Profit and loss statement template – free download

What is a profit and loss statement?

A profit and loss statement (sometimes called a P&L statement or income statement) is a financial report that summarizes your business’s revenues, expenses, and net profit (or loss) over a given period of time. It’s a useful report for tracking your profitability and assessing your overall financial performance, helping you to make better-informed business decisions.

Often, profit and loss statements from different periods are compared to see the ways the metrics change over time, helping you get a better idea of your business performance. Your profit and loss statement is usually accompanied by your balance sheet and cash flow statement, which are used together to get a more in-depth perspective on your business’s financial health.

How do I create a P&L statement?

Creating profit and loss statements is easy with the free template from FreshBooks! It can be broken down into 6 simple steps:

Choose a format

First, choose the P&L statement format that is most useful for you and your business’s needs.

Download the template

Next, download your free profit and loss statement template of choice in seconds from the FreshBooks website.

Enter revenue

You’ll be prompted to enter revenue information in the relevant field—keep your financial records on hand for this part.

Enter expenses

After entering revenue, you’ll input all relevant business operating expenses into the P&L report template.

Calculate net income

Simply subtract your business expenses from your business revenue to calculate your total net income.

Determine profitability

Finally, look at your bottom line. If your net income is positive, you’re profitable. If it’s negative, you’re currently unprofitable.

Download profit and loss template

Business owners depend on the outstanding templates from FreshBooks because they’re easy to use and simple to customize to their needs. Download the P&L report template in seconds, free of charge, in either spreadsheet or PDF format, and start using it to grow your business right away.

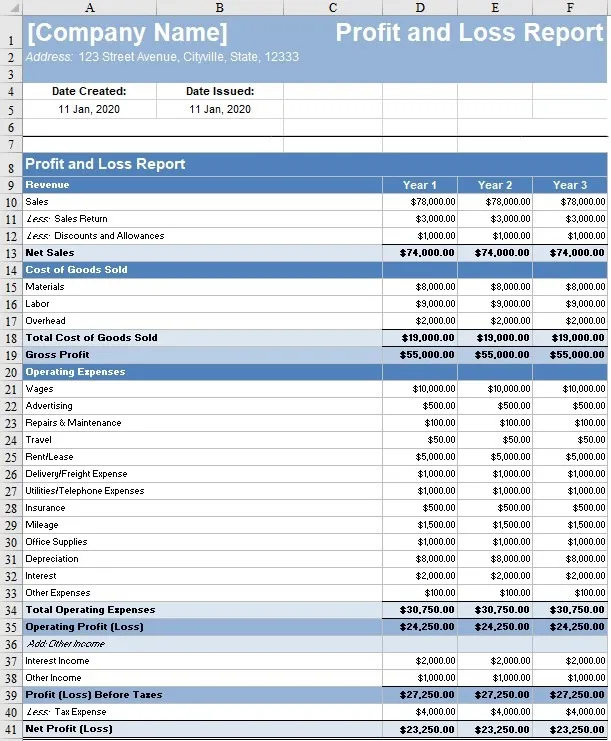

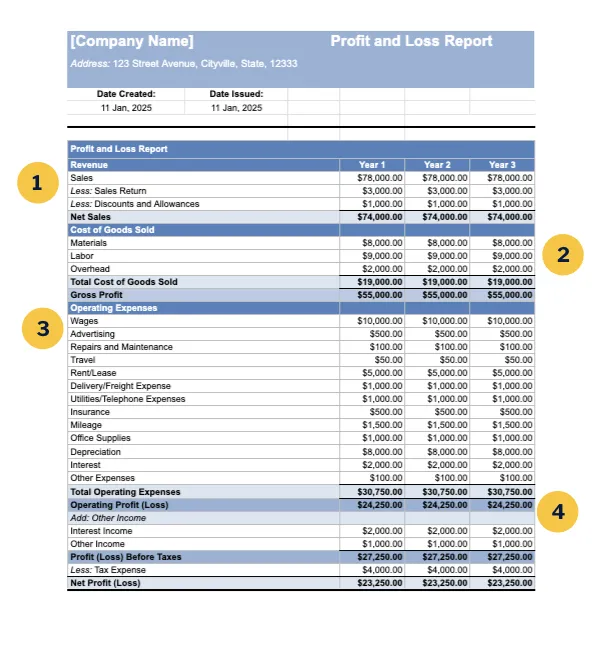

Profit and loss statement format

What should go on your profit and loss statement? There are a few important components that all templates will include, including:

1. Revenue

Revenue (also called sales or income) refers to the money your business receives in exchange for goods or services you provide during a given time period.

