Accounting Software Built for Non-profits

Built for non-profit organizations, FreshBooks is easy to use accounting software. Your non-profit works hard to help others, and FreshBooks will work hard for you. With the best non-profit accounting software at your side, your accounting tasks will be effortless.

Non-profit Accounting Software That Will Make Billing Easy

Put time back into your day with FreshBooks. Get rid of those spreadsheets and separate time tracking systems. FreshBooks is one complete software package. Run reports, track expenses, and even track and log time for your employees.

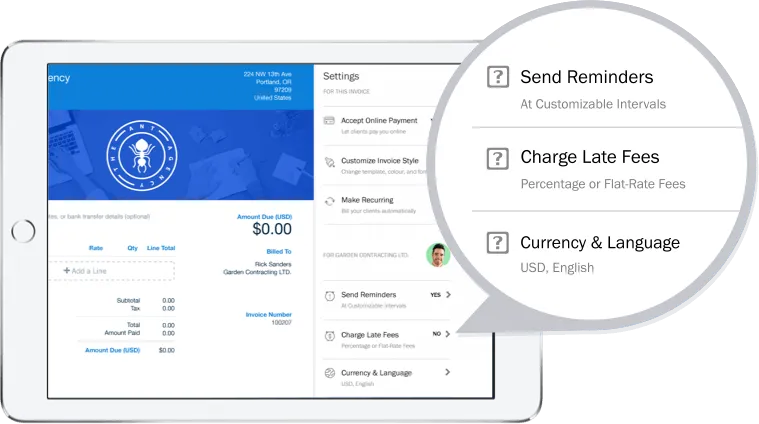

Even if you’ve never used an accounting software before, with FreshBooks you’ll be an accounting professional in no time. Create invoices and estimates in seconds, and offer online payment options that are simple and secure for your customers. Never worry about late payments again with automated late payment reminders.

It’s all here for you in one smart accounting software package.

The Fastest Way for Non-Profit Organizations To Invoice

Create customized invoices for your clients complete with your organization’s logo. When you need to send out thank you emails to your clients for their donations, create a personalized thank you email in seconds. With the best non-profit accounting software at your disposal, you can add time and expenses to your invoices with ease so that your clients aren’t bothered with multiple invoices.

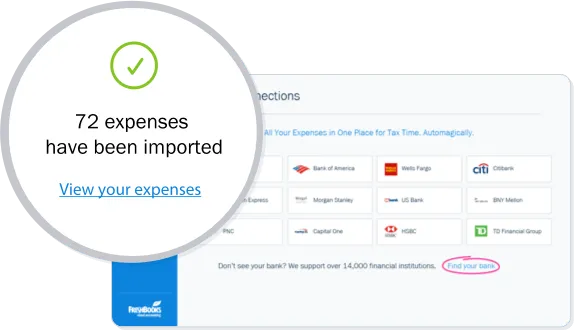

Easily Organize your Business Expenses

FreshBooks accounting software will store and organize your expenses securely in the cloud. You can even import expenses from most financial institutions as well. It’s simple. Enter your expenses into the software and FreshBooks will turn the information into meaningful reports so that you can see how the charitable organization is doing financially.

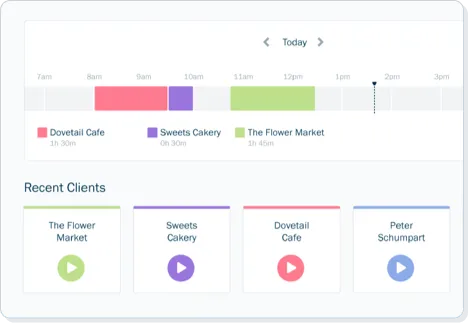

Track Every Second of Your Precious Time

FreshBooks is more than just an accounting program for charitable organizations and nonprofit institutions. With FreshBooks, you can manage your team members’ hours with ease. Simply have your employees click on the timer and you’ll have an accurate log of hours spent on the project. You can also track productivity as well to make sure that everyone is on the same page.

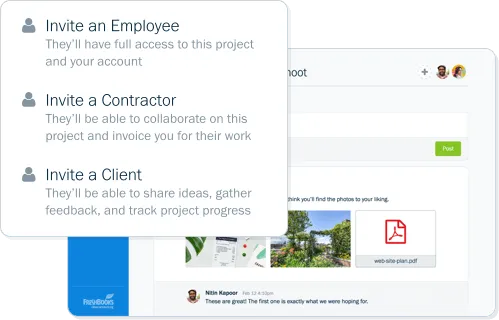

Effortlessly Manage and Collaborate with Your Volunteers and Team

Project management becomes an easy task with FreshBooks. Create a project in FreshBooks to keep your team on the same page. With projects, you can assign tasks to individual employees and manage their time and productivity. Your clients can also see progress summaries as well so that they’re always updated on when the project will be completed. Share information, files, and updates with ease so that every team member is always working with the latest information. Collaboration becomes a breeze with FreshBooks non-profit accounting financial accounting software.

Featured In

Accept Donations Easily With Secure Online Payments

FreshBooks non-profit accounting software makes it easy for your clients to make payments and donations. Your clients can pay straight from their invoice in just a few simple clicks using their credit card. FreshBooks allows you to customize which payment methods your not-for-profit accepts and the fees are straightforward so that there are no surprises. Your clients can rest easy as well knowing that their financial information is secure.

