10 Best Making Tax Digital (MTD) Software for VAT

Due to fairly recent changes in the UK’s tax system, all UK businesses registered for value-added tax (VAT) must use Making Tax Digital, or MTD software.

The idea of MTD-compliant software is to simplify the tax process for businesses and allow for improved tracking and management of tax liability throughout the year.

Although this new system has added benefits for taxpayers, businesses may need to adapt their existing tax system to ensure their income and tax filing process is fully optimized and compliant. To do this, you’ll need to start using one of the many MTD software options available on the market.

But how do you go about choosing the best making tax digital software? What do small businesses, self-employed businesses, and sole traders need to know about MTD for income tax returns and filing? Let’s break it down.

Key Takeaways

- All VAT-registered businesses in the UK must now comply with MTD to file their VAT returns.

- HMRC’s Making Tax Digital is poised to simplify the tax filing process, but you may need to adapt and adjust first.

- You’ll need dedicated MTD-compatible accounting software or bridge software to make your current system work.

- There are several MTD software options on the market, each with pros and cons.

- Look for MTD software that meets MTD regulations, integrates with your existing accounting software, and keeps your data secure.

Here’s What We’ll Cover:

MTD VAT Software: What Is It and How Does It Work?

10 Best Making Tax Digital Software Options

Benefits of Using MTD VAT Software

Factors to Consider When Selecting the Best MTD Software

What Is Making Tax Digital?

Making Tax Digital is HMRC’s plan to make the UK’s tax system “more effective, more efficient and easier for taxpayers to get their tax right.” These “fundamental changes” are vital because they affect how businesses and individuals report and pay taxes to HMRC.

This means a transition period from old methods to new processes, which is made even more challenging by concerns about financial penalties for making even genuine mistakes as you adapt to their digital expectations.

But it doesn’t need to be a tremendous stress. We’ve got you. FreshBooks online accounting software is ready for ‘Making Tax Digital for VAT.’ We know it’s just right for your VAT-registered business, but HMRC has a long list of options, so we’ve rounded up a list of 10 respected competitors to help you make an informed decision.

MTD VAT Software: What Is It and How Does It Work?

Making Tax Digital software for VAT is the first step in HMRC’s plan to introduce a fully digital tax system. As of January 2025, all value-added tax (VAT) registered businesses must fully comply with MTD. Companies must adopt one of the many MTD VAT software options to do this.

Making Tax Digital software solutions are simply digital accounting software adapted to comply with HMRC’s MDT regulations. They either bridge the gap between your current accounting system (such as spreadsheets) to be compatible and compliant with MDT’s file requirements and filing frequency or are intended to replace your system entirely.

MDT VAT software works almost the same as any other digital accounting platform. The main difference is that the software needs to be compatible with API, allowing it to communicate with the HMRC system. You simply file your accounts as usual and use the MDT software of your choice to file quarterly.

Not sure where to start with your VAT returns? FreshBooks makes your tax filing easy with financial reporting software. Our MTD-compliant software integrates with the HMRC’s system, so you can manage your accounting, prepare your returns, and send them off all with a straightforward software.

10 Best MTD-Compliant Software Options

Finding the best software for making tax digital will depend on your needs and your existing accounting setup. Here, we only highlight the software type, VAT-specific features, and pricing. This gives you a clearer picture to compare.

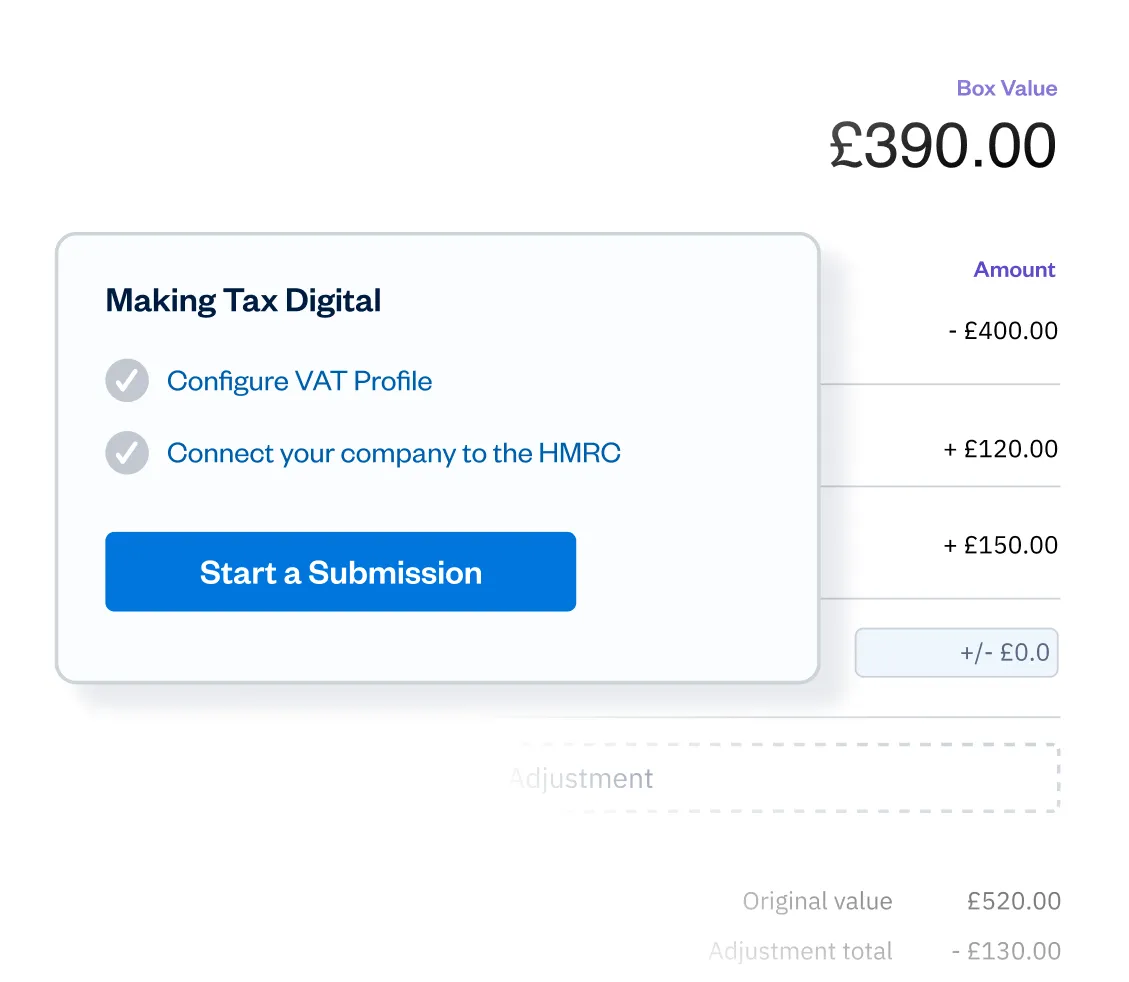

1. FreshBooks

Ideal for new, emerging, and established small businesses, FreshBooks offers flexible pricing plans tailored to your business size and client volume. You can manage your records and send your VAT returns to the HMRC directly through FreshBooks’ portal for quick, easy taxes.

Helpful Features

- Record–keeping software: FreshBooks keeps all your required digital VAT records

- Bridging connection: You can send your VAT returns directly to HMRC through FreshBooks’ portal

VAT Specific Features

- Check the VAT you owe whenever you need to

- View your VAT payment history

- Submit your next VAT return straight from FreshBooks to HMRC

- See all your previously submitted VAT returns

Pricing

FreshBooks has four packages based on the number of billable clients you have.

- Lite: £15.00 per month, up to 5 billable clients

- Plus: £25.00 per month, up to 50 billable clients

- Premium: £35.00 per month, unlimited number of clients

- Select: Bespoke pricing package for unlimited clients and specialized features

All packages include VAT return filing for HMRC MTD. FreshBooks accounting software helps you prepare your VAT records, and the built-in bridging allows you to send your VAT returns straight to the HMRC–no go-between, no extra steps, and no fuss. Discover how FreshBooks MTD compliant software can help streamline your tax filing with a 30-day, no-strings, free trial; sign up now!

2. Xero

Xero also offers pricing tiers so that you can tailor your accounting plan to the size of your small business. The basic 6-feature plan provides a functional base for accounting for new small businesses, while the direct-submit VAT system included with all plans helps you process your tax returns quickly and securely.

Helpful Features

- Keep digital VAT records

- Connects directly to HMRC

VAT Specific Features

- See VAT history, details, and VAT return due dates

- Accessible to check and change before submission

- Directly submit a VAT return to HMRC from Xero

Pricing

Xero has three levels of pricing:

- Starter £14 per month

- Standard £28 per month

- Premium £36 per month

- Ultimate £49 per month

All of these plans include ‘Submit VAT returns to HMRC.’ The plans each have at least 6 features and a variety of optional add-ons to appeal to a range of businesses, like payroll and submitting CIS returns. You can also quickly compare Xero with FreshBooks to make better business choices.

You can also try Xero for 30 days for free, with the option to cancel anytime. This gives you access to all the features to help you decide which plan suits you best.

3. QuickBooks

Fill, check, and submit your VAT returns through QuickBooks’ easy tax-management software. The ultra-affordable self-employed plan is an excellent fit for freelancers and those running very small businesses, and all five plans offer VAT checking and direct return submission to the HMRC.

Helpful Features

- Bridging software supports standard and cash schemes

- Up-to-date MTD for VAT data collection

VAT Specific Features

- VAT error checker

- Submit completed VAT returns

- Full MTD compliance for your record-keeping

Pricing

QuickBooks has five levels of pricing:

- Self Employed £10 per month

- Simple Start £14 per month

- Essentials £24 per month

- Plus £34 per month

- Advanced £70

All include ‘Check VAT return’ and ‘Submit VAT directly to HMRC.’ There’s also a QuickBooks free trial option to help you explore and compare.

4. FreeAgent

Make filing your taxes especially easy with FreeAgent’s auto-generated VAT returns. FreeAgent is a good fit for those who bank with NatWest, Royal Bank of Scotland, or Ulster Bank NI, as those with a business bank account will receive FreeAgent and its VAT services at no cost.

Helpful Features

- Record keeping that follows all the MTD for VAT rules

- File VAT returns online

VAT Specific Features

- VAT returns are generated automatically

- Support for cash basis and invoice VAT returns

- Submit VAT returns and make VAT payments directly to HMRC

Pricing

You can get FreeAgent, including their MTD for VAT services if you have a business bank account with NatWest, Royal Bank of Scotland, or Ulster Bank NI. FreeAgent divides its pricing structure into types of business, and you need to add VAT on top:

- Sole trader: £9.50 monthly for the first 6 months, then £19. Or an annual charge of £95 for your first year, then £190.

- Limited company: Monthly, first 6 months £14.50, then £29. Or £145 for the first year and then an annual £290.

- Partnerships and LLP: First six months for £12, then up to £24. Or £120 for the first year, then £240 annually.

- Landlord: Beginning in 2024, FreeAgent will offer £10.00/month +VAT for landlords earning income from a maximum of 5 properties.

5. KashFlow

Great for those seeking a VAT-focused accounting solution, KashFlow offers features like automatic VAT adding to invoices, VAT reporting, and a live VAT dashboard. It has three basic pricing plans and centers primarily on VAT with fewer supports for general accounting.

Helpful Features:

- Cloud accounting software that keeps your bookkeeping and data aligned with MTD for VAT

- Digital VAT submissions directly to HMRC

VAT-Specific Features:

- VAT-registered businesses can have VAT automatically added to invoices

- Live VAT liability dashboard

- VAT reports

- VAT return history

Pricing

KashFlow has 3 monthly pricing solutions:

- Starter Package price: £10.50+VAT

- Business Package price: £22.00+VAT

- Business + Payroll price: £29.00+VAT

And 3 annual prices of £71.50, £152.75, and £201.50 respectively – +VAT.

All their accounting packages let you manage and submit your Value Added Tax return online.

6. Sage

A good option for basic all-around accounting, Sage helps you manage your invoicing, cash flow, and VAT returns. It’s compatible with MTD, so it’s easy to submit your returns to the HMRC, but somewhat more limited regarding things like VAT accuracy checking.

Helpful Features

- Accounting software that manages bank transactions, cash flow, invoices, self-assessment tax returns for the self-employed, and everything else you’d expect from a system designed for businesses.

VAT Specific Features

- Live running total of your tax bill liabilities

- Data capture of all necessary VAT details

- Submits quarterly VAT returns directly to HMRC

Pricing

Sage offers three pricing plans for businesses:

- Start package: £14 per month

- Standard package £28 per month

- Plus package £36 per month

VAT is not included in the pricing. All 3 packages include calculating and submitting your MTD VAT data and submission to HMRC.

7. Zoho Books

Helpful for those who manage international trade as well as domestic business, Zoho lets you incorporate VAT duty on foreign trade into your accounting. Manage multiple VAT schemes and prepare liability reports with six pricing plans from this flexible VAT software.

Helpful Features

- End-to-end online accounting

- Connects seamlessly to the UK Government’s portal for VAT Return filing

VAT Specific Features

- One solution across multiple VAT schemes

- International trade recorded by VAT duty

- Generates business reports to show VAT liability

- Easily lets your accountant work within the software at no extra cost

Pricing

Zoho offers five pricing plans:

- Free: £0 per month, 1 user

- Standard: £12 per month, 3 users

- Professional: £24 per month, 5 users

- Premium: £30 per month, 10 users

- Elite: £99 per month, 10 users

- Ultimate: £199 per month, 15 users

All plans include VAT records, VAT MOSS reports, and filing VAT returns.

If you want to learn more and compare Zoho Books with FreshBooks, follow our guide on it.

8. QuickFile

Another popular choice for VAT-registered self-employed business owners, QuickFile offers a free package and a sliding scale to support your business as it grows. All packages include MTD for VAT returns, making it easy to enjoy affordable tax filing.

Helpful Features

- Bridging connection

- Record-keeping software

VAT Specific Features

- Record everything you need to meet your digital VAT requirements

- Submit VAT returns digitally

- See your entire VAT history and check what VAT you owe in real-time

Pricing

QuickFile prices are on a sliding scale, based on “the number of nominal transactions created over the previous 12-month period.” The first software package is free for extra-small, small, and medium-sized businesses. That means companies with up to 1000 nominal transactions. For businesses over that number, it’s £60+VAT per year. Even the free packages include MTD for VAT returns, full multi-currency support, and banking automation. This is great for QuickFile customers who are self-employed VAT-registered businesses.

9. Adminsoft Accounts

Adminsoft Accounts is helpful for those who already have accounting software and are looking for a way to use that with HMRC’s VAT return system. Adminsoft bridges between your software and HMRC so you can review previous tax returns and submit your current VAT returns.

Helpful Features

- Record-keeping desktop software recognized by HMRC

VAT Specific Features

- Bridge between your current spreadsheets and HMRC’s VAT return submission portal

- See your previously submitted tax returns and bills paid

- Submit your tax return directly

Pricing

Adminsoft Accounts is downloadable for free. Buying a Software Registration Key is possible to eliminate the advertising. This starts at £179 for one user.

10. MTDSorted

A free option for those seeking a simple VAT bridging software, MTDSorted offers a no-cost bridging platform that connects your current accounting software to the HMRC’s VAT submission portal. You can also access more comprehensive accounting software for a subscription fee.

Helpful Features

- Digital bridging software

- Record-keeping system for MTD

VAT Specific Features

- Spreadsheet importer to transfer your VAT details

- Either use MTDSorted to bridge across to HMRC’s portal from your existing software or send your VAT return directly to HMRC

Pricing

Businesses can access MTDSorted’s Lite plan on their platform for free. This includes accountant access to all the mandatory bookkeeping and filing elements you need to be MTD for VAT compliance. They also have a Plus Plan, costing £15 per month, which gets you access to their full accounting experience. You can try this for 30 days for free. A £25/month Pro Plan and £75/month Enterprise Plan are also available for more extensive usage.

Benefits of Using MTD VAT Software

Using MTD VAT software for your business has many benefits over other methods. These benefits include:

- Simplified bookkeeping – Thanks to automation features, changes will automatically be reflected across all relevant reports. This leaves less margin for error.

- Easy sharing – MTD software’s online, digital nature means your data can be easily shared with your accountant or bookkeeper.

- Automatic reports – MDT software automatically generates financial reports for your business, providing detailed insights without the usual time commitment.

- Reduced accounting costs – Because the MDT software automatically completes so many routine tasks, you’ll spend less on accounting and bookkeeping services.

- Always accessible – Your accounting information is available to you no matter where you are in the world, provided you have an internet connection. Most accounting software also offers a mobile app, simplifying things even further.

Factors to Consider When Selecting the Best MTD Software

With so many options out there, it’s important that you consider these crucial factors when determining the best software for making tax digital for VAT.

Compliance with MTD Regulations

First and foremost, your chosen software must be fully compliant with MTD regulations. HMRC requires you to use functional, compatible software that allows you to record and store digital records of tax affairs, provide HMRC with information, submit income tax updates from the data held in those records, and receive information from HMRC.

Integration with Accounting Software

If you’re already using accounting software you like, you should see if they have an option for MTD compliance. Otherwise, you should see if the MDT software options you’re considering will integrate into your current accounting software and system.

User-Friendliness and Ease of Use

Your MDT software should be simple yet capable, with an intuitive user interface and simple functions for the tools you need. Remember that you may not be the only person using this software later on, so try to choose something easy to learn.

Reporting Capabilities

The best MTD software will automatically generate essential reports, providing detailed insights into your bank accounts and the overall financial health of your business. The more types of reports your software can create, the better off you’ll be.

Data Security

Last but certainly not least, it’s vital that you choose software with an extremely high standard of data security. Your financial details must be stored securely, which is more of a concern when using a cloud-based accounting option. Look for SSL encryption, encryption of other important info like cardholder data, and firewalls.

Worried about MTD compliance? It’s easy with FreshBooks. Our MTD-compliant software lets you record all your VAT information, check it whenever needed, and review your previous VAT payment history to ensure everything is sorted. It’s also compatible with the HMRC’s portal so you can submit directly from your accounting software. VAT filing doesn’t get easier than that.

Conclusion

Choosing the best Making Tax Digital software for small businesses will depend on your business size, needs, and accounting setup. As you can see, many companies provide software that can simplify the filing of VAT returns while remaining compliant with MTD. FreshBooks does it in the easiest way possible.

Tax compliance is fully integrated into the rest of your business’s financial health so that you can make business development decisions based on a holistic picture with every relevant detail.

That’s why people love FreshBooks MTD VAT Software. You’ll find the information to support any business developments within a few clicks. We get you back to your customers – even at tax time!

FAQs on Making Tax Digital Software

Is MTD mandatory?

MTD compliance is now mandatory for all VAT-registered businesses. You can only apply for an exemption to MTD for particular reasons like your location inhibiting your access to the internet.

What do I need to do for Making Tax Digital for VAT?

To comply with MTD for VAT, businesses should start by signing up and choosing tax software. You’ll also need digital records starting from April 1st, 2022. Then, file your VAT returns on schedule using the MTD online portal. The right accounting software can help you quickly meet all of these obligations.

Will HMRC provide free software for Making Tax Digital?

Despite initial discussions about providing free MTD software, HMRC decided against it. As an alternative, they created application programming interfaces (APIs) software. These enable multiple separate programs to share digital data. We and other companies use them to ensure the VAT records in your FreshBooks account are compliant and your VAT returns can easily be transmitted to HMRC.

What is the deadline for Making Tax Digital?

The deadline for submitting your VAT return and paying your VAT bill through MTD is 1 calendar month and 7 days after the end of your accounting period.

Who is exempt from Making Tax Digital?

Companies are currently exempt from MTD if they’re going through an Insolvency Procedure. You can also apply for an exemption if it is ‘not reasonable or practical to use computers,’ for example, due to disability or internet access. HMRC considers exemption applications on a case-by-case basis and will consider reasons like religion, disability, location, and age.

How do I submit a digital VAT return?

If you don’t already use FreshBooks, you need to sort out compatible MTD software before you do anything else. Then, you can sign up for ‘MTD for VAT through your Government Gateway account. You need to get all your information together before you start, including your VAT registration number and most recent VAT return.

Reviewed by

Levon Kokhlikyan is a Finance Manager and accountant with 18 years of experience in managerial accounting and consolidations. He has a proven track record of success in cost accounting, analyzing financial data, and implementing effective processes. He holds an ACCA accreditation and a bachelor’s degree in social science from Yerevan State University.

RELATED ARTICLES

Does Making Tax Digital Apply to Sole Traders?

Does Making Tax Digital Apply to Sole Traders? When Does Making Tax Digital Start?

When Does Making Tax Digital Start? Making Tax Digital for Landlords: Everything You Need to Know

Making Tax Digital for Landlords: Everything You Need to Know Everything You Need to Know About Making Tax Digital Software

Everything You Need to Know About Making Tax Digital Software