Free Invoice Generator

How to Create an Invoice With the Free Invoice Maker

The free invoice creator is a simple, user-friendly tool—and it does all the math for you.

1

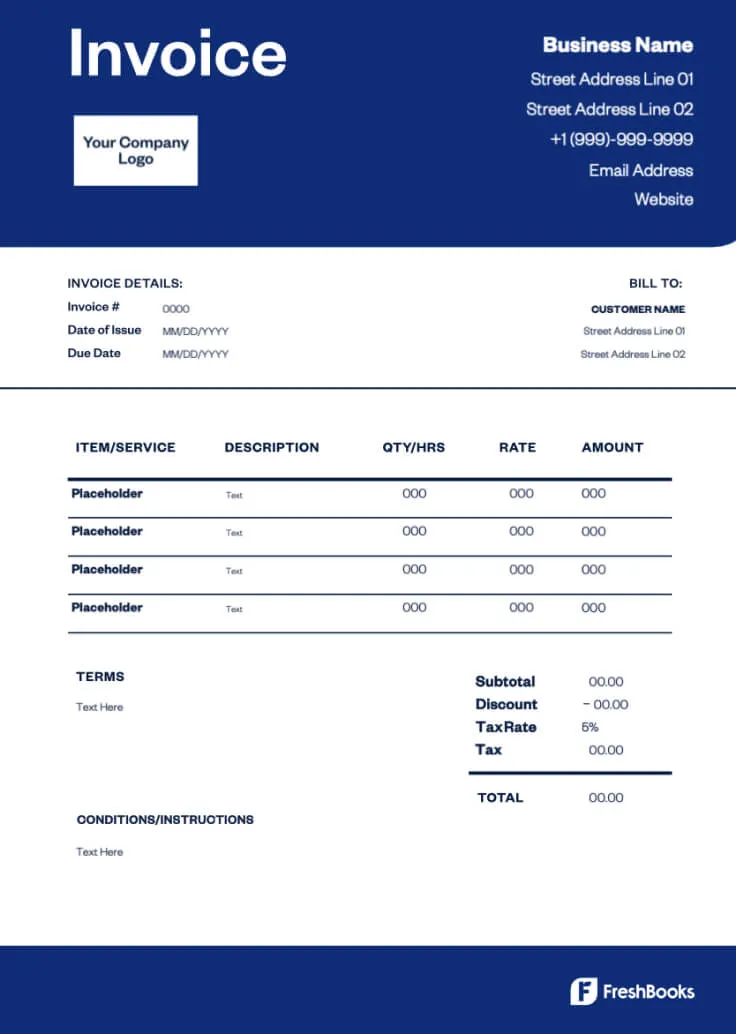

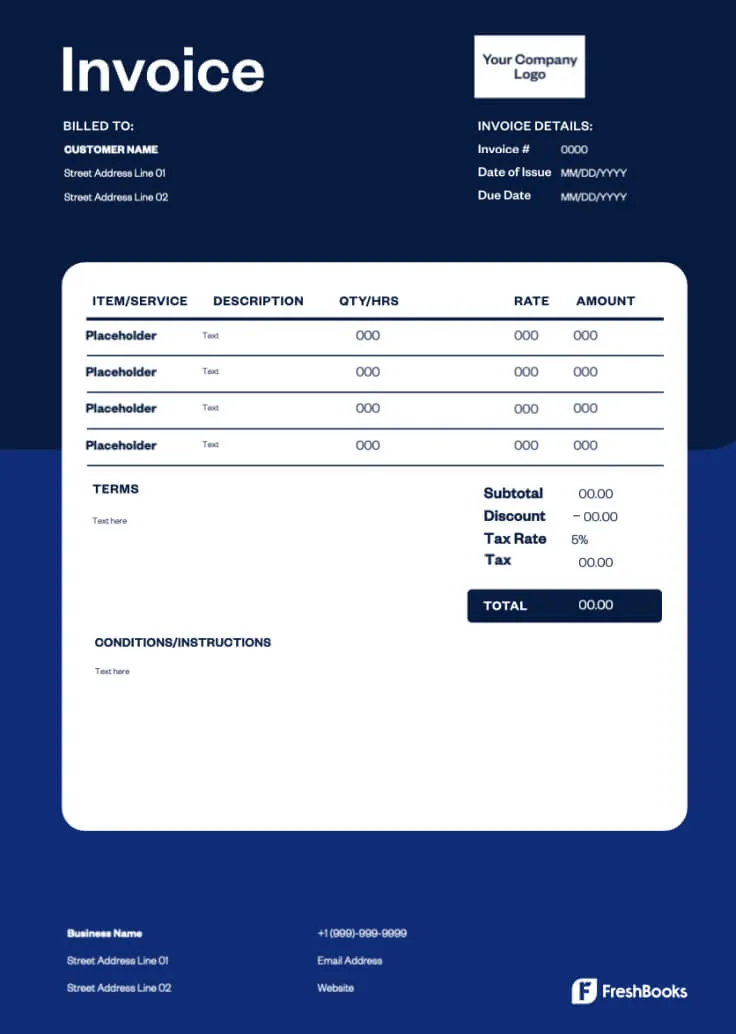

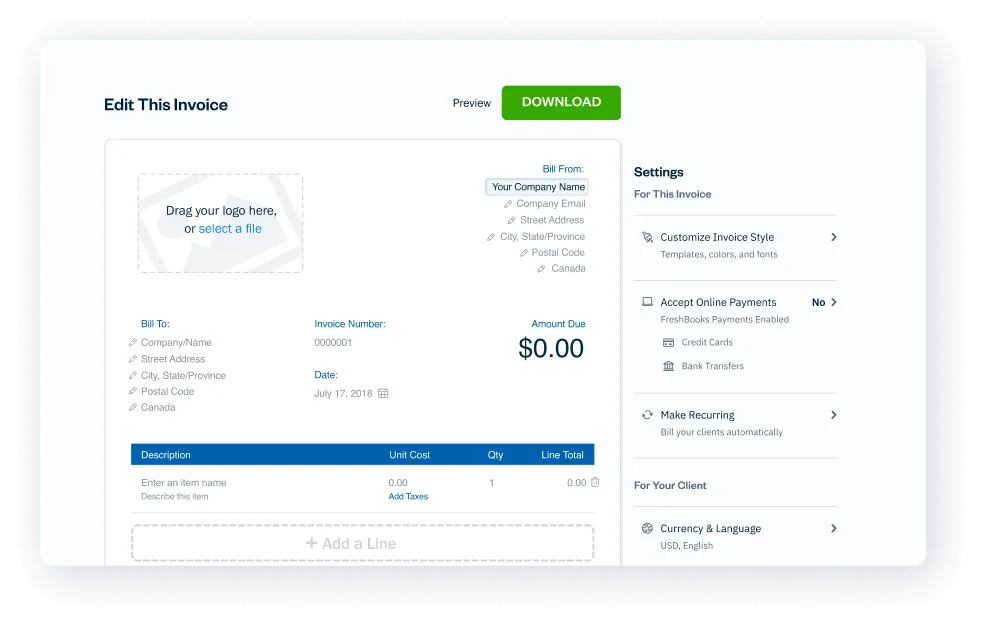

INVOICE HEADING

Stick with the standard template or opt for a more modern style. Change the colour of your blank invoice template, and add your business logo if you wish.

2

COMPANY NAME AND CONTACT INFORMATION

Include your company’s name, address, and phone number.

3

CLIENT NAME AND DETAILS

Add the client’s name, address, and phone number.

4

INVOICE NUMBER

Enter your own invoice number, or allow the invoice generator to choose it for you.

5

INVOICE DATE

Enter the date of the invoice.

6

DESCRIPTION OF SERVICES RENDERED

Fill out a single line item detailing each product or service sold and the quantity.

7

COST OF SERVICES AND TAX

Enter the rate or cost of the services or products provided along with GST/HST.

8

PAYMENT TERMS, CONDITIONS, AND INSTRUCTIONS

Include information in these optional fields, like notes you want to add to the invoice or the invoice terms and conditions.

