Wondering How to Record Overpayment in Accounting Software? Credits on FreshBooks Makes It Easy

In a perfect world, every project would go off without a hitch. You deliver great work, and your customer pays the invoice straight to your bank account. But in reality, working with different clients on different projects makes every invoice a little different too.

Sometimes a client wants to pay for your work before you’ve even created an invoice. Other times you may want to reward a loyal customer with a discount on their next invoice. And sometimes, you need to refund a client after an invoice has been paid (for a customer overpayment).

To help with all of this, FreshBooks just launched the new Credits feature. It’s a powerful addition that allows you to track overpayments, refunds, and discounts, and easily apply them to invoices, so you know exactly how much a client owes.

What Are Credits?

Credits allow you to track prepayments and overpayments from clients, that you can easily apply to future invoices. This allows you to keep track of discounts, refunds, and service credits.

Why Should I Use Credits?

Credits are a great way to ensure you’re tracking every transaction between you and your clients – even when you don’t have an invoice created.

It also allows you to build better relationships by offering discounts, service credits, and even refunds for your work – so you can be more flexible with your payments.

It also allows you to carry forward a credit balance for any subsequent invoice payment – making a potential invoice payment on a future invoice super easy for you and your client.

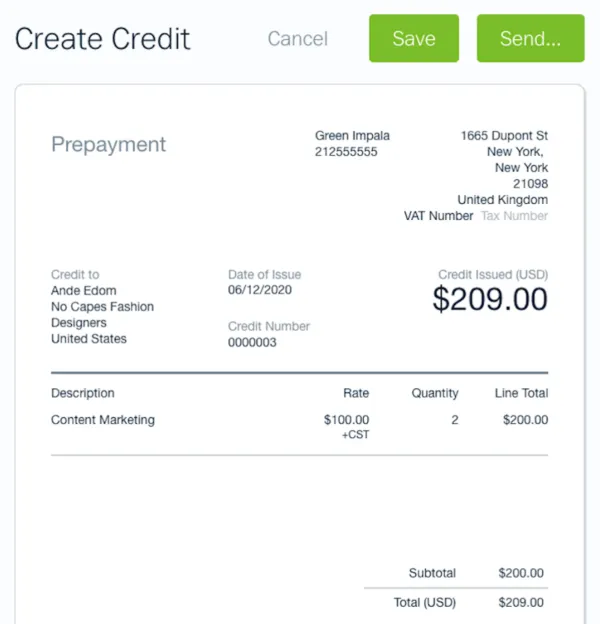

How Do I Create A Credit?

Creating a Credit is simple:

- Log into your FreshBooks account

- Once on your Dashboard, click Create New in the top right corner

- Select Credit

- Choose a Credit Type

- Click on Add a Client to choose a Client

- Click on Date of Issue to change the date if needed

- Click on Add a Line to add Items or Services you’re giving a credit for

- Click Save to create the Credit, or click Send to email it directly to your Client

That’s it. Plus, once you’ve created a Credit, you can then View, Edit or Delete it. Click here to learn more.

How Do I Apply a Credit to an Invoice?

After creating a Credit, you can quickly apply it to an Invoice:

- Click Invoices in your left navigation

- Click on the Invoice you want to apply the Credit to

- Click on the More Actions button

- Select Add a Payment

- If there is Credit available, it will automatically be selected for you

- Add Payment Notes if needed and click Add Payment to finish

Note: If a client has a Credit tied to their account, you’ll have the option of automatically applying it when creating your next new invoice for them.

Plus, when you run a Bank Reconciliation, you can match any existing Credits with your bank transactions (so that your bank account and FreshBooks account are in line).

What Types of Credits Are There?

There are 3 types of Credits that you can create on FreshBooks:

- Prepayments: For when a client has prepaid for a service, before an invoice has been created (think of it as an advance payment)

- Overpayments: For when a customer overpays an invoice, and you want to carry the amount forward (for use on a future invoice)

- Credit Note: For when you want to apply an offer, service credit or refund for a client

Wait: How Are Prepayment Credits Different Than Deposits?

Prepayment Credits can be used when a client voluntarily pays for your product or service ahead of time. Deposits can be used when you ask for payment upfront on a specific project.

What Else Can Credits Do?

Credits are also directly linked to each of your client’s Account Statements. This makes it easier for you to keep track of all Credits and credit balance tied to specific clients, so you’ll know exactly where they stand financially. This makes it easy to ensure your accounts receivable is accurate for each customer account.

Alternatively, you can run a Credit Balance Report to see any balances, credits issued, and applied amounts tied to a particular client. Here’s what it looks like:

If You Need Help, FreshBooks Is Here

Your business’ success is always top of mind for us. So if you have any questions on how to use Credits, or anything else, our support team is here to help.

Ready to use Credits? Click here to learn more or log into your account and check it out for yourself!

This post was last updated in December 2022.