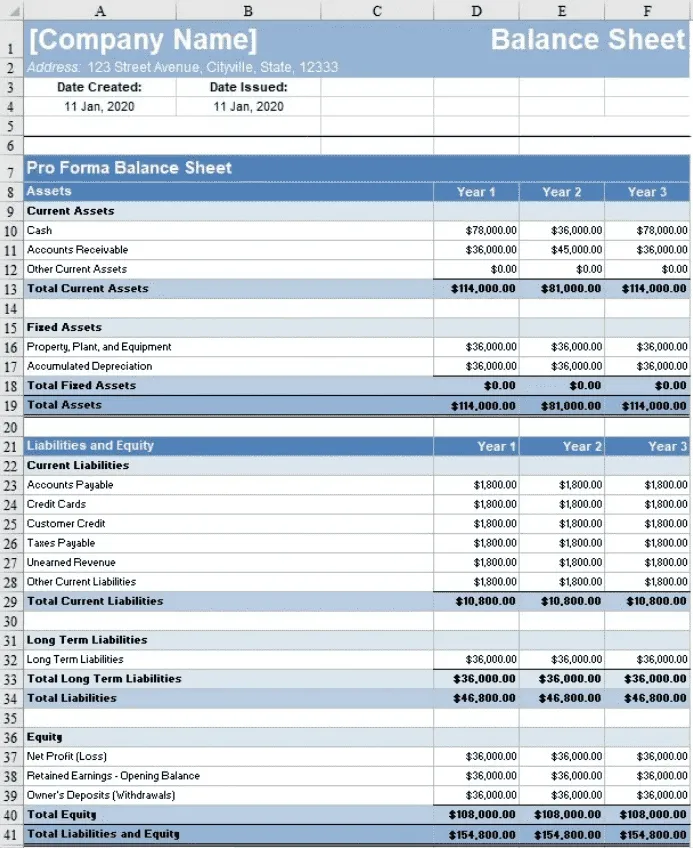

2. Make a Balance Sheet

It’s possible to create a simple balance sheet in Excel by reviewing the above liability types and including those relevant to your business. Plug in the amount owing for each liability type. Only include the amount owing for the accounting cycle you’re reviewing — the past financial year, quarter, or month.

It’s easier and generally more accurate to use accounting software to produce a balance sheet. The below example is a basic balance sheet made using FreshBooks:

Some of the most common liabilities found on business balance sheets are accounts payable, sales and employment taxes, corporate income tax (if applicable), current loans payable, long-term loans payable, and your credit card balance.

3. Add up Your Liabilities

Your accounting software should automatically add up all your liabilities for you. Otherwise, you will need to manually add your liabilities up in your spreadsheet or the software of your choice.

4. Check the Basic Accounting Formula

In double-entry bookkeeping, the accounting formula used to check if your books are correct is:

Liabilities + Equity = Assets

Equity is the value of all the assets a company holds minus any money owed. An asset is an item of financial value, like cash or real estate.

Your total liabilities plus total equity must be the same number as your total assets. If both sides of this basic accounting equation are the same, then your book’s “balance” is correct.

As an example, say Company A reported the following on its balance sheet:

- Total liabilities: $480,000

- Total Equity: $20,000

- Total Assets: $500,000

Using the basic accounting formula, the equation would be:

$480,000 (liabilities) + $20,000 (equity) = $500,000

This equation matches the value of the assets the company has reported, so the books are balanced.

How To Calculate Total Liabilities

To calculate total liabilities, simply add up all of the liabilities the business has. This includes all money owed to creditors, like payroll liabilities, accounts payable, costs for rent or mortgage, loans, pension liabilities, etc. In short, your total liabilities are the sum of your long-term and short-term liabilities.

Total Liabilities Formula

Long-Term Liabilities + Short-Term Liabilities = Total Liabilities

Long-term liabilities are any debts due more than one year in the future, while short-term liabilities are due within the year.

In the following example, we’ll calculate a small pet store’s total liabilities. They owe:

- $500 in accounts payable for utility bills

- $2,000 for mortgage per month

- $5,000 in credit card debt

- $2,000 is still owed on the balance of a $10,000 business loan they took out for renovations a few years ago

- $1,000 to the government for sales and income tax

| Liability | Amount Owed |

| Utility Bills | $500 |

| Mortgage | $2,000 |

| Credit Card Debt | $5,000 |

| Business Loan Balance | $2,000 |

| Sales and Income Tax | $1,000 |

| Total | $10,500 |

How To Calculate Current Liabilities

To calculate current liabilities, you need to add up the money you owe lenders within the next year (within 12 months or less) or within the business’ normal operating cycle. This may include current payments on long-term loans (like monthly mortgage payments) and client deposits. They can also include loan interest, salaries and wages payable, and funds owed to suppliers or utility bills.

Current Liabilities Formula

The current liabilities formula is:

Current Liabilities = Notes Payable + Accounts Payable + Accrued Expenses + Unearned Revenue + Current Portion of Long-Term Debt + Other Short-Term Debt

Notes payable (also known as promissory notes) are written promises to repay a specific amount of money to a lender by a specified future date, or upon demand, while accounts payable are any obligations a business owes to suppliers, including goods purchased on credit.

Accrued expenses are any expenses that have been put in the books before being paid, and unearned revenues are any money paid in advance by a client for goods and services that haven’t been delivered yet.

The current portion of the long-term debt in this formula will be calculated by determining the number of payments owed within the calculation’s specified amount of time. For example, if you’re figuring out one year’s current liabilities, you would factor in 12 mortgage payments.

What is the Purpose of Calculating Liabilities?

Understanding your company’s liabilities will give you the full story behind your company’s finances and how much total debt you’ve incurred.

Knowing what you owe may prevent you from taking on additional debts you can’t afford. It can give you a metric to help balance your books, look for trends, and compare your assets and liabilities to measure your business’ solvency and liquidity.

Conclusion

Understanding debts and profits is all part of owning your own business. Whether you’ve hired a professional accountant or do it yourself, knowing about business transactions, liabilities, and what they mean to your company can be a huge asset, as you can calculate its net worth, owner’s equity, shareholder’s equity, and know how much money you need to bring in to be profitable.

You can manually calculate your total liabilities by adding up the short-term and long-term liabilities from your balance sheet, but using accounting software like FreshBooks can make tracking your small business’s cash flow even easier. With just a few clicks, the software will produce a balance sheet that lists and calculates your liabilities, so you can focus on growing your business, rather than spending the day crunching numbers.

Reviewed by

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

RELATED ARTICLES

What Is an Income Statement?

What Is an Income Statement? How to Calculate Accounts Receivable Turnover

How to Calculate Accounts Receivable Turnover What Are Fixed Assets? | A Simple Primer for Small Businesses

What Are Fixed Assets? | A Simple Primer for Small Businesses Operating Margin Equation: How to Calculate

Operating Margin Equation: How to Calculate Is Service Revenue an Asset? Breaking down the Income Statement

Is Service Revenue an Asset? Breaking down the Income Statement Chart Of Accounts: Definition, Types And How it Works

Chart Of Accounts: Definition, Types And How it Works