2. Cost of goods sold

This section details your cost of goods sold, also called COGS. It includes expenses incurred for materials, labor, and overhead which directly contribute to the production of the goods your company sells.

3. Operating expenses

In this field, you enter any costs associated with running your business, such as cost of goods sold (COGS), property rental expenses, and other operating expenses.

4. Operating profit (loss)

Your profit/loss is your revenues minus your expenses. It will either be a positive number (indicating profitability for that period) or a negative number (indicating non-profitability).

Additional accounting templates

A profit and loss statement is only part of the equation for a successful business accounting system. We offer many other useful accounting templates for free, including:

Expense report template

This is a report containing categorized information on expenses incurred by the business, plus amounts, descriptions, and reimbursement details.

Simple balance sheet templates

This report details the company’s assets, liabilities, and shareholder equity to provide a snapshot of company finances.

General ledger templates

A foundational document for managing ongoing double-entry accounting systems, assigning transaction journal entries to various sub-ledger accounts.

Income statement templates

Income statements (another term for P&L statements) track expenses, revenues, gains, and losses over a given period.

Billing statement templates

A document that tracks all transactions between the company and a particular client, including payments, fees, and interest.

Bank reconciliation templates

A summary of banking and business activities that compares your bank balance(s) with your internal financial records.

As one of the foundational parts of an accounting system, a profit and loss statement is a great place for business owners to start improving their financial health. Download our free P&L statement template!

Profit and loss statement template vs. FreshBooks accounting software

What’s the difference between downloading our free profit and loss statement template and using FreshBooks accounting software? Accounting software is invaluable for streamlining your transactions and also helps you stay informed with easily generated reports on demand for any date range.

Here are some of the other advantages of using our all-in-one, cloud-based accounting solution:

Features

Free Profit & Loss Templates

FreshBooks Accounting Software

Mobile Access

Pre-designed Templates

Downloadable Templates

Automated Data Entry

No, manual entry

Automated Calculations

Manual formula creation

Reduced Error Risk

Cloud Data Storage

Limited

Automatic Report Generation

Scalability

Difficult

Automatic Recurring Reports

Sign up for a free FreshBooks trial today

Try It Free for 30 Days. No credit card required.

Cancel anytime.

Helpful resources for your business

Ready to take your business to the next level? A quality profit and loss statement template is a great place to start. But there are even more resources that can help you make more data-driven decisions in your business, empowering you to organize your finances and move with confidence:

How to Make a Profit & Loss Report?

Monthly Financial Reports: What Are They And How to Read

How to Prepare Financial Statements for Small Businesses

Frequently Asked Questions

Yes, income statements are the same as profit and loss statements. Both reports display revenues, expenses, and overall profitability (or non-profitability) for the business during a specific period of time. The only difference is in the name.

Your profit and loss statement must include all business revenues, relevant expenses, and the final statement of profit or loss (revenues minus expenses), which will be expressed as either a positive or negative number, depending on whether or not the business is profitable.

To create a profit and loss statement, first track your revenue for the time period, then subtract your expenses (cost of goods sold, overhead, etc.) from that number. This will result in either a positive or negative number, which is your profit or loss for that period.

The basic formula for your profit and loss statement is Revenue – Expenses = Net Profit (or Loss). You calculate profit/loss by subtracting all costs from revenue for a given time period.

It’s common to generate a profit and loss statement monthly, quarterly, and for each tax season. This helps you track your company’s overall financial performance more accurately throughout the year.

To calculate net revenue, you would first take your gross revenue and then subtract all expenses, including COGS, overhead expenses, and any other costs. This results in your net revenue, otherwise known as your net profit or loss.

FreshBooks accounting software automatically generates efficient, easy-to-interpret P&L statements. It does this regularly, ensuring you always have the most up-to-date snapshot of your company’s financial health.