9

PREVIEW YOUR INVOICE

Click the black “Preview Invoice” button near the top, and carefully review your work for accuracy. To exit preview mode, simply click outside of the invoice.

10

DOWNLOAD AND SAVE YOUR INVOICE

Once you’re satisfied with your work, click “Download Invoice.”

Confirm your email address, and click “Get My Invoice.” The download link for your invoice is automatically sent to your email address. The invoice will also open as a PDF on your computer screen.

1

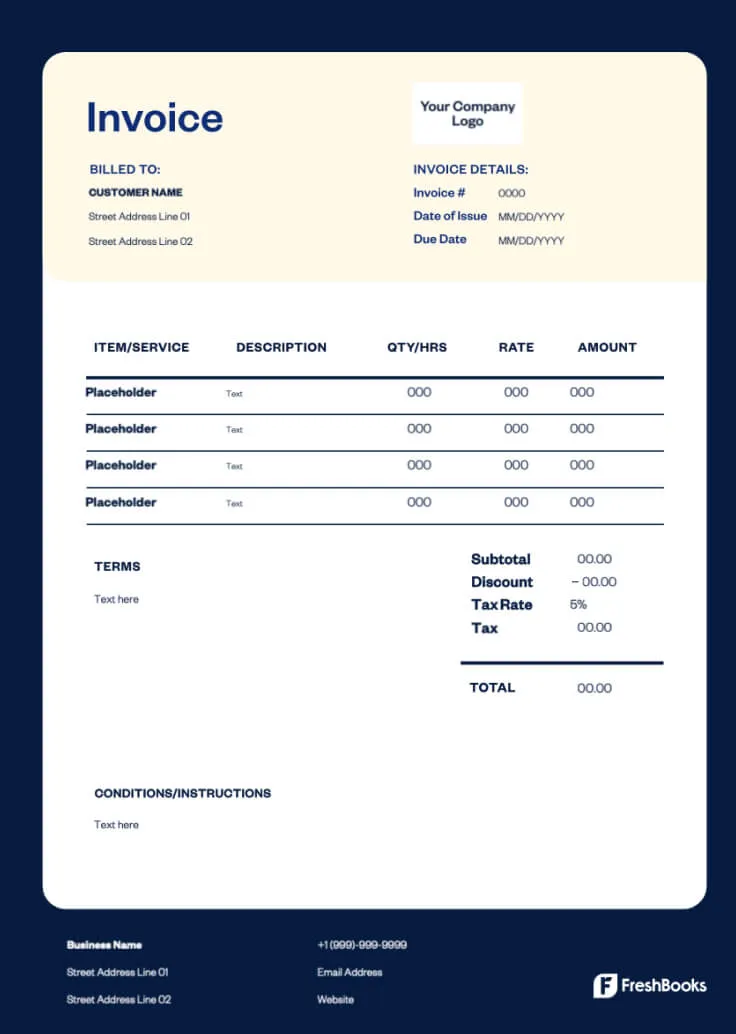

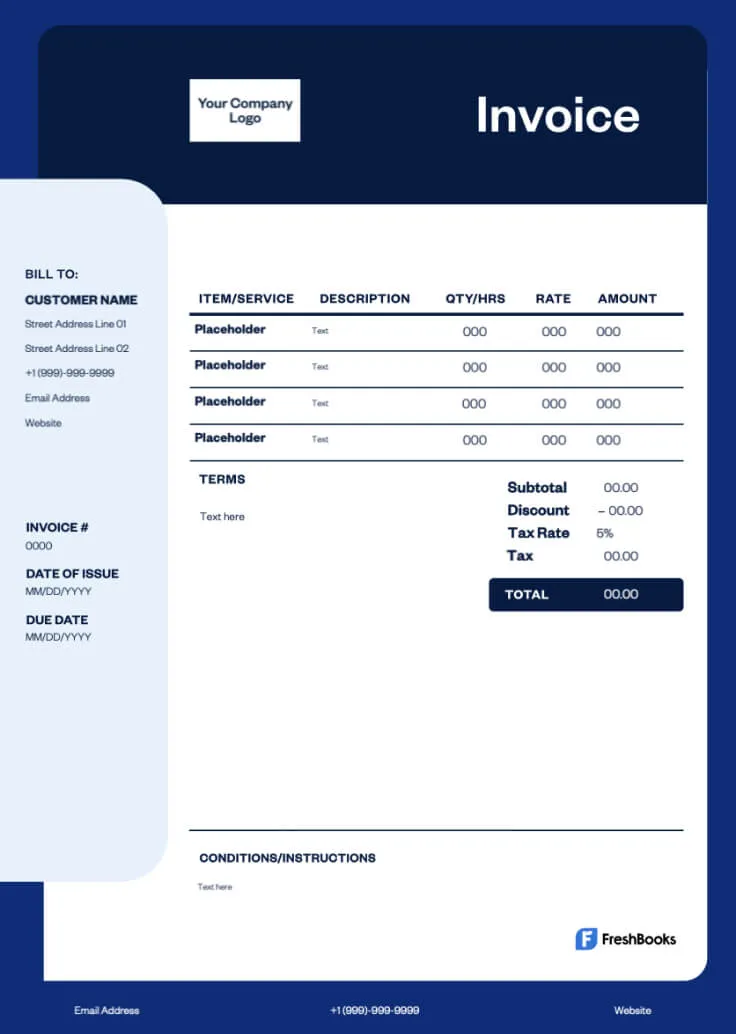

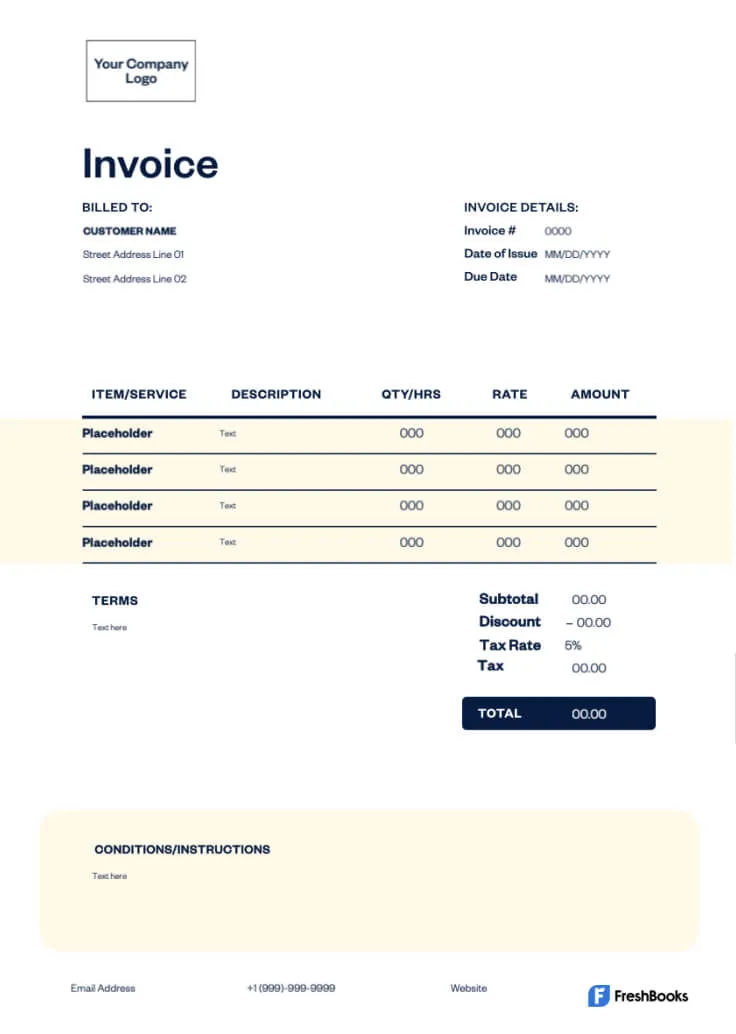

INVOICE HEADING

Stick with the standard template or opt for a more modern style. Change the colour of your blank invoice template, and add your business logo if you wish.

2

COMPANY NAME AND CONTACT INFORMATION

Include your company’s name, address, and phone number.

3

CLIENT NAME AND DETAILS

Add the client’s name, address, and phone number.

4

INVOICE NUMBER

Enter your own invoice number, or allow the invoice generator to choose it for you.

5

INVOICE DATE

Enter the date of the invoice.

6

DESCRIPTION OF SERVICES RENDERED

Fill out a single line item detailing each product or service sold and the quantity.

7

COST OF SERVICES AND TAX

Enter the rate or cost of the services or products provided along with GST/HST.

8

PAYMENT TERMS, CONDITIONS, AND INSTRUCTIONS

Include information in these optional fields, like notes you want to add to the invoice or the invoice terms and conditions.

9

PREVIEW YOUR INVOICE

Click the black “Preview Invoice” button near the top, and carefully review your work for accuracy. To exit preview mode, simply click outside of the invoice.

10

DOWNLOAD AND SAVE YOUR INVOICE

Once you’re satisfied with your work, click “Download Invoice.”

Confirm your email address, and click “Get My Invoice.” The download link for your invoice is automatically sent to your email address. The invoice will also open as a PDF on your computer screen.

Benefits of Using an Online Invoice Generator

Look Like a Pro

Create professional-looking invoices right out of the gate with customization options that reflect your company’s colours and incorporate your logo. Since online invoices are templated, you’ll never leave out important information—it’s tough to make mistakes with an invoice maker.

Save Time

An online invoice maker does the heavy lifting for you—just enter the information already at your fingertips, and the generator creates the invoice number and performs the calculations. You can even have invoices generated and sent automatically.

Save Money

Time is money, and online invoicing is a great way to streamline your accounting processes and reduce the time you spend creating and managing invoices. The accuracy and efficiency of online invoicing keeps your bookkeeping up-to-date and makes it easy to track payments.

CRA Compliant

Invoice generators that are CRA-compliant help you submit invoices that are error-free. You can rest easy knowing that all invoices created using the generator are CRA-compliant.

Reduce Errors

As you will be submitting this to CRA, you want to ensure that there are no errors. Keep your invoices accurate and your books balanced with online invoicing. Invoice generators do the math for you, allowing you to reduce potential mistakes and keep your invoices looking clean and professional.

Go Paperless

An online invoice generator makes quick work of sending your invoices electronically—no paper necessary. The CRA requires that documentation is kept for 6 years, and keeping track of your invoices digitally with an invoice generator helps you stay compliant. Create, send, edit, and manage your invoices all in one place, and save money on paper, ink, envelopes, and postage while reducing your impact on the environment.