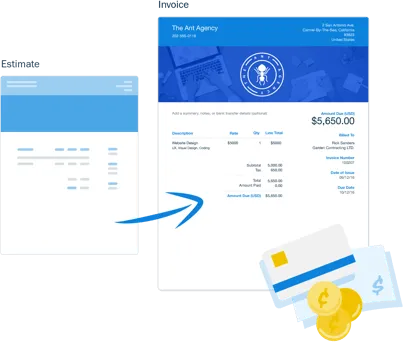

Set Clear Expectations With Estimates

FreshBooks allows you to give your clients options with estimates so that you can customize projects for your clients. In just a couple of clicks, you can send off the estimate and your clients can accept the estimates right from the email. FreshBooks accounting software for non-profit organizations is there to support your projects from start to finish.

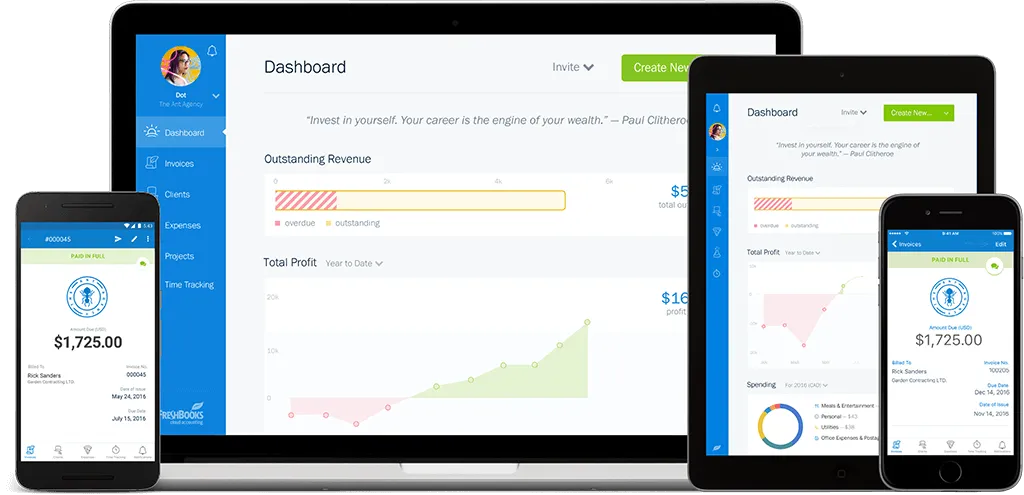

Check-In on Your Business Anywhere

With the FreshBooks mobile app for nonprofit institutions, you can stay connected with your business while you’re traveling or overseas. The app allows you to send invoices out to your clients while on the road, and upload receipts for business expenses while traveling. When your clients have questions, you can respond right from the app without having to open your email. FreshBooks makes sure that you’re always working with the most current information. The app stays in sync between your desktop and the app so that you don’t miss a single update.

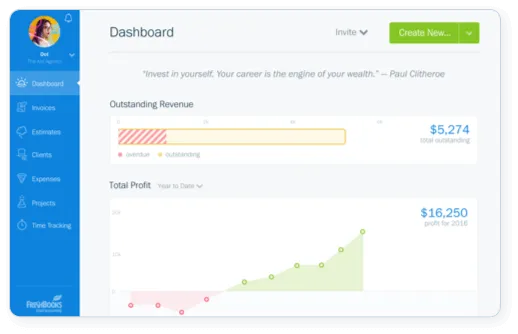

Simple Financial Reports For Powerful Business Insights

Straightforward reports make it easy to know how well your not for profit is doing. FreshBooks accounting software for non-profit organizations has a built-in dashboard where you can view how much funds are available for your charitable efforts. When tax time rolls around, FreshBooks has you covered with the tools and information that you need to make taxes easier.

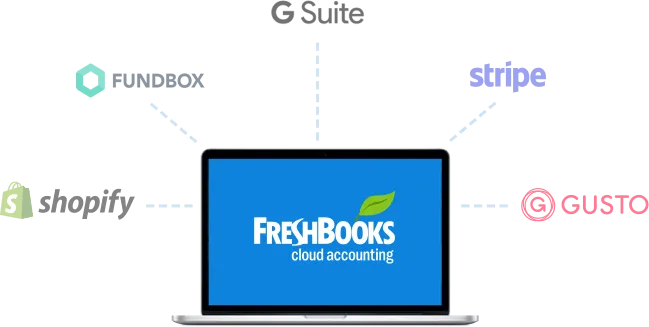

Connect With Industry Leading Apps To Level Up Your Accounting

FreshBooks integrates with lots of apps you already use (and some new ones you’ll be glad you found) to make running your business a breeze.

Accounting Software by Industry

Feeling overwhelmed by bookkeeping? FreshBooks offers industry-specific accounting software that simplifies finances and boosts efficiency, letting you focus on what truly matters. Visit our industry pages below to learn how FreshBooks can fulfil all your accounting needs!

Trades and Home Services

Creative Professionals

Specific Professions

Specialized Industries

Online and Digital Services

Business

Frequently Asked Questions

It would depend to some degree on your own workflow, however, we have non-profits using FreshBooks so to answer your question yes it’s definitely possible for non-profits to operate with FreshBooks.

As for tax forms, we don’t directly supply specific tax forms but instead have multiple reports that keep track of earnings, tax summaries, profits and loss which can always be forwarded out to accountants should that be needed.

We do have discounts for non-profits that we can offer. We have a couple different tiers of pricing, and what we do for non-profits is give you the price of the tier below (i.e. if you needed the Plus plan, we would set you up that you were paying the Lite cost). We would need some sort of documentation of your non-profit status to get you set up with this discount.