How Do I Claim My Mileage Back From HMRC?

You can usually make an HMRC mileage claim on cars, vans, motorcycles, or bicycles that you use for business purposes.

It applies to vehicles you pay for yourself, leased or owned or company car.

This isn’t for your daily commute between home and a permanent workplace. That’s just ‘getting to work’. But it does include any temporary workplace you travel to while working, among others. This article will discuss what you can and can’t claim and how.

Key Takeaways

- The HMRC determines an approved rate you will use to claim business mileage.

- The approved rate considers various individual expenses like repairs, fuel, and MOTs.

- Your daily commute to and from home to your business and personal journeys does not qualify for mileage reimbursement.

- You should keep a detailed log of your travels and expenses.

- You must complete form P87 online or use the self-assessment system to claim mileage from HMRC.

Here’s What We’ll Cover:

What Costs Does Business Mileage Tax Relief Cover?

Approved Mileage Allowance Rates

What Rate is the Rate of Mileage Tax Relief?

Do I Need Proof of My Work Journeys?

What if I Get a Business Mileage Allowance From My Employer?

What Does ‘Temporary Workplace’ Mean?

How Do I Claim My Mileage Back From HMRC?

What Costs Does Business Mileage Tax Relief Cover?

HMRC acknowledges your vehicle maintenance costs like:

- Ministry of Transportation test (MOTs)

- Repairs

- Fuel

- Electricity

- Road tax

When you claim mileage allowance relief, you don’t apply for all these individual costs separately. Instead, there is an approved rate determined by the HMRC that takes these costs into account. That rate is multiplied by the amount of business-related travel in miles.

Approved Mileage Allowance Rates

HMRC sets Approved Mileage Allowance Payments (AMAPs). They give value to your business journey per mile.

Currently, they are set at:

- Car/Van £0.45 per mile for the first 10,000 business miles, £0.25 per mile from 10,000 miles

- Motorcycle £0.24 per mile

- Bicycle £0.20 per mile

The rates don’t change because the price of one element increases or falls. For example, if fuel prices rise. Your vehicle’s engine size and age have no impact on the rate.

What Rate is the Rate of Mileage Tax Relief?

The rate of mileage tax relief you can claim is based on the rate of income tax you pay: 20%, 40%, or 45%.

For example:

- 10,000 miles of business travel at 45p per mile = £4500

- Basic rate of income tax paid at 20%

- 20% of £4500 = £900 tax relief

Do I Need Proof of My Work Journeys?

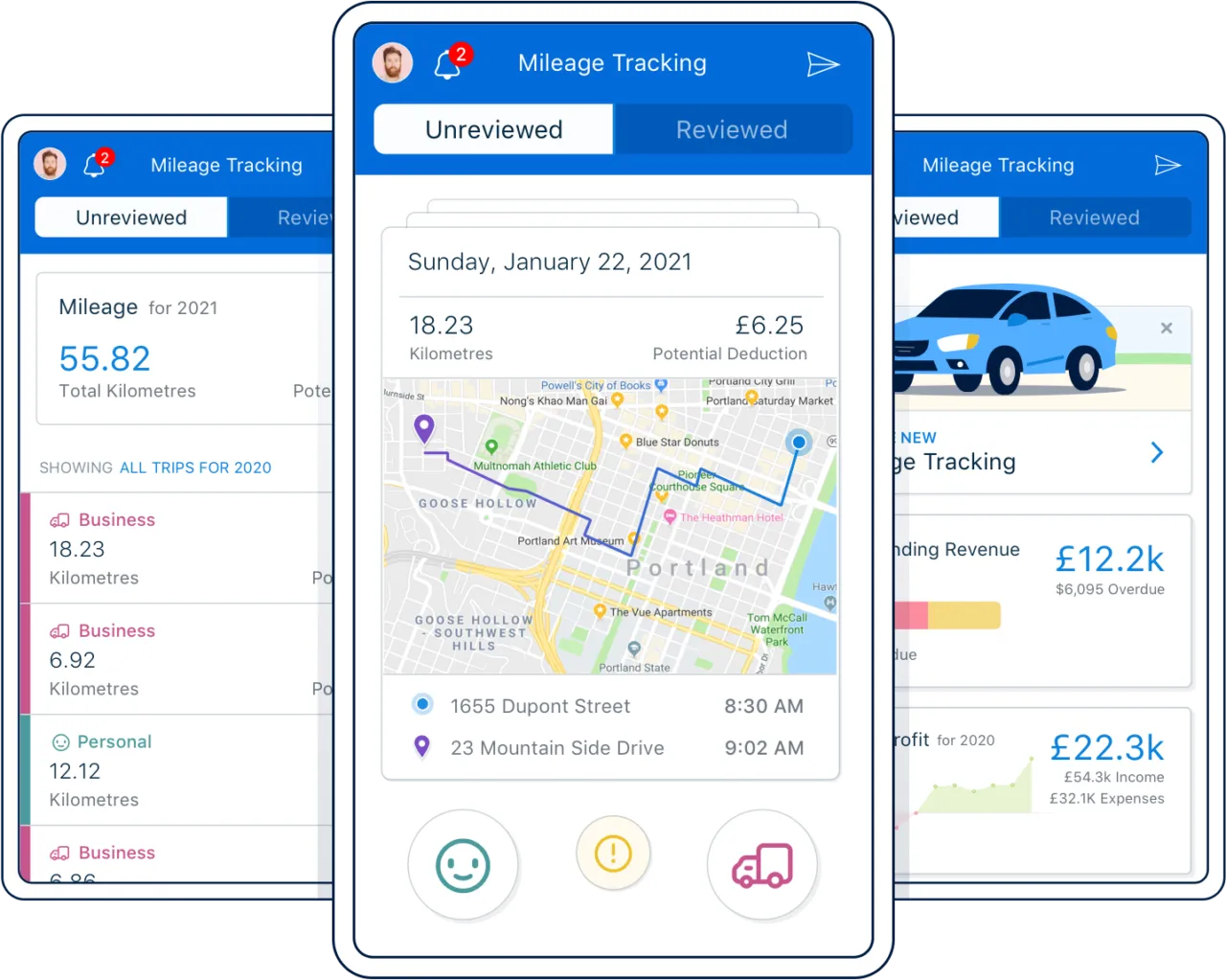

Yes, you need to keep records of all your work travel, including public transportation, for all the vehicles you use, supporting your HMRC travel expenses claim. just a simple diary that notes the dates, number of miles and destination of each journey and any relevant receipts. FreshBooks Expenses Tracker keeps everything in order as you go. This means you have the evidence to prove your claim is legitimate, should HMRC decide to investigate.

What if I Get a Business Mileage Allowance From My Employer?

If you’re employed and your employer pays you some business mileage allowance, you can still claim the rest up to the total Approved Mileage Allowance Payment (AMAP) amount. This is the same if you drive your own or company vehicle.

For example:

- You travel 7,000 miles for work

- You’re given a mileage allowance by your employer of 20p per mile

- The AMAP is 45p per mile

- You can claim the remaining 25p from HMRC

You can use your payslips as evidence of your business travel and the amount you’ve already been paid.

What Does ‘Temporary Workplace’ Mean?

This is a crucial definition for determining which of your journeys are eligible for mileage tax relief. Remember, you can only claim mileage tax relief for travel to temporary workplaces but not to permanent workplaces.

HMRC Definitions

Permanent workplace: A building or site where you work for at least 40%. With some jobs, like an area manager’s role, this can also be defined as a particular geographical area.

Temporary workplace: A site or building where you work for less than 24 months.

HMRC has a handy free tool called ‘Check if you can claim work-related expenses,’ so you can have a quick look before you invest any time in completing a claim.

How Do I Claim My Mileage Back From HMRC?

There are 2 different ways to submit a claim:

If you’re an employee and claiming less than £2,500, fill in a P87 or file online.

Self-employed taxpayers or employees claiming over £2,500: use the self-assessment system by submitting a self-assessment tax return.

FreshBooks makes self-assessment easy for you by keeping your records organised and simplifying submission, whether you’re self-employed or an employee.

Automate Mileage Tracking

Making a mileage claim can feel overwhelming at times. First, you need detailed logs that include any work-related passengers, mileage, destinations and fuel receipts. Then, you have to make accurate calculations to claim your mileage back. Keeping it all organised and error-free can be a daunting task. FreshBooks understands. That’s why we developed a mileage-tracking app. It’s easy to use and simplifies filing.

Good To Know…

- You can backdate a mileage tax rebate claim for 4 tax years.

- It doesn’t matter if you’re still working at the same place. You can still claim tax relief.

- You can also claim for public transport expenses: bus, train, ferry and taxi fares can all be in your mileage tax rebate claim. Just keep those receipts in your FreshBooks app.

Conclusion

In business, any edge can help you get ahead. It’s not always easy to know everything you should all at once. By understanding how to claim your mileage from the HMRC, you are one step closer to getting the most out of your tax rebate. Utilizing a reliable mileage tracker app, such as FreshBooks’ mileage tracking software, can make the process even smoother, ensuring accuracy and speed so that you can focus on the big picture.

FAQs on How to Claim Mileage Back from HMRC

How far back can I claim mileage expenses from HMRC?

You can claim mileage expenses for the previous 4 years and this year. In general, keeping your tax records for up to 2 years after their file date is recommended. However, this is one of the few examples demonstrating why keeping your tax records longer may benefit you.

Can I claim mileage expenses if I am self-employed or a sole trader?

Yes, self-employed and sole traders can claim mileage expenses. HMRC acknowledges mileage expenses are a common cost in business. They offer two options to make such a claim. The flat-rate scheme simplifies the process for some. For others, the best way is to claim the actual vehicle expenses.

Can I claim mileage expenses if I am a company director?

A company director can claim mileage expenses. However, you can only make claims for expenses incurred wholly and exclusively for business expenses. You have to have personally paid for these expenses. Personal travel is not an acceptable claim, and neither are expenses paid for with company funds.

What happens if I have already been reimbursed for mileage by my employer?

If your employer reimbursed you for the complete approved amount, you cannot make a claim on top of it. However, if the portion reimbursed is below the HMRC Recognised amount, you can make a personal claim for the remaining amount on your taxes. The personal claim is called the Mileage Allowance Relief (MAR).

Are there any restrictions on claiming mileage for international travel?

There is no limit to the number of miles you can claim for so long as they are used for business-related travel. This includes business travel using your own vehicle outside the UK. However, you cannot claim reimbursement for VAT mileage expenses for fuel purchased outside of the UK.

Reviewed by

Levon Kokhlikyan is a Finance Manager and accountant with 18 years of experience in managerial accounting and consolidations. He has a proven track record of success in cost accounting, analyzing financial data, and implementing effective processes. He holds an ACCA accreditation and a bachelor’s degree in social science from Yerevan State University.

RELATED ARTICLES

Tax Refund: How to Claim Tax Back? (PAYE & Self-Assessment)

Tax Refund: How to Claim Tax Back? (PAYE & Self-Assessment) Can I Change the Address on My Tax Return After Filing It?

Can I Change the Address on My Tax Return After Filing It? Can You Change Your Tax Return After Filing It With HMRC?

Can You Change Your Tax Return After Filing It With HMRC? Can I File My Taxes After The Deadline?

Can I File My Taxes After The Deadline? Are Charitable Donations Tax Deductible For Sole Traders?

Are Charitable Donations Tax Deductible For Sole Traders? What Tax Relief Can I Claim as a Sole Trader?

What Tax Relief Can I Claim as a Sole Trader?