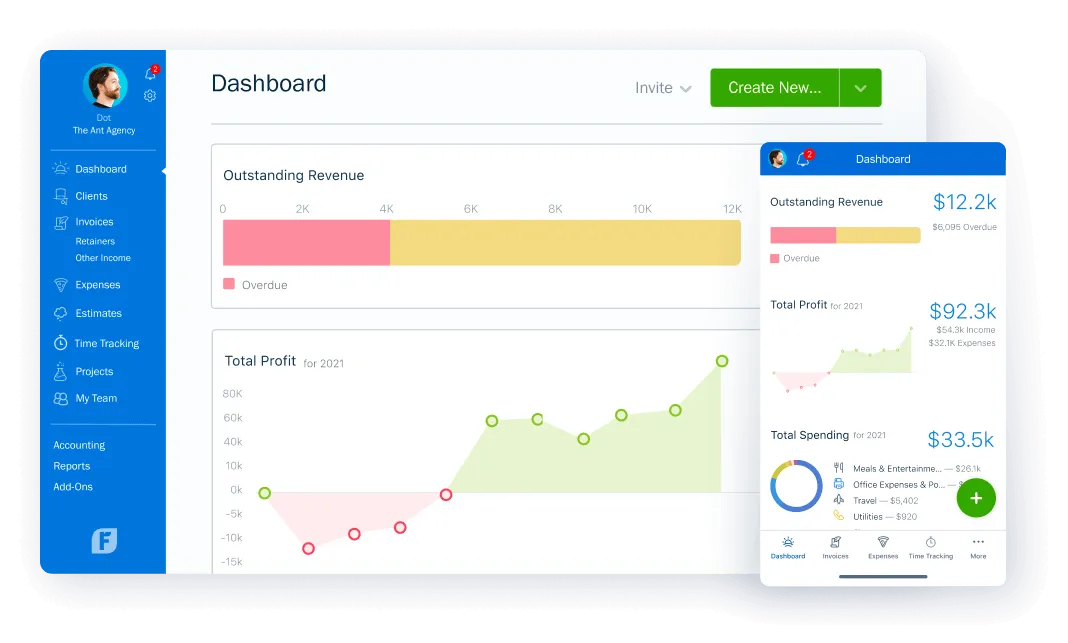

Create Your Free Invoice Now or Try FreshBooks Invoice Software for Free

Free Invoice Generator vs. FreshBooks

Running a business is more than just invoicing. Payments, recurring invoices, and managing the full scope of each project all impact the future success of your business. With FreshBooks, you can ensure clients can pay invoices as quickly and easily as possible while managing client communication and setting your bookkeeping up for tax time success. Check out the comparison chart below to see if your business needs the full force of the FreshBooks platform.

Free Invoice Generator

VS

FreshBooks

Features

Free Invoice Generator

Customizable invoice templates

Printable for clients who love snail mail

Email invoices to clients for free

Accept safe and secure online payments and credit card payments on invoices

Add a payment schedule, automate late payment reminders and fees

Keep track at a glance of who’s paid and who has not

Easily set up deposits for projects

Easily add a discount to your invoice

Automate your invoices for recurring work and subscriptions

Create and send invoices from your mobile device

Submit GST/HST returns & review past submissions

Get a GST return report

Sign up for a free FreshBooks trial today

No credit card required.

Cancel anytime.

View Our Invoice Template Gallery

Choose from a range of invoice formats and custom templates, and tailor them to suit your business.

Helpful Invoicing Resources

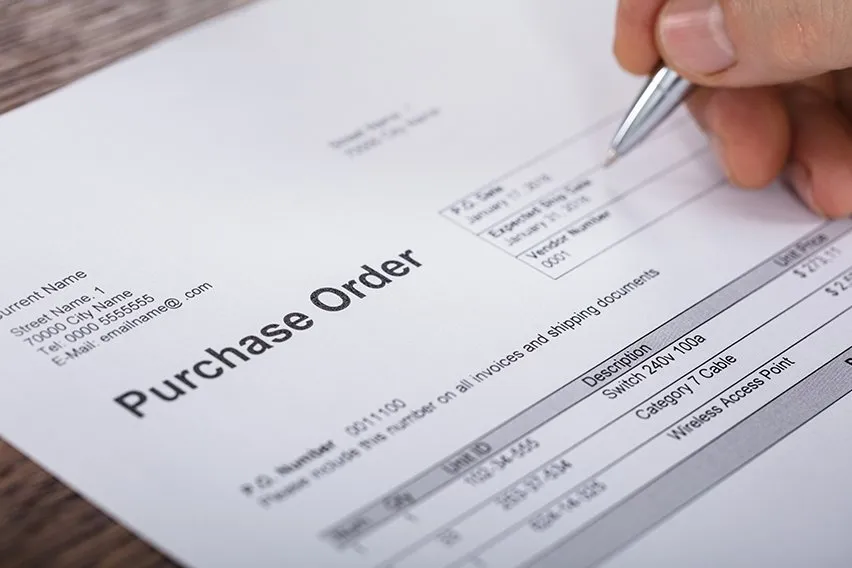

Check out these helpful pages and articles to learn more about GST/HST returns, how to get your GST refund, plus everything you need to know about purchase invoices.

What Is a GST/HST Return?

What Is GST Refund & How to Get It

Purchase Invoice: Everything You Need to Know

Other Free Business Tools

ROI Calculator

Calculate your FreshBooks

ROI (return on investment).

Markup Calculator

Calculate your product markup

and margin

Business Loan Calculator

Calculate how much it will cost to take out a loan

Business Name Generator

Use this tool to help create a name for your new business

Frequently Asked Questions

An invoice generator is an online tool that helps you create clean, professional invoices for your business that can be sent electronically or downloaded as a PDF. Invoice generators make it easy for business owners and accountants to calculate GST/HST and send and file invoices paperlessly using standard invoice templates or custom invoices that suit your business’s specific needs.

Using a generator tool for invoicing is fast and simple, saving you time—especially if you opt to have your invoices automatically generated and sent. Auto-invoicing streamlines accounts receivables, increases efficiency, and saves paper and postage.

An invoice should contain the seller’s business name and address, the buyer’s name and address, a detailed list of all items or services purchased, an invoice number, an invoicing date, a due date, payment processing terms, sales tax, and the total amount due upon receipt.

GST and HST vary by region. Zero-rated supply has a 0% GST/HST throughout Canada. Currently, taxable supplies have a 5% GST rate if the supply is made in a non-participating province, 13% HST rate if the supply is made in Ontario, and a 15% HST rate if the supply is made in any other participating province.

Yes—with an invoice generator, you can create and send mobile invoices from wherever you are and whatever device you’re on. FreshBooks allows you to generate and send an invoice from your mobile phone in minutes using the FreshBooks app, available on iOS 9.0 or higher or Android 4:2 or higher.

There are many benefits to using an invoice generator. It saves time by automating the invoice creation process and it improves accuracy since it does the math for you. Invoice generators allow you to automate invoice tracking, and they let you create invoices that look sleek and professional.

To use an invoice generator, you’ll need several key pieces of information: Your name and contact information, the recipient’s name and contact information, the invoice number and date of issue, the products or services provided and their cost breakdowns, the payment terms, and remittance information.

Yes. Many invoice generators allow you to tailor the colours of your invoices, add your company logo, choose your own font, or add background images. Invoice generators make it easy to design professional, branded invoices.

Yes—many. One of the best things about some invoice generators is that you can integrate them with many different types of accounting software—including FreshBooks. This makes invoice generators a great way to streamline your invoicing and payment processes.

No. An invoice is different from an estimate or a quote. However, FreshBooks can be used to create estimates and quotes on a blank invoice. This can be useful in situations where your client wants to see how much a project or product will cost before committing to it. Try FreshBooks for Free.

Yes. You can use most commercial invoice generators on your mobile device. As long as the generator is responsive (which just means they adjust their layout depending on the type of device you’re using). Some invoice generators have an app you can download to your mobile device for invoicing on the go, making these great for freelancers and those who work out of the office.

Yes. Many invoice generators, including the FreshBooks Invoice Generator, allow you to adjust the currency based on where your client is located. This feature is ideal for people who trade goods in multiple countries or have customers who live all over the world. Some invoice generators will even automatically convert your currency into the selected different currency based on the exchange rate at that time.

How much tax you charge on your invoices depends on the province you live in. Canadian provinces are subject to various tax rates. Online GST/HST calculators can help you accurately calculate the amount of tax to charge. Simply enter the tax rate of your province and let the calculator do the rest.

Different provinces have different regulations and tax exemptions, and certain items—like some children’s clothes or basic groceries—aren’t subject to sales tax at all. To better understand the exemptions and special cases in your region, contact an accountant that specializes in tax law in your area.

There are a few requirements to keep in mind to ensure your invoices are accurate, including:

- The date

- An invoice number unique to that transaction

- The supplier’s business name and trading number

- The buyer’s business name and trading number

- The amount due for products or services provided

Canada has many tax credits and deductions that you might be eligible for. To find out which tax credits or deductions apply to your business, contact an accountant who can assess your situation and possibly help you save money at tax time.

If you aren’t charging appropriately on your invoices, you could experience out-of-pocket expenses or an audit by the CRA. Gain peace of mind and correctly calculate the tax-related information on your invoices every time with invoicing and accounting software like FreshBooks. Try it free today.