Production Costs: Definition & Formula

Operating a small business can come with lots of exciting opportunities. You have goals to provide the best possible product or service to your customers. But creating a product or service comes with certain costs.

One of the biggest considerations is the production costs. Understanding how these costs can affect your bottom line is critical for business success. So how do production costs really work? We put together this guide to break down everything that you need to know. We also included a formula for your calculations to help stay on track.

Keep reading to find out everything about production costs and how they can affect your business.

Table of Contents

KEY TAKEAWAYS

- Production costs are the total amount of your fixed and variable costs.

- Production costs can include a wide variety of expenses. These can include raw materials, labor, general overhead, and supplies.

- To find the total product costs, you can add together any labor costs and total direct materials.

What Are Production Costs?

When you produce a product or service, production costs are any expenses incurred along the way. It’s all going to depend on the type of product or service and the industry that you’re in.

Some of the most common production costs can include:

- Raw materials

- Labor

- Equipment

- Rent

- Supplies

- Overhead

Typically, production costs can get associated with a business that has high inventory levels, such as a manufacturer. That said, these costs still affect many different types of businesses. For example, service-based businesses, retailers, and distributors monitor how much production costs.

Production costs are important to understand since they’re connected with generating revenue. Plus, they can also account for most business expenses.

But for a production cost to get labeled as an expense, it must get incurred when producing the product or service. Think about it in terms of manufacturing businesses, for example. Production might include things like rent, direct labor costs, raw materials, and machinery.

But on the flip side, a software company might have different production costs. These could be things such as web hosting, third-party applications, and software licenses.

Increasing your production costs means that you’re going to see a decrease in your cash on hand. This is why these types of production cost expenses will impact cash flow and the overall pricing structure.

It’s also important to recognize that simply reducing production costs won’t necessarily generate more profit. There’s always a need to have certain raw materials and labor to ensure your product or service is high-quality.

Balancing all of these demands, like production costs and projected revenue, is a critical element of any business’s success.

Different Types of Production Costs

It was mentioned above, but the type of business you operate and the industry you’re in can impact production costs. That said, there are typically five primary types of costs to know and understand.

1. Fixed Costs

Fixed costs, as the name suggests, are always going to remain the same. They can also get referred to as indirect costs or overhead. And they always stay the same regardless of the number of products or services you produce.

Types of expenses like rent, business equipment, and monthly salaries are good examples of fixed costs.

2. Variable Costs

Variable costs will have price fluctuations depending on if there are changes in production. If production volume increases, variable costs will also increase. If production volume decreases, the costs will decrease. Keep an eye on things like operating costs and energy prices.

A variable cost could be packaging, shipping, or raw materials.

3. Total Cost

When you add together both the variable costs and fixed costs they’re going to equal the total cost. Essentially, this is the total cost incurred for production including any changes to production volume.

4. Average Cost

To determine the average cost, you simply divide the total cost of production by the total unit of output. It can also get referred to as the unit cost. Basically, it’s how much it costs you to produce a single product or service, or the cost per unit.

Understanding average cost is an effective way to help determine the final selling price with details from the balance sheet.

5. Marginal Cost

When you produce an additional unit, you’re going to see an incremental increase in your total cost. This is the marginal product cost and they’re most often related to variable costs.

Marginal costs will help find the ideal and most optimum level of production for your product or service.

How Do You Calculate Production Costs?

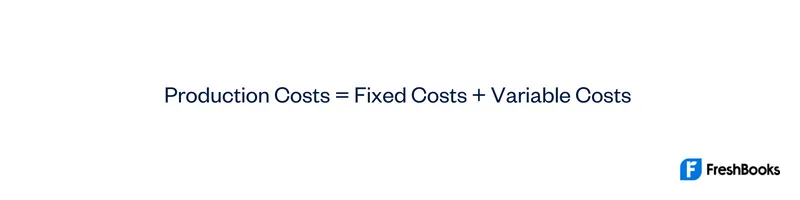

The good news is that calculating your production costs is relatively simple. All you need to do is add any of your fixed costs and variable costs together. To calculate the cost of production expenses, you can use this formula:

Keep in mind that any fixed or variable costs you include must get incurred while producing your product or service. Just add the total fixed costs from a specific period of time to the total variable costs over the same period.

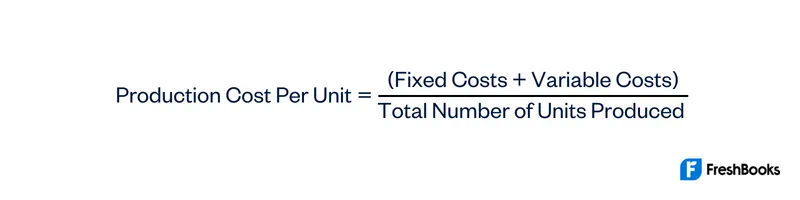

You’re also able to use the following formula to determine the specific production costs per unit:

Once you find out your production costs using the first formula outlined above, you can divide it by the total number of units produced during the same period. This formula can be a great way to find out how much it costs to produce a single unit, which can allow you to break down your production costs further.

Summary

Understanding how business production costs work is a critical part of any type of company. It’s going to impact everything from the suppliers you use to the type of product or service you produce. Plus, they’re going to help determine the final price point that you offer your product or service to your customers.

Production costs might vary depending on your type of business and the industry that you’re in. But you can typically find five common types. These include fixed costs, variable costs, total costs, average costs, and marginal costs.

Doing proper calculations will help with decision-making and increase business sales. You can find new opportunities and areas for improvement so you can operate at an optimal level.

Frequently Asked Questions

Let’s say a furniture company has a demand for patio sets. Fixed costs might include equipment, warehouse rent, labor, and utilities. Variable costs could be packaging, raw materials, and freight. You would add these costs together to determine the total cost and find average and marginal costs.

Cost of production is the expenses you incur while producing your product or service. Price relates to how much your customers are going to pay for your finished product or service.

You can look into using different suppliers to source your materials at a lower rate. Or, you could explore ways to make your production processes more efficient. Price increases aren’t always necessary if you have concerns over production costs.

To keep things simple, production costs are expenses incurred when producing your product or service. Manufacturing costs, on the other hand, relate to only the expenses that are required to make your product or service.

You can determine production costs by adding together any labor costs and direct material costs. It’s important to also consider any of your manufacturing overhead costs. These direct costs can include everything from labor, raw materials, and supplies.

Share: