What is Accounts Payable: Definition, Process, and Examples

When a company purchases goods and services from a supplier or creditor on credit that needs to be paid back quickly. The accounting entry to record this transaction is known as Accounts Payable (AP).

On a balance sheet, it appears under current liabilities. In a company, an AP department is responsible for making payments owed by the company to suppliers and other creditors.

Key Takeaways

- Accounts payable refers to any money owed expected to be paid in one year or less

- Accounts payable is the department that handles all the payments that go out of a company

- Accounts payable is responsible for keeping records of what is paid and to pay invoices on time

- Accounts payable does not include payroll

- Accounts payable needs to have a concrete process and guidelines in place so nothing gets missed

In this article, you will learn:

What Is Accounts Payable vs. Accounts Receivable?

What Is the Role of Accounts Payable?

What Is the Accounts Payable Process?

What Is Included in Accounts Payable?

What are Examples of Accounts Payable Expenses?

Benefits of Accounts Payable Automation

Accounts Payable Best Practices

What Is Accounts Payable?

Accounts Payable refers to a business’s obligations to suppliers and creditors for purchases made on an open account. It specifically refers to any amounts owed expected to be paid within one year or less (usually due in 30 to 60 days). Additionally, Accounts Payable could refer to the department responsible for these expenses.

What Is Accounts Payable vs. Accounts Receivable?

While Account Payable refers to how much a business owes, Accounts Receivable (AR) encompasses the money owed to the business. It refers to the money that is expected from customers but has not yet been paid. Like Accounts Payable, AR could refer to the department responsible for this money.

What Is the Role of Accounts Payable?

A company’s Accounts Payable department tracks the amounts owed and records them as short-term obligations on the general ledger. They are also responsible for keeping these records up-to-date and ensuring that invoices get paid by the payment date.

Accounts Payable and Receivable are usually different departments in larger companies. However, smaller businesses may combine their accounts receivable and accounts payable into one department. They are typically responsible for more than just paying incoming bills and invoices.

While the business size ultimately determines the role accounts payable plays, AP fulfills at least three essential functions besides paying bills.

Business Travel Expenses

Larger businesses or any business that requires staff to travel may have their AP department manage their travel expenses. The travel management by the AP department might include making advance airline, car rental, and hotel reservations.

Depending on the responsibilities accounts payable receives from a company, they might process requests and distribute funds to cover travel expenses. After business travel, AP would then be responsible for settling funds distributed versus funds spent and processing travel reimbursement requests.

Internal Payments

Accounts Payable is responsible for distributing invoice processing, internal reimbursement payments, controlling and administering petty cash, and distributing sales tax exemption certificates.

Employees must submit a manual log report, receipts, or both to substantiate reimbursement requests.

Small expenses such as miscellaneous postage, out-of-pocket office supplies or company meeting lunch are handled as petty cash. AP often handles a supply of sales tax exemption certificates issued to managers to ensure qualifying business purchases don’t include sales tax expenses.

Vendor Payments

Accounts Payable organizes and maintains vendor contact information, payment terms, and Internal Revenue Service W-9 information either manually or using a computer database.

Depending on a company’s internal controls, an AP department either handles pre-approved purchase orders or verifies purchases after a purchase. The AP department also handles end-of-month aging analysis reports that let management know how much the business currently owes.

Other Functions

The accounts payable department also works to reduce costs by developing strategies to save a business money. For example, paying an invoice within a discount period that many vendors provide.

AP is also a direct line of contact between a business and its vendor representatives. Strong business relationships between the two could benefit the company and a vendor might offer relaxed credit terms.

What Is the Accounts Payable Process?

Every accounts payable department has a process to follow before making a vendor payment — this is the accounts payable process. Concrete guidelines are essential because of the value and volume of transactions during any period.

The AP process involves:

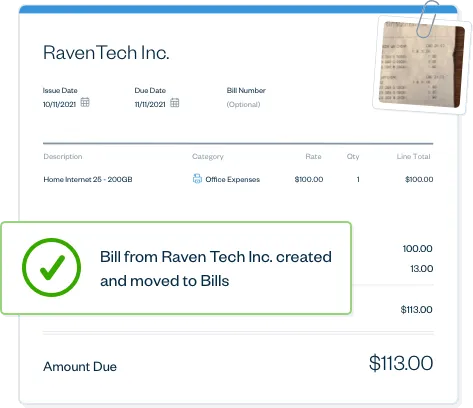

Receiving The Bill

If a company purchases goods, the bill helps trace the quantity of what was received. The validity of the bill can be known during this time too.

Reviewing Bill Details

Ensure that the bill includes vendor name, authorization, date, and verified and matching requirements to the purchase order.

Updating Records Once The Bill Is Received

Ledger accounts need to be updated based on the received bills and an expense entry is usually required. Managerial approval might be required at this stage with the approval hierarchy attached to the bill value.

Making Timely Payment

All payments should be processed before or at their due date on a bill, as agreed upon between a vendor and a purchasing company. Required documents need to be prepared and verified.

The details entered on the check, vendor bank account details, payment vouchers, and the original bill and purchase order must be scrutinized. Managerial authorization might be required at this point too.

To make sure a company’s cash and assets are safe, the accounts payable process should have internal controls to:

- Prevent paying fraudulent invoices

- Prevent paying an inaccurate invoice

- Prevent paying a vendor invoice twice

- Ensure that all vendor invoices are accounted for

What Is Included in Accounts Payable?

Accounts Payable is presented as a current liability on a company’s balance sheet. It includes a collection of short-term credits extended by vendors and creditors for goods and services a business receives.

An AP department also handles internal payments for business expenses, travel, and petty cash.

What are Examples of Accounts Payable Expenses?

AP encompasses any amount of money a company owes besides payroll, including goods or services purchased, software subscriptions, logistics, late fees, or office utility bills.

While payroll is not included in AP, it appears on the balance sheet as another of the business’s current liabilities. This amount is referred to as wages payable.

Benefits of Accounts Payable Automation

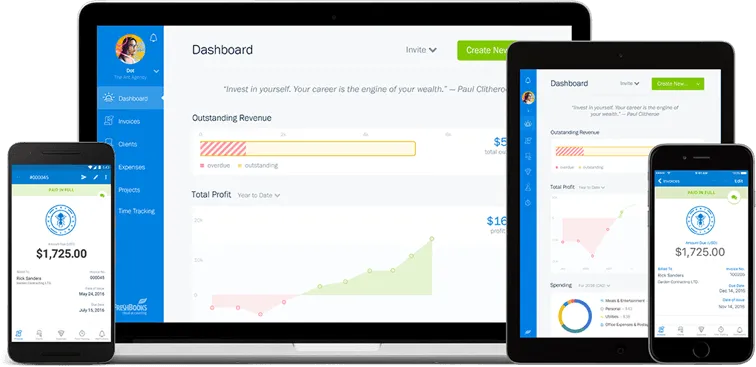

Businesses can streamline the accounts payable process with their accounting software tool. Investing in this technology is worthwhile for several reasons.

Manual processes are always prone to human error. Errors from outside the company can also compromise the integrity of the financial data. Automated processes reduce the risk of this occurrence and capture information from the original invoice so you can verify accuracy.

Paying invoices in a timeframe that keeps cash flow liquid and obligators satisfied is a common challenge. Automated processing helps companies easily achieve this balance while giving their accounting team more time to spend on other tasks.

A digital accounting system always leaves an audit trail. Every time there’s a transaction, an accounting software tool will record when it occurred, who handled it, and whenever each step of the payment process happened.

Miscommunication is all too common in every company. One employee may have one way of doing things, while another may do the same tasks differently. Implementing an automated accounts payable process is a simple yet effective way to get everyone on the AP team on the same page.

If you want to start automating AP at your business, consider FreshBooks as your accounting software solution. Click here to try it for free today.

Accounts Payable Best Practices

Here are some best practices to follow:

- Consolidate checks into a central repository to accelerate workflows

- Be selective about who can access the Master Vendor File

- Create fake vendor accounts to test your systems for ways accidental fraud can happen

- Be open to negotiating payment terms if additional cash flow is needed

- Seek discounts whenever possible to decrease the amount of money your company pays

- Be vigilant about duplicate records

- Make sure all invoices match what your company expects. If they don’t, find out why.

- Review all accounts at the end of every workday

Conclusion

Accounts Payable has a few definitions. It could refer to an account on a company’s general ledger, a department, or a role. Yet, no matter where the term appears, it’s always related to the amount of money a business owes to other entities within a specific timeframe.

FAQs on Accounts Payable

What are the Different Types of Accounts Payable?

Accounts payable can be categorized into trade payables, non-trade payables, and taxes payable. Trade payables refer to payments on goods or services, and non-trade payables refer to business expenses that don’t directly affect operations (e.g. utility bills). Taxes payable refer to the company’s federal, state, and local obligations.

What Is GAAP for Accounts Payable?

GAAP stands for Generally Accepted Accounting Principles. These principles refer to the guidelines that all accounting teams, AP or otherwise, must follow when recording transactions and preparing financial statements to maintain legal compliance.

What Is Another Name for Accounts Payable?

Accounts Payable is sometimes referred to as a current liability account. This is simply in reference to the fact that the account represents the company’s short-term liabilities.

Why Is Accounts Payable Important?

Accounts payable is a liability that represents money owed to creditors. It is included in a balance sheet as a current liability. Keeping accurate accounts payable records is essential to managing the company’s cash flow and producing accurate financial statements.

Who Manages Accounts Payable?

An accountant or an AP department manages Accounts Payable. In some companies, one specific accountant may be responsible for all accounts payable. In other cases, one accountant is responsible for all of the company’s accounting, AP included.

More Resources on Small Business Accounting

RELATED ARTICLES

What Is Accounts Receivable?

What Is Accounts Receivable? What Is DSCR? It’s Debt Service Coverage Ratio

What Is DSCR? It’s Debt Service Coverage Ratio What is a Cash Flow Statement? Definition and Importance

What is a Cash Flow Statement? Definition and Importance Fixed Cost: Definition, Formula, and Examples

Fixed Cost: Definition, Formula, and Examples Variable Cost: Definition, Formula, and Examples

Variable Cost: Definition, Formula, and Examples What Is Cost Accounting? It’s Cost Control

What Is Cost Accounting? It’s Cost Control