Claiming VAT on Mileage Expenses

Travel in business is common, and HMRC recognises the VAT you pay on business travel is subject to a possible refund. While you cannot claim daily mileage expenses for a company vehicle, you can claim VAT on mileage for your and your employee’s business travel expenses, provided your employees need to use their personal cars for business. You must be a VAT-registered business to claim a VAT refund.

This guide will teach you what expenses qualify for a VAT refund and how to calculate the amount.

Key Takeaways

- An employer can reclaim VAT on mileage for themselves and their employees as long as they pay their employees a mileage allowance.

- The HMRC has predefined rates for mileage claims.

- Electric vehicles can make mileage claims.

- An employer or sole trader must keep a detailed travel log to remain compliant with HMRC VAT on mileage regulations.

Here’s What We’ll Cover:

How Much Can You Reclaim on Mileage Expenses?

How to Calculate VAT Reclaim on Mileage – Example

Reclaiming VAT as an Employer

You can reclaim mileage costs incurred by your employees if you pay them a mileage allowance for business travel. If your employees use their private vehicles and pay for their own expenses, you cannot claim any portion.

When claiming VAT on mileage allowance must be for business purposes only, and it cannot include personal journeys or daily commutes to work. Mileage and fuel expenses only cover business travel outside of these two categories.

The expenses you claim must come from the business travel of actual employees. Freelancers and contractors are omitted.

As an employer, it’s important to note you can only claim VAT on fuel. The allowance you give your employees for mileage must equal the fuel allowance. You must keep detailed mileage records to remain compliant with HMRC regulations. It’s not enough to submit your VAT fuel receipts. You must show the mileage used for business travel per receipt when you use a personal vehicle.

How Much Can You Reclaim on Mileage Expenses?

The HMRC uses predefined rates for mileage claims. As of August 2024, the rate for cars and vans is £0.45 per mile for the first 10,000 miles of business travel and £0.25 per mile after that.

For motorcycles, that rate lowers to £0.24 per mile, and £0.20 per mile for bicycles. For fully electric vehicles, the advisory electric rate is 7 pence per mile.

Mileage rates cover expenses beyond fuel. That could be wear and tear costs like repairs. It could also include fixed costs like insurance and road tax.

Part of the 45/25 pence mileage rate is for the cost of fuel. The fuel portion is what is eligible for VAT reclaim. Remember that you’ll need VAT receipts for fuel to support your business mileage claim.

The amount that is considered deductible is called the Advisory Fuel Rate. The HMRC revises these every quarter. As of 1 September 2024, they are as follows:

| Engine Size (cc) | Petrol (Rate per Mile) | LPG (Rate per Mile) | Diesel (Rate per Mile) |

| 1400cc or less 1600cc or less (diesel) | 13p | 11p | 12p |

| 1401cc to 2000cc NV 1601cc to 2000cc (diesel) | 15p | 13p | 14p |

| Over 2000cc | 24p | 21p | 18p |

You can check the latest rates on the HMRC website.

What About Electric Cars?

You can make a VAT mileage claim for business travel if you have a fully electric car at a rate of 9 pence per mile.

Rates for electric vehicles are calculated using data from four data bodies: fleet audits, Office for National Statistics, Department for Transport, and Department for Business, Energy & Industrial Strategy (BEIS). The cost of electricity per mile for each model provided by the DFT, the average of how many EVs sold in a three-year period provided by fleet audits, and electricity price data from the BEIS and ONS. The average determines the AER or Advisory Electric Rate.

Hybrid vehicles qualify as petrol or diesel vehicles for advisory fuel rates.

How to Calculate VAT Reclaim on Mileage – Example

To calculate the amount of VAT you can reclaim on mileage, you need the following details:

- The type of fuel the vehicle uses.

- Your CO2 emission figure or the cylinder capacity of the engine.

- The destination and origin of the trip.

- The purpose of the trip.

- The amount of mileage that counts as business travel

- The VAT receipts for the fuel costs related to the journey

Let’s take a look at some examples!

An employee with a petrol car:

The car is over 1400c but under 2000c. The car has less than 10,000 miles.

Of the 45p per mile mileage allowance, 15p is for fuel.

The VAT rate is currently 20%. Therefore, we need to calculate 20% of 15p.

15p is 120% (100% plus 20% of VAT).

The VAT element is 15/120*20 = 2.5p

So for every business mile, you can reclaim 2.5p back on VAT.

Next, multiply 2.5p by the number of miles travelled by that employee. You can submit a VAT claim to the HMRC on your VAT return through your accounting system.

Et voilá! You have calculated and reclaimed expenses from VAT for business-related travel expenses.

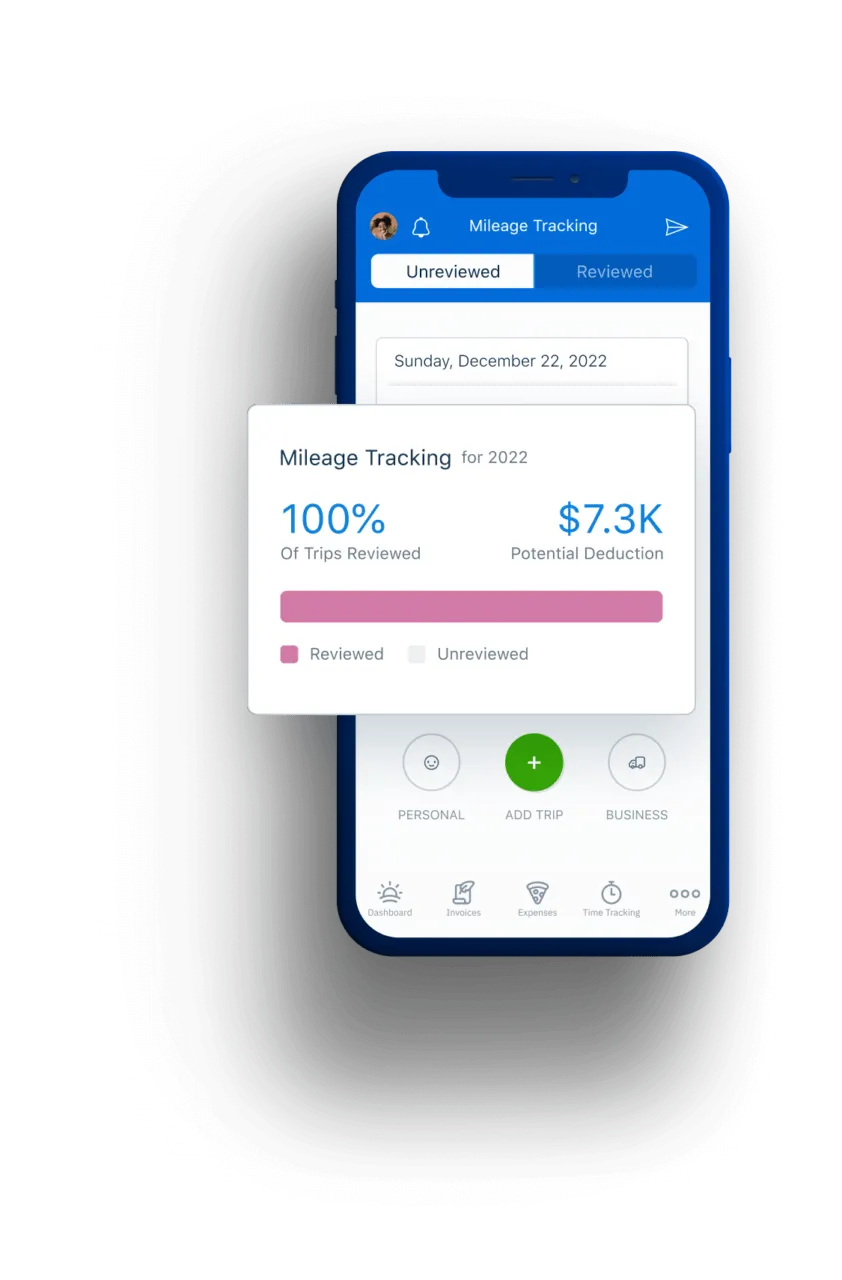

FreshBooks knows you have so much to tackle in a day. That’s why we developed a mileage-tracking app that simplifies and automates the tracking process. The intuitive app is easy for you and your employees to use and can even calculate tax deductions. FreshBooks’ hands-free mileage tracker eliminates the need for manual entry so that you can focus on the bigger picture.

Conclusion

Many business owners are uncertain about what expenses they can reclaim. Travel and mileage expenses from their own car and employees’ own car are often eligible. You can take advantage of this very useful tax relief by tracking fuel receipts, mileage, and other related details. If you have a reliable mileage tracker app like ours, you can make calculating and tracking mileage allowance payments and deductions quick and easy.

For more guides like this one, check out our resource hub.

FAQs on VAT on Mileage Claims

What is the VAT rate applicable to mileage expenses in the UK?

The VAT rate for mileage expenses is currently 20%. Mileage expense qualifies for the standard rate. Decreased or nil VAT rates only apply to fuel and power used for homes, things like children’s car seats, and most foods and children’s clothing. The rate does not change because the mileage is a business expense.

Can I claim VAT on mileage for business travel outside of the UK?

HMRC acknowledges that sometimes a person must travel outside of the UK for business. For the most part, you can make standard travel claims. To make a mileage claim for business, you only claim the fuel portion. Therefore, you can only claim VAT for fuel if you purchased the fuel in the UK.

Can I claim VAT on mileage if I use public transportation for business purposes?

When you make a mileage claim, you submit for a refund for a portion of the VAT you pay on fuel. UK public transportation is zero-rated. This means there is no VAT to claim a refund for. However, you may be eligible for other relief claims for travel expenses when you use public transport.

What happens if I make an error in claiming VAT on mileage?

Errors on VAT returns can result in a penalty and interest. If you discover an error in your records and have not made a return, you can simply correct the error and make a note for the correction. If you have already filed your return, your process becomes more involved but can be corrected on your current return.

Can I claim VAT on mileage for charity or non-profit organisations?

Yes, you can claim mileage for charity or non-profit organisations. If you have an expense policy for your charity or non-profit organisation, and it includes reimbursement for travel expenses that your volunteers incur with their personal vehicles while travelling on charity-related business, you can make a claim.

Reviewed by

Levon Kokhlikyan is a Finance Manager and accountant with 18 years of experience in managerial accounting and consolidations. He has a proven track record of success in cost accounting, analyzing financial data, and implementing effective processes. He holds an ACCA accreditation and a bachelor’s degree in social science from Yerevan State University.

RELATED ARTICLES

What Is the Marginal Tax Rate? How Much Tax Do You Pay

What Is the Marginal Tax Rate? How Much Tax Do You Pay What Is a P35 – Payee Annual Return?

What Is a P35 – Payee Annual Return? What Is HMRC Mileage Claim Tax Relief Policy? A Guide

What Is HMRC Mileage Claim Tax Relief Policy? A Guide How to Claim VAT Refund: An EU Guide

How to Claim VAT Refund: An EU Guide What Is a P11D Form? Expenses & Benefits for Employers

What Is a P11D Form? Expenses & Benefits for Employers Best Tax Software For 2025

Best Tax Software For